| Name | Designation | Number of units held |

|---|---|---|

| PARAG PARIKH FINANCIAL ADVISORY SERVICES LTD | Sponsor Company | 30,622 |

| Suneel Rasmikant Gautam | Director | 2,205 |

| Sahil P Parikh | Director | 79 |

| Name | Designation | Number of units held |

|---|---|---|

| PPFAS ASSET MANAGEMENT PVT LTD | AMC Company | 4,04,302 |

| Neil Parag Parikh | Chairman and CEO | 2,040 |

| PPFAS TRUSTEE COMPANY PRIVATE LIMITED | Trustee Company | 989 |

| Rajeev Navinkumar Thakkar | Director and CIO | 252 |

| Geeta Parag Parikh | Promoter | 54 |

| Name | Designation | Number of units held |

|---|---|---|

| V RAMESH | Independent Director | 71 |

| Name | Designation | Number of units held |

|---|---|---|

| Raunak Onkar | Dedicated Fund Manager for overseas investments | 3,688 |

| Jayant R Pai | Chief Marketing Officer | 227 |

| Priya Hariani | Chief Compliance Officer and Company Secretary | 32 |

| Ranbir D.Nayal | Chief Information Security Officer and Head - IT | 26 |

| Shailendra Pandey | Head - Corporate Communications And Distributor Channel (North & South) | 24 |

| Aalok Ramesh Mehta | Chief Sales Officer - Direct Channel and Head Investor Relations | 5 |

| Raj Kirit Mehta | Fund Manager - Debt | 1 |

| Name | Number of units held |

|---|---|

| Usha Dalsukhbhai Galia | 243 |

| Sneh Bhatia | 74 |

| Sagarkumar Anilbhai Pandya | 67 |

| Kavita Sahadeo Kamble | 44 |

| Jignesh C Desai | 43 |

| Abhishek Tyagi | 38 |

| Digamber Singh Bisht | 30 |

| Vinay Teli | 23 |

| Lunar Chandrakant Sutar | 19 |

| Ashok Pandurang Kerkar | 15 |

| Era Naynish Kadam | 10 |

| Apala Bose | 4 |

| R Venkataramana | 4 |

| Dasari Kiranmai | 3 |

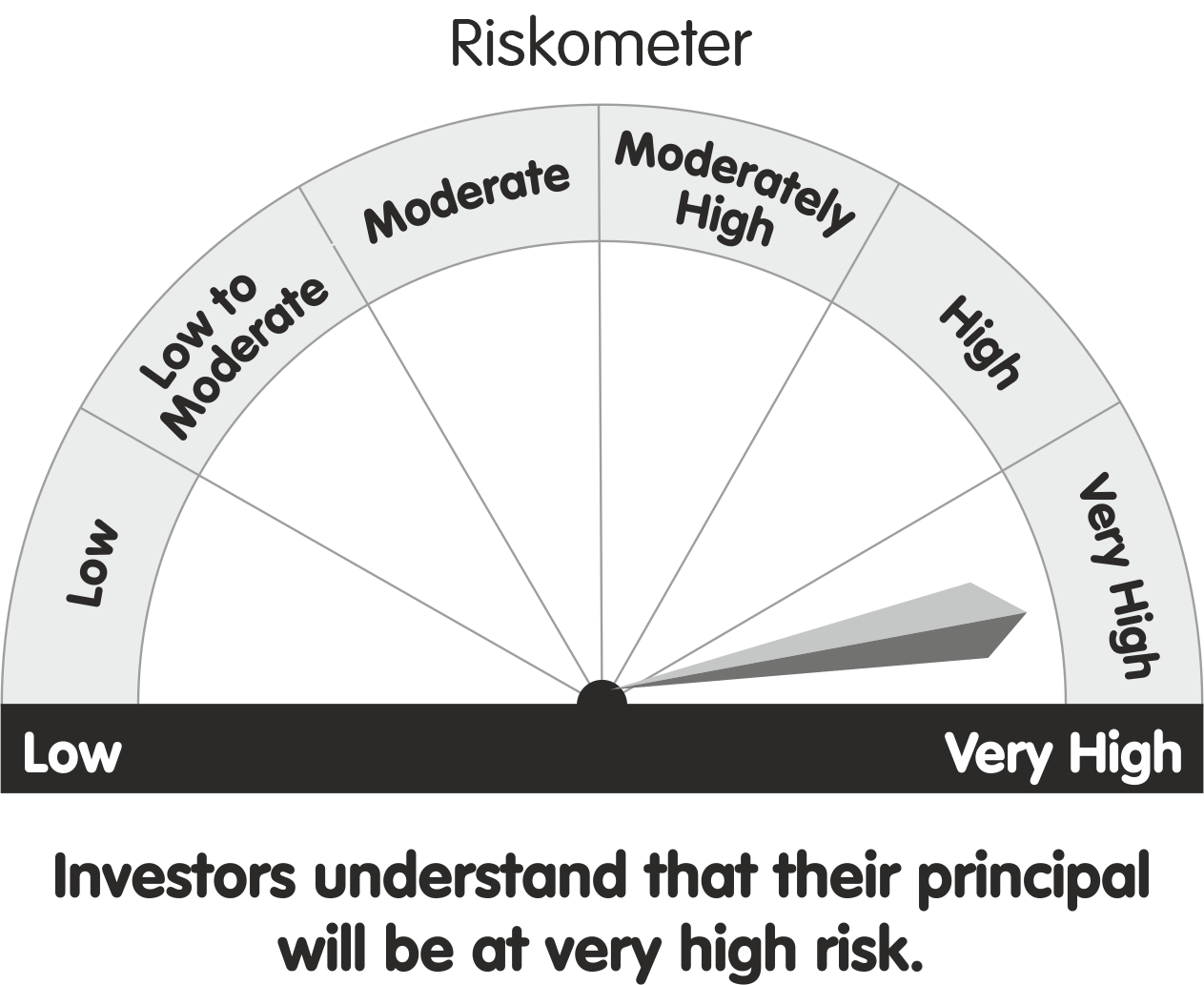

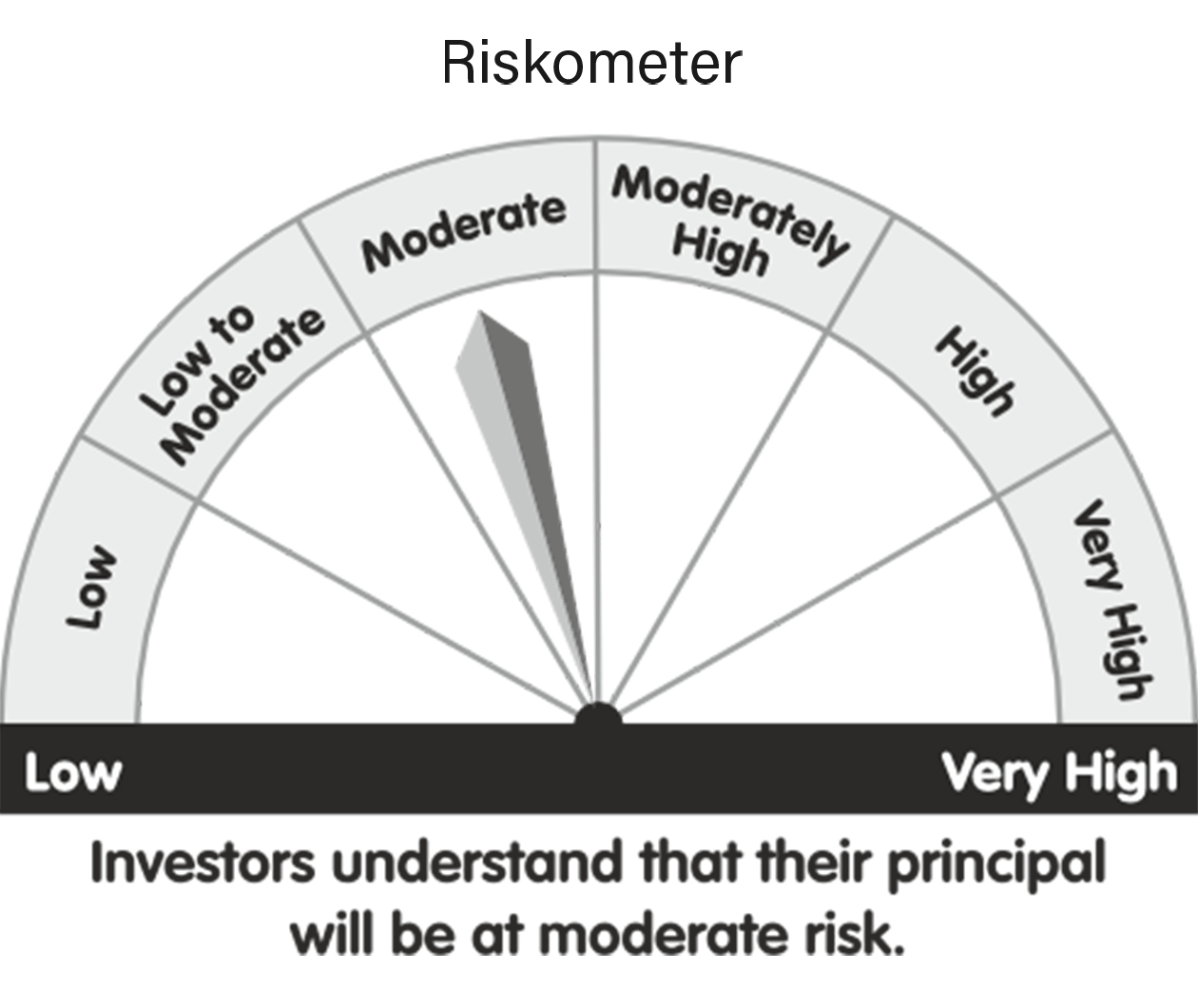

Parag Parikh Flexi Cap Fund

This product is suitable for investors who are seeking* This product is suitable for investors who are seeking* The investment objective of the Scheme is to seek to generate long-term capital growth from an actively managed portfolio primarily of Equity and Equity Related Securities. Scheme shall invest in Indian equities, foreign equities and related instruments and debt securities. *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. |

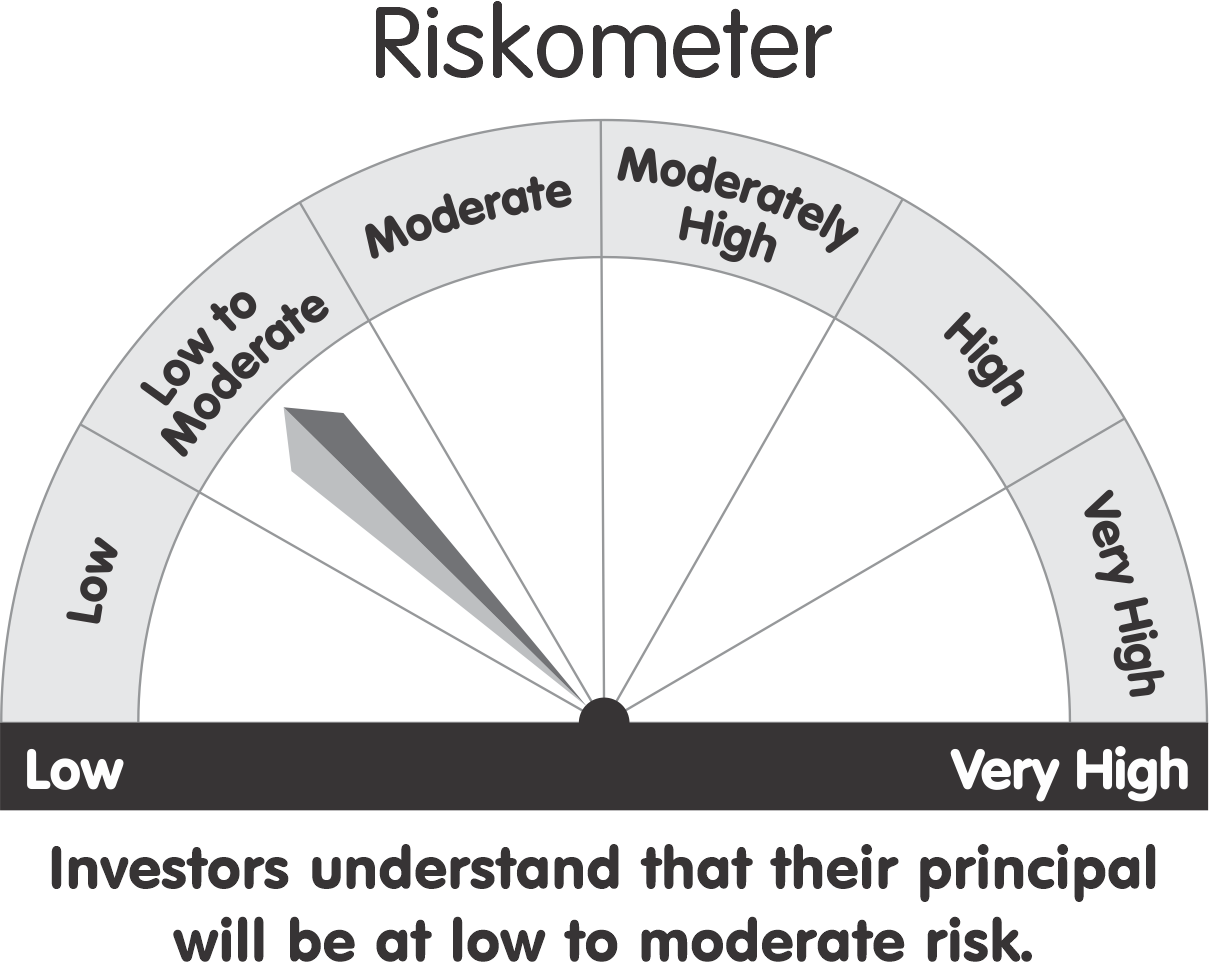

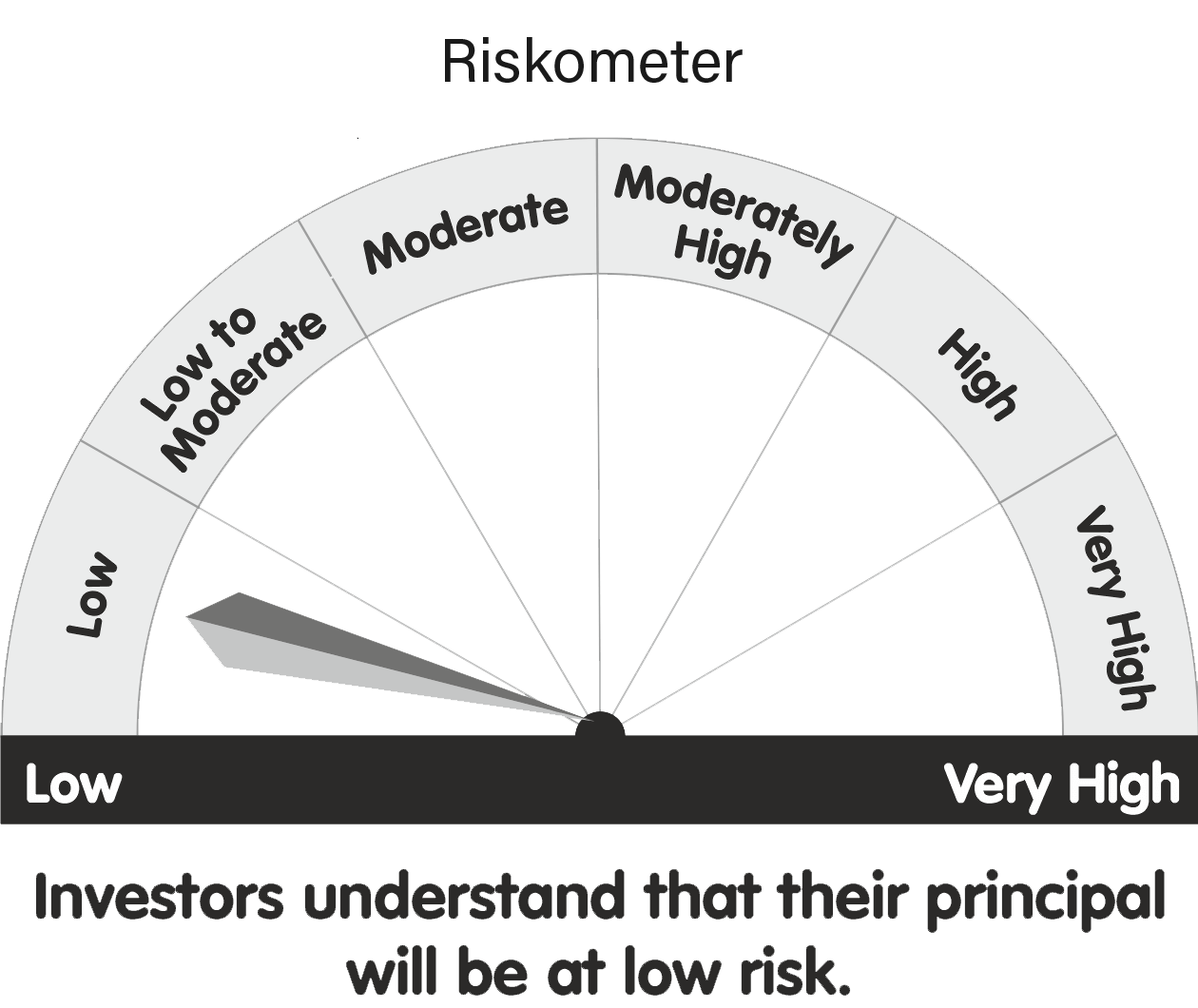

Parag Parikh Liquid Fund

This product is suitable for investors who are seeking*

This product is suitable for investors who are seeking*

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them. |

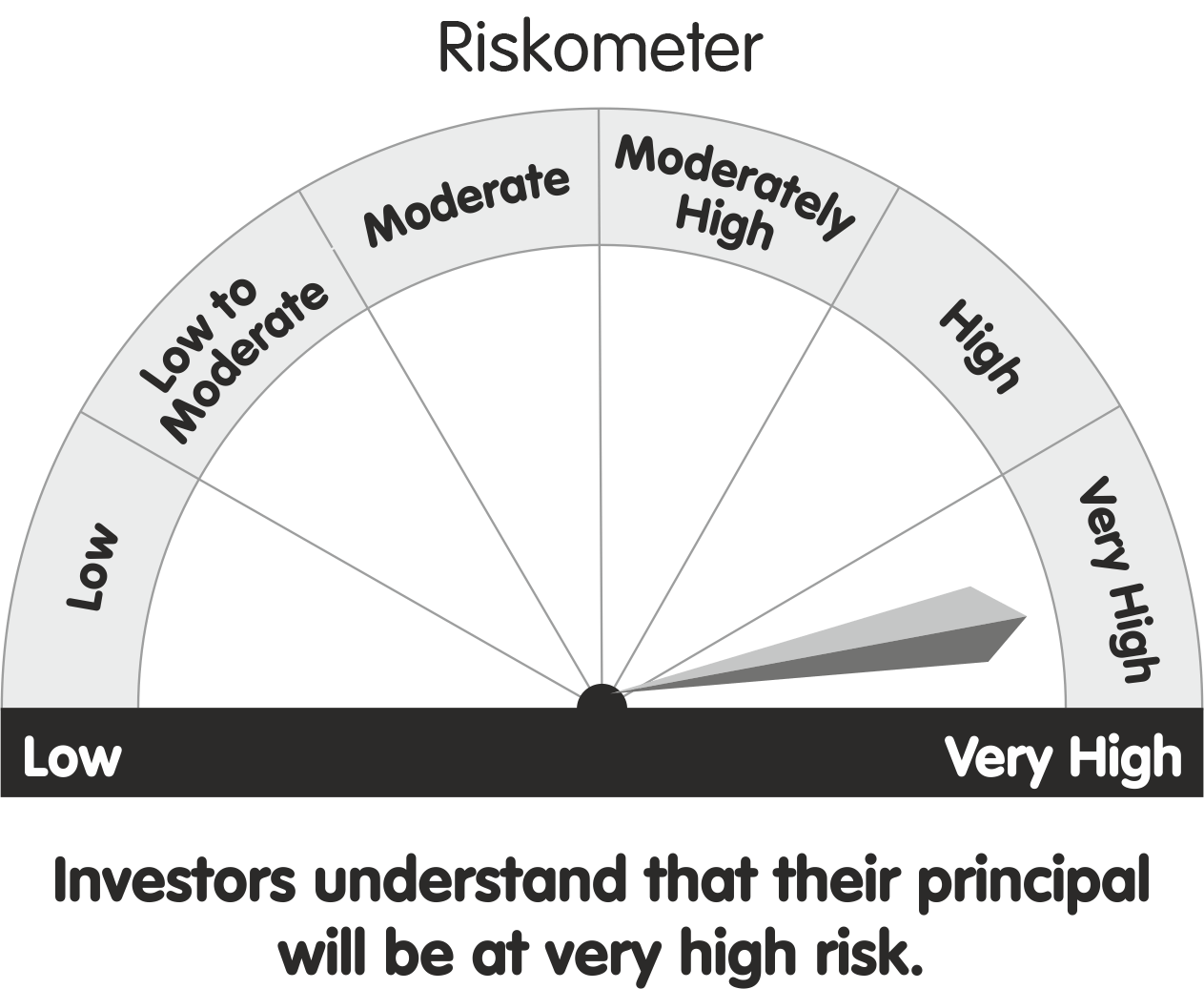

Parag Parikh ELSS Tax Saver Fund

This product is suitable for investors who are seeking* This product is suitable for investors who are seeking*

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them. |

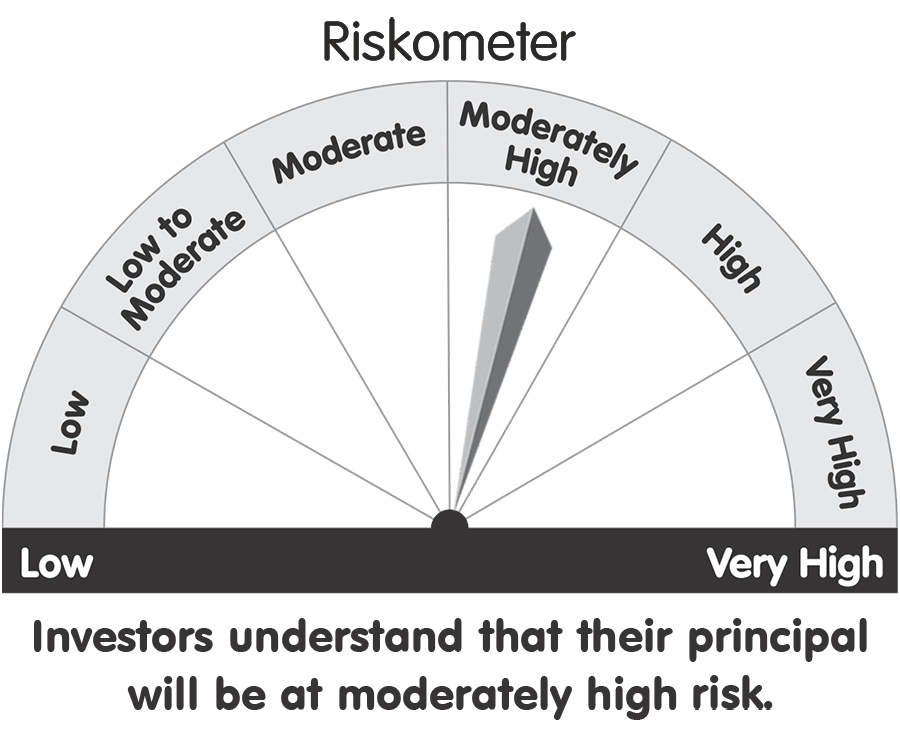

Parag Parikh Conservative Hybrid Fund

This product is suitable for investors who are seeking* This product is suitable for investors who are seeking*

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them. |

Parag Parikh Arbitrage Fund

This product is suitable for investors who are seeking* This product is suitable for investors who are seeking*

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them. |

Parag Parikh Dynamic Asset Allocation Fund

This product is suitable for investors who are seeking* This product is suitable for investors who are seeking*

|