Readers should take note of the following:

The information provided on this website is meant only for general reading purposes and the views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

None of the Sponsor, the Investment Manager, the Trustee, their respective directors, employees, affiliates or representatives shall be liable in any way for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including on account of loss of profits arising from the information contained in this material.

The contents available on the website are as on a particular date; therefore the viewers/ investors may at their discretion, seek latest/ updated information.

Views expressed in this section are in his/her personal capacity.

Risk Factors:

Mutual Funds and securities investments are subject to market risks and there is no assurance or guarantee that the objectives of the Scheme will be achieved.

As with any investment in securities, the NAV of the Units issued under the Scheme can go up or down depending on various factors and forces, affecting the capital markets.

Investors are requested to also read the Scheme Information Document, Statement of Additional Information and Key Information Memorandum for Scheme specific relevant details & risk factors.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

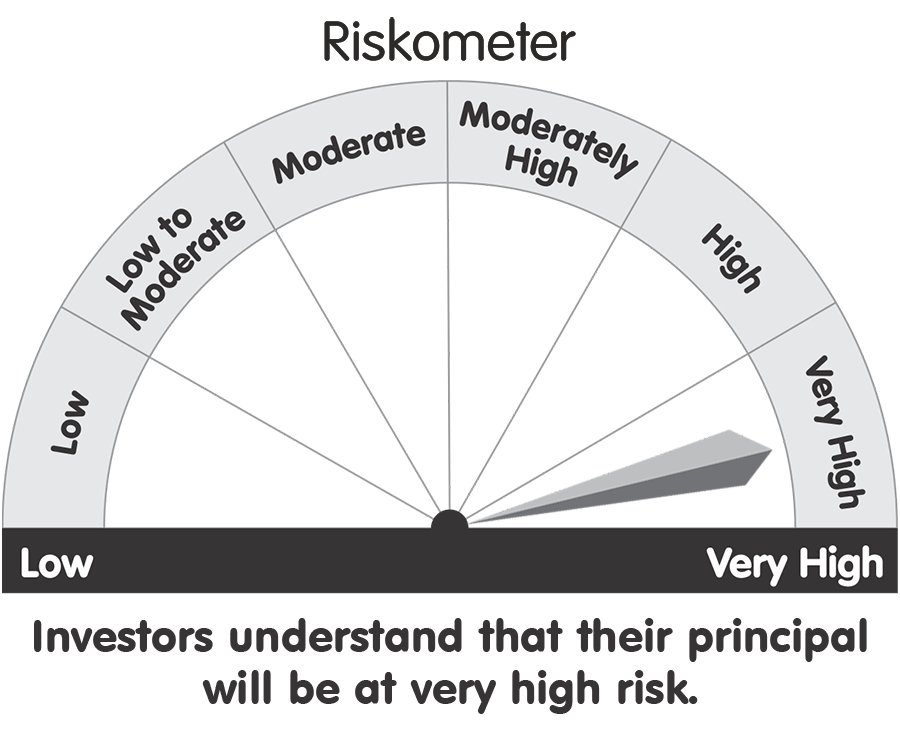

Parag Parikh Flexi Cap Fund

This product is suitable for investors who are seeking*

The investment objective of the Scheme is to seek to generate long-term capital growth from an actively managed portfolio primarily of Equity and Equity Related Securities. Scheme shall invest in Indian equities, foreign equities and related instruments and debt securities. |

|

|

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

|

|

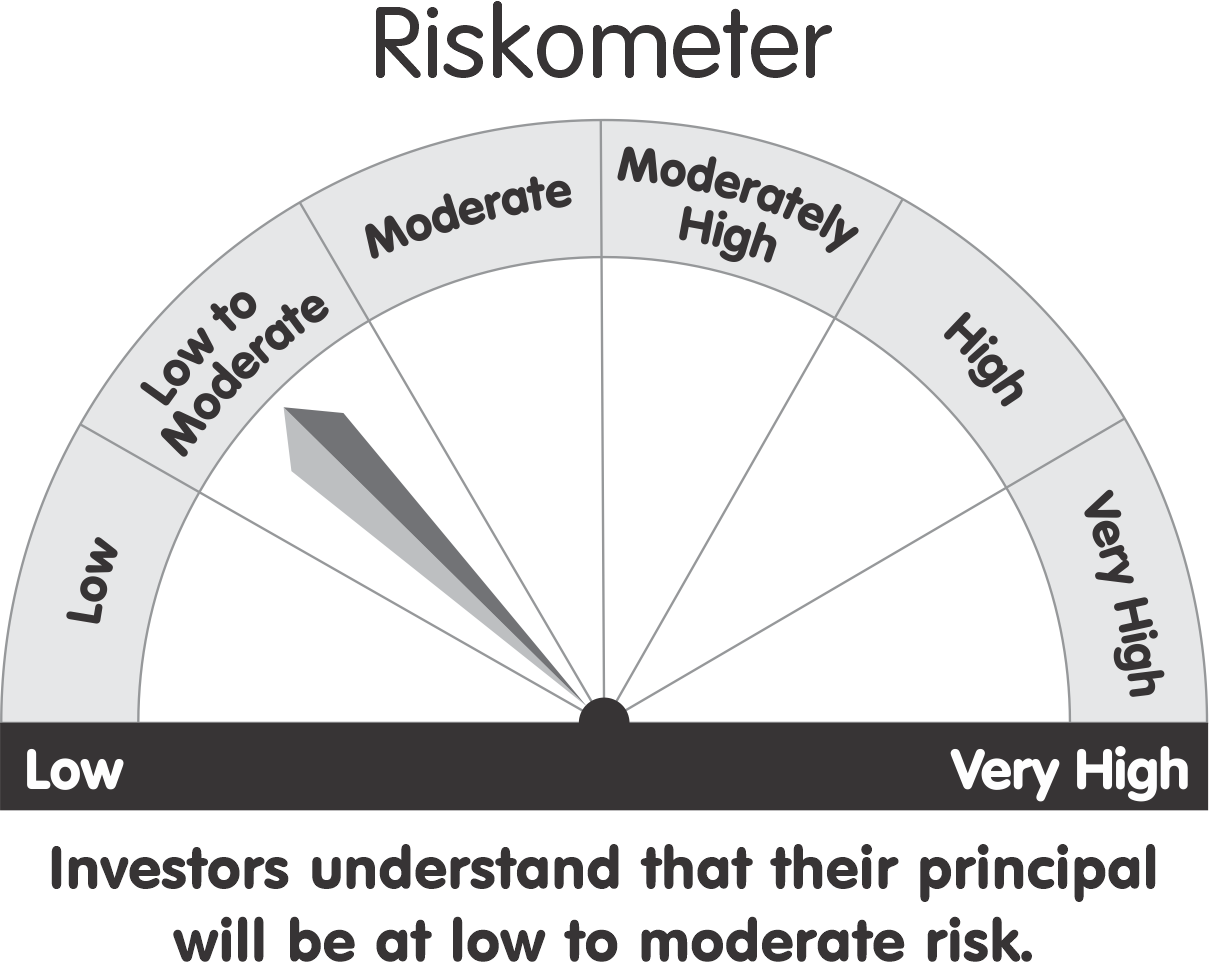

Parag Parikh Liquid Fund

This product is suitable for investors who are seeking*

- Income over short term

- Investments in Debt/money market instruments

|

|

|

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

|

|

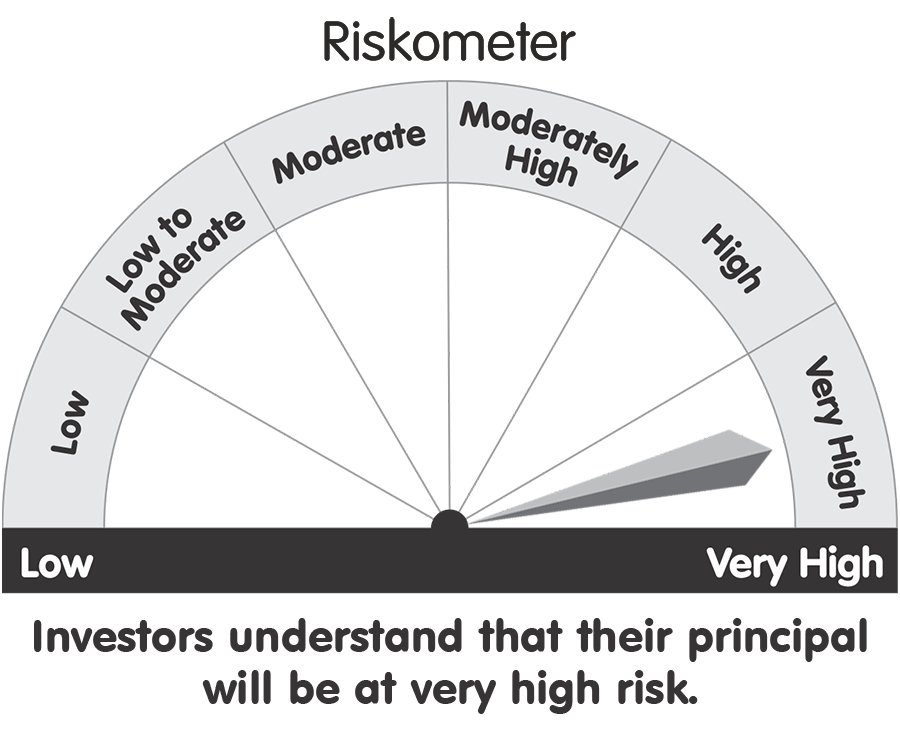

Parag Parikh ELSS Tax Saver Fund

This product is suitable for investors who are seeking*

- Long term capital appreciation

- Investment predominantly in equity and equity related securities.

|

|

|

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

|

|

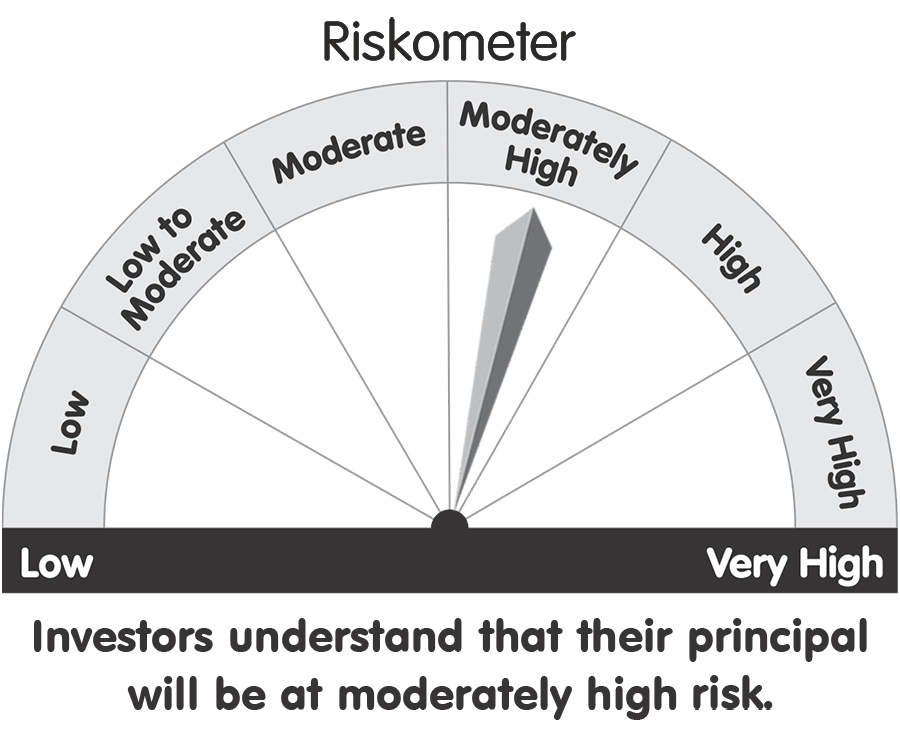

Parag Parikh Conservative Hybrid Fund

This product is suitable for investors who are seeking*

- To generate regular income through investments predominantly in debt and money market instruments

- Long term capital appreciation from the portion of equity investments under the scheme.

|

|

|

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

|

|

Parag Parikh Arbitrage Fund

This product is suitable for investors who are seeking*

- To generate income by investing in arbitrage opportunities.

- Predominantly investing in arbitrage opportunities in the cash and derivatives segment of the equity market.

|

|

|

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

|

|

Parag Parikh Dynamic Asset Allocation Fund

This product is suitable for investors who are seeking*

- Capital Appreciation & Income generation over medium to long term.

- Investment in equity and equity related instruments as well as debt and money market instruments while managing risk through active asset allocation.

|

|

|

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

|

|

Potential Risk Class (PRC) of the debt scheme of PPFAS Mutual Fund :

|

Download SID/SAI and KIM here.

|