| Name | Designation | Number of units held |

|---|---|---|

| PARAG PARIKH FINANCIAL ADVISORY SERVICES LTD | Sponsor Company | 17,65,690 |

| Suneel Rasmikant Gautam | Director | 4,29,986 |

| Sahil P Parikh | Director | 1,47,305 |

| Hitesh Dharmasinh Gajaria | Director | 1,08,617 |

| Neeta Milan Shukla | Others | 19,217 |

| Rohil A Gandhi | Fund Manager & Principal Officer | 11,268 |

| Pritam Mahendra Kijbile | Others | 876 |

| Name | Designation | Number of units held |

|---|---|---|

| PPFAS ASSET MANAGEMENT PVT LTD | AMC Company | 1,51,13,953 |

| Geeta Parag Parikh | Promoter | 10,15,470 |

| Neil Parag Parikh | Chairman and CEO | 3,64,582 |

| Rajesh Bhojani | Independent Director | 48,605 |

| Rajeev Navinkumar Thakkar | Director and CIO | 12,751 |

| Subrata Kumar Mitra | Independent Director | 9,473 |

| Name | Designation | Number of units held |

|---|---|---|

| Dhaval Sumantrai Desai | Independent Director | 37,168 |

| Asmit Lodha | Trustee Officer | 2,848 |

| Name | Designation | Number of units held |

|---|---|---|

| Aalok Ramesh Mehta | Chief Sales Officer - Direct Channel and Head Investor Relations | 3,91,637 |

| Raunak Onkar | Dedicated Fund Manager for overseas investments | 46,093 |

| Sanjay B Shroff | Head-Admin | 13,803 |

| Raju H Shelat | Head - Back Office Operations | 10,451 |

| Priya Hariani | Chief Compliance Officer and Company Secretary | 9,493 |

| Shailendra Pandey | Head - Corporate Communications And Distributor Channel (North & South) | 6,759 |

| Jayant R Pai | Chief Marketing Officer | 4,457 |

| Shubham Gupta | Chief Risk Officer | 3,028 |

| Sathyanarayanan Prawin Visesh | Research - Analyst | 2,557 |

| Rukun R Tarachandani | Fund Manager - Equity | 1,265 |

| Chandrasekaran Vaidhyanathan | Research - Analyst | 1,182 |

| Name | Number of units held |

|---|---|

| Ashok Pandurang Kerkar | 53,318 |

| Saransh Banga | 39,264 |

| Usha Dalsukhbhai Galia | 32,910 |

| Ratnavathi Arun Puthran | 20,020 |

| Priyanka Yadav | 16,656 |

| Shivin Kumar | 13,546 |

| Siddhartha Ghosh | 9,554 |

| Lunar Chandrakant Sutar | 8,935 |

| Rajendra Bane | 8,356 |

| Biju Abraham Verghese | 7,137 |

| Mansi | 6,764 |

| Digamber Singh Bisht | 6,268 |

| Avijit Roy | 5,960 |

| Abhishek Goenka | 5,857 |

| S.Radhakishan Rao | 5,667 |

| Manoj Chauhan | 5,434 |

| Vinay Teli | 5,258 |

| Madhavi D Dey | 5,039 |

| Ankur Pal | 4,546 |

| Indresh Vishwanath Yadav | 4,234 |

| Ninad Chandrakant Bhosle | 3,615 |

| Parminder Singh Surendar Singh Saini | 3,301 |

| Abhishek Tyagi | 2,911 |

| Hardik J Trivedi | 2,430 |

| Abimanue A | 2,355 |

| Harikrishna Ramabadraiah Theerupari | 1,894 |

| Dasari Kiranmai | 1,792 |

| Radheshyam Sahani | 1,759 |

| Prithvinath Reddy Gaddam | 1,610 |

| Paresh Dilipkumar Shukla | 1,473 |

| Prasanna Vilas Patil | 1,294 |

| Shrikant P Pancholi | 1,251 |

| Sudhakaran Gopalan | 1,180 |

| Priyanka Mangesh Shetye | 993 |

| Paresh Ashok Kerkar | 923 |

| Nikhila K | 922 |

| NARENDRA KALA | 904 |

| Kavita Sahadeo Kamble | 788 |

| Arjun Dalui | 473 |

| R Venkataramana | 389 |

| Mansi Riki Kariya | 264 |

| Janhavi Udyavar | 242 |

| Arijit Chakraborty | 241 |

| Akshata Nilesh Nadkar | 236 |

| Nilesh Anil Soman | 225 |

| Era Naynish Kadam | 23 |

| Pallavi Korgaonkar | 23 |

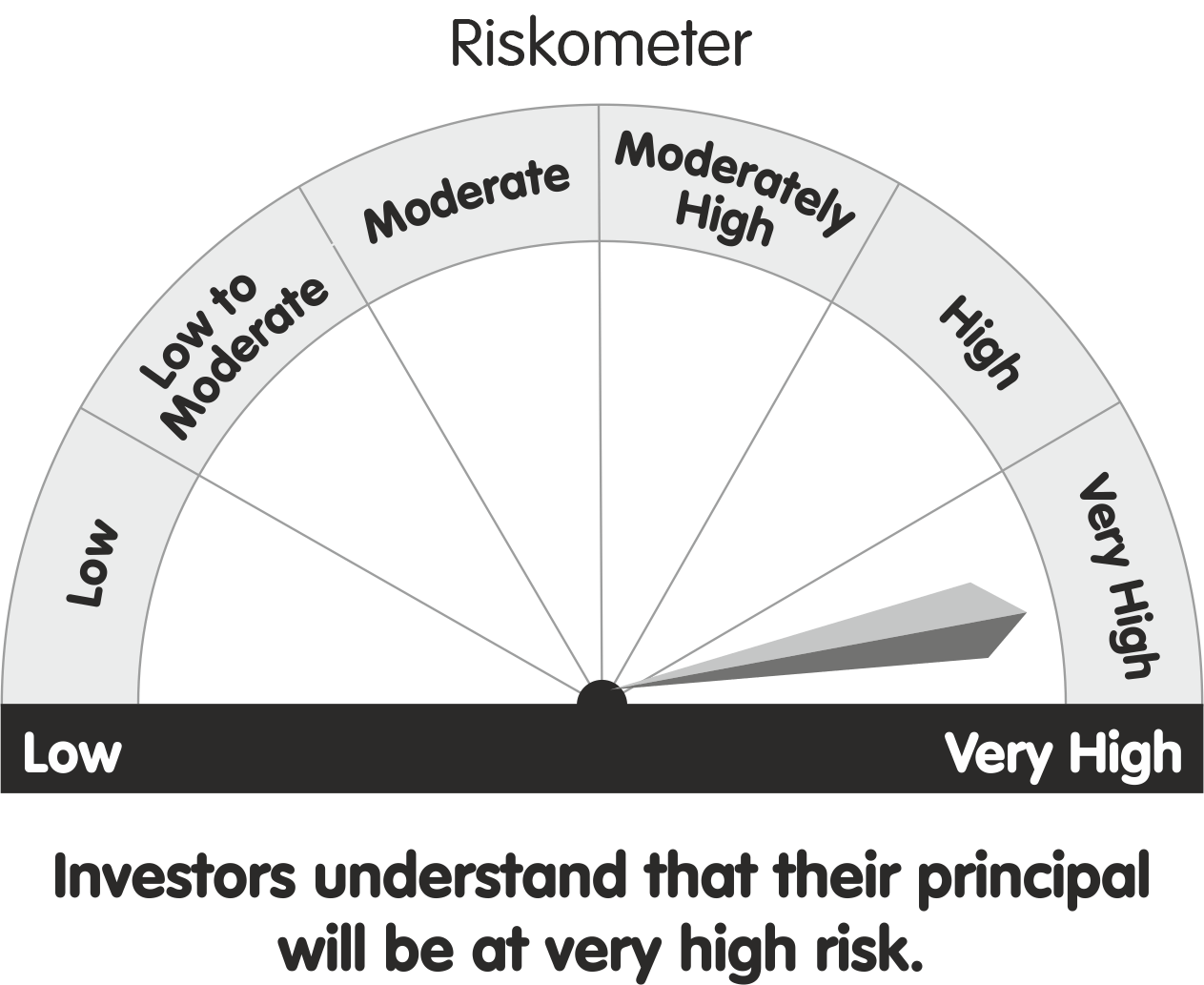

Parag Parikh Flexi Cap Fund

This product is suitable for investors who are seeking* This product is suitable for investors who are seeking* The investment objective of the Scheme is to seek to generate long-term capital growth from an actively managed portfolio primarily of Equity and Equity Related Securities. Scheme shall invest in Indian equities, foreign equities and related instruments and debt securities. *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. |

Parag Parikh Liquid Fund

This product is suitable for investors who are seeking*

This product is suitable for investors who are seeking*

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them. |

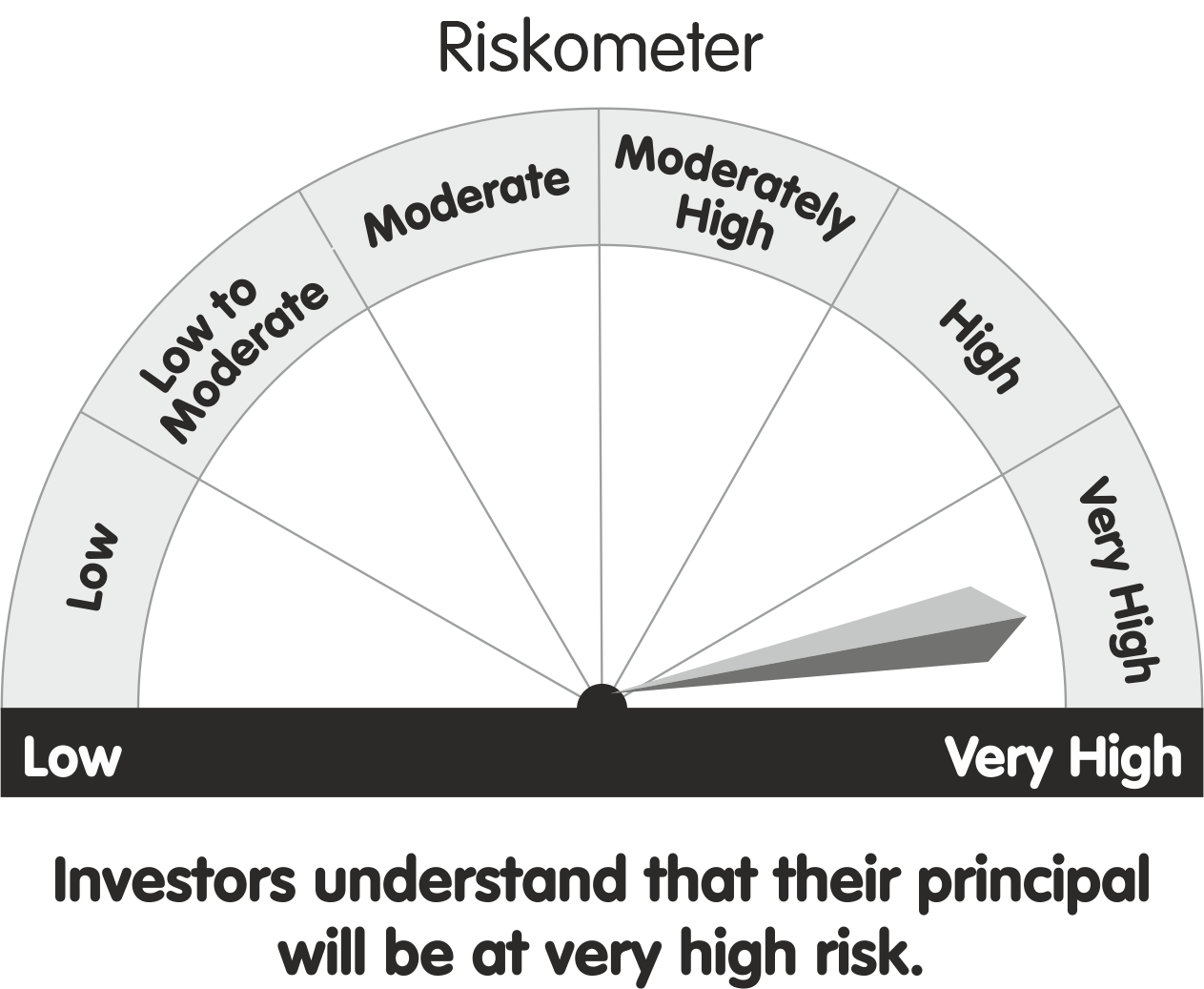

Parag Parikh ELSS Tax Saver Fund

This product is suitable for investors who are seeking* This product is suitable for investors who are seeking*

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them. |

Parag Parikh Conservative Hybrid Fund

This product is suitable for investors who are seeking* This product is suitable for investors who are seeking*

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them. |

Parag Parikh Arbitrage Fund

This product is suitable for investors who are seeking* This product is suitable for investors who are seeking*

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them. |

Parag Parikh Dynamic Asset Allocation Fund

This product is suitable for investors who are seeking* This product is suitable for investors who are seeking*

|