| Name | Designation | Number of units held |

|---|---|---|

| PARAG PARIKH FINANCIAL ADVISORY SERVICES LTD | Sponsor Company | 8,66,555 |

| Sahil P Parikh | Director | 8,24,889 |

| Hitesh Dharmasinh Gajaria | Director | 4,02,428 |

| Rohil A Gandhi | Fund Manager & Principal Officer | 48,017 |

| Suneel Rasmikant Gautam | Director | 26,763 |

| Name | Designation | Number of units held |

|---|---|---|

| PPFAS ASSET MANAGEMENT PVT LTD | AMC Company | 2,38,92,776 |

| Geeta Parag Parikh | Promoter | 36,46,866 |

| Neil Parag Parikh | Chairman and CEO | 1,69,309 |

| Rajeev Navinkumar Thakkar | Director and CIO | 9,999 |

| Name | Designation | Number of units held |

|---|---|---|

| Burjor Dorab Nariman | Independent Director | 30,705 |

| Name | Designation | Number of units held |

|---|---|---|

| Raunak Onkar | Dedicated Fund Manager for overseas investments | 7,43,484 |

| Jayant R Pai | Chief Marketing Officer | 1,65,568 |

| Rukun R Tarachandani | Fund Manager - Equity | 24,948 |

| Priya Hariani | Chief Compliance Officer and Company Secretary | 19,999 |

| Aalok Ramesh Mehta | Chief Sales Officer - Direct Channel and Head Investor Relations | 15,685 |

| Shailendra Pandey | Head - Corporate Communications And Distributor Channel (North & South) | 5,099 |

| Chandrasekaran Vaidhyanathan | Research - Analyst | 2,887 |

| Sanjay B Shroff | Head-Admin | 1,099 |

| Name | Number of units held |

|---|---|

| Jignesh C Desai | 2,49,987 |

| Sonal Vinod Makwana | 32,176 |

| Usha Dalsukhbhai Galia | 15,039 |

| Vinay Teli | 3,380 |

| Kavita Sahadeo Kamble | 2,999 |

| Lunar Chandrakant Sutar | 599 |

| Oly Das | 509 |

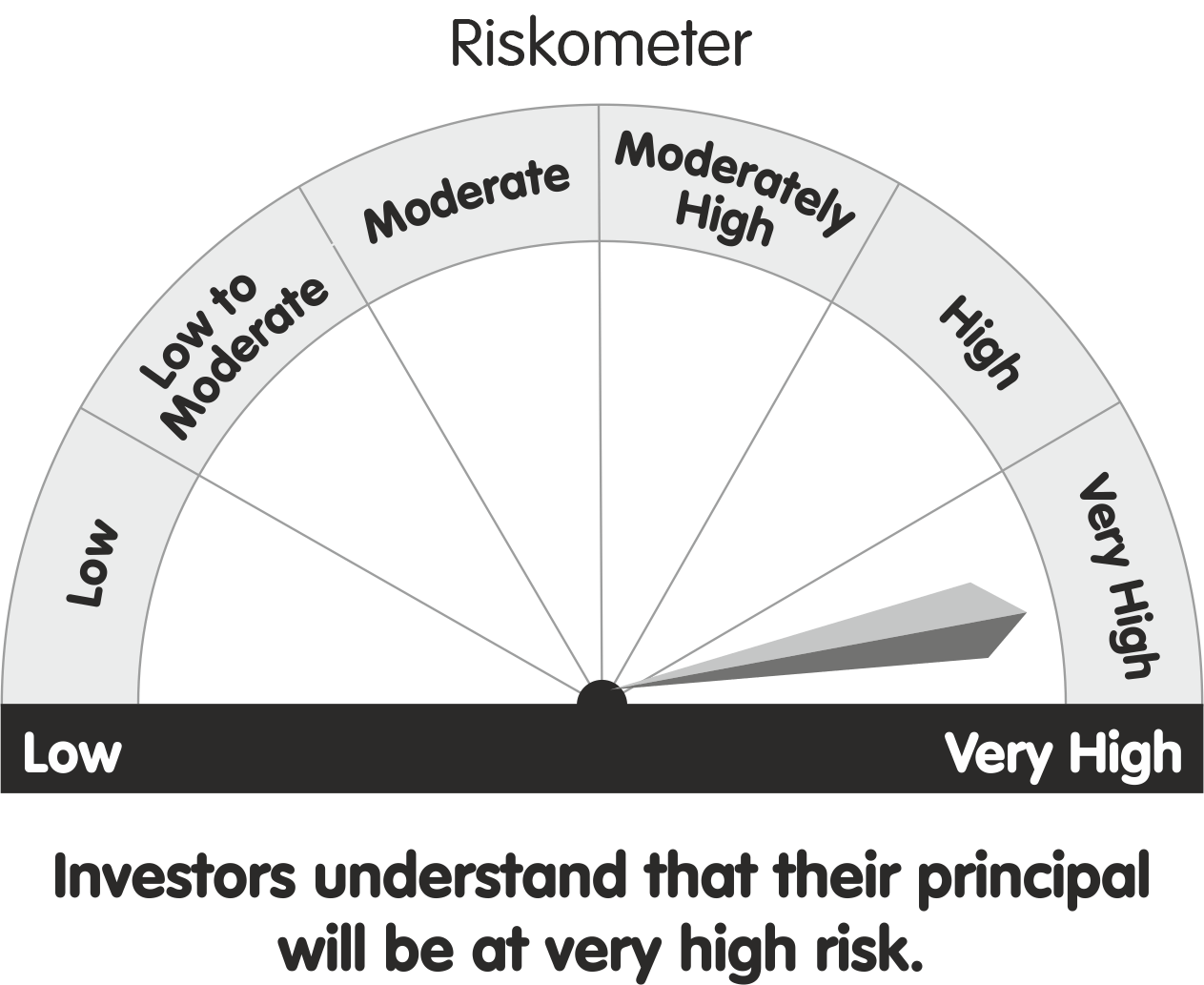

Parag Parikh Flexi Cap Fund

This product is suitable for investors who are seeking* This product is suitable for investors who are seeking* The investment objective of the Scheme is to seek to generate long-term capital growth from an actively managed portfolio primarily of Equity and Equity Related Securities. Scheme shall invest in Indian equities, foreign equities and related instruments and debt securities. *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. |

Parag Parikh Liquid Fund

This product is suitable for investors who are seeking*

This product is suitable for investors who are seeking*

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them. |

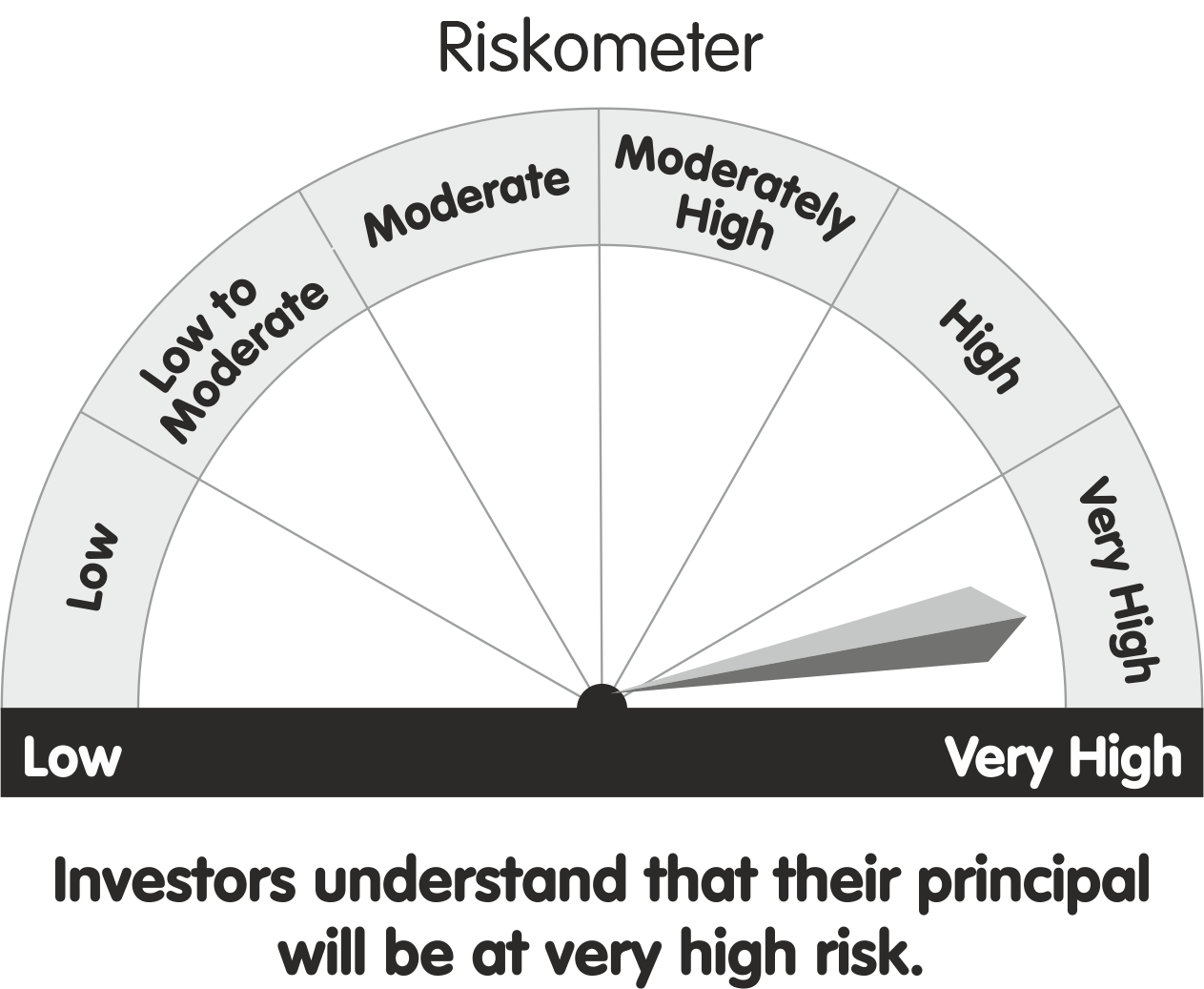

Parag Parikh ELSS Tax Saver Fund

This product is suitable for investors who are seeking* This product is suitable for investors who are seeking*

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them. |

Parag Parikh Conservative Hybrid Fund

This product is suitable for investors who are seeking* This product is suitable for investors who are seeking*

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them. |

Parag Parikh Arbitrage Fund

This product is suitable for investors who are seeking* This product is suitable for investors who are seeking*

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them. |

Parag Parikh Dynamic Asset Allocation Fund

This product is suitable for investors who are seeking* This product is suitable for investors who are seeking*

|