Parag Parikh Liquid Fund (PPLF) is an open-ended scheme whose primary investment objective is to deliver reasonable (non-guaranteed) market related returns with lower risk and high liquidity through judicious investments in money market and debt instruments. However, there is no assurance that the investment objective of the scheme will be realized and the scheme does not assure or guarantee any returns.

At Parag Parikh Liquid Fund, we prefer safety and liquidity ahead of returns. Hence, you will see that our liquid fund returns will always be lower than that of the peers but we strongly believe that when an investor parks the money in a liquid fund, the main aim of the investor should be preservation of capital first and then comes earning a reasonable rate of return on it.

As you might have seen in our previous portfolios, it will be dominated by sovereign rated securities like Treasury bills, Government Securities and overnight money with RBI. Our exposure towards corporate papers i.e. Commercial papers (CP) and Certificate of Deposits (CD) will be limited to a certain percentage of our portfolio and we are very conscious of the credit risks associated with it.

PPLF is a suitable option for investors who are seeking a low risk savings solution for short periods (usually, less than a year).

The key advantages of PPLF are:

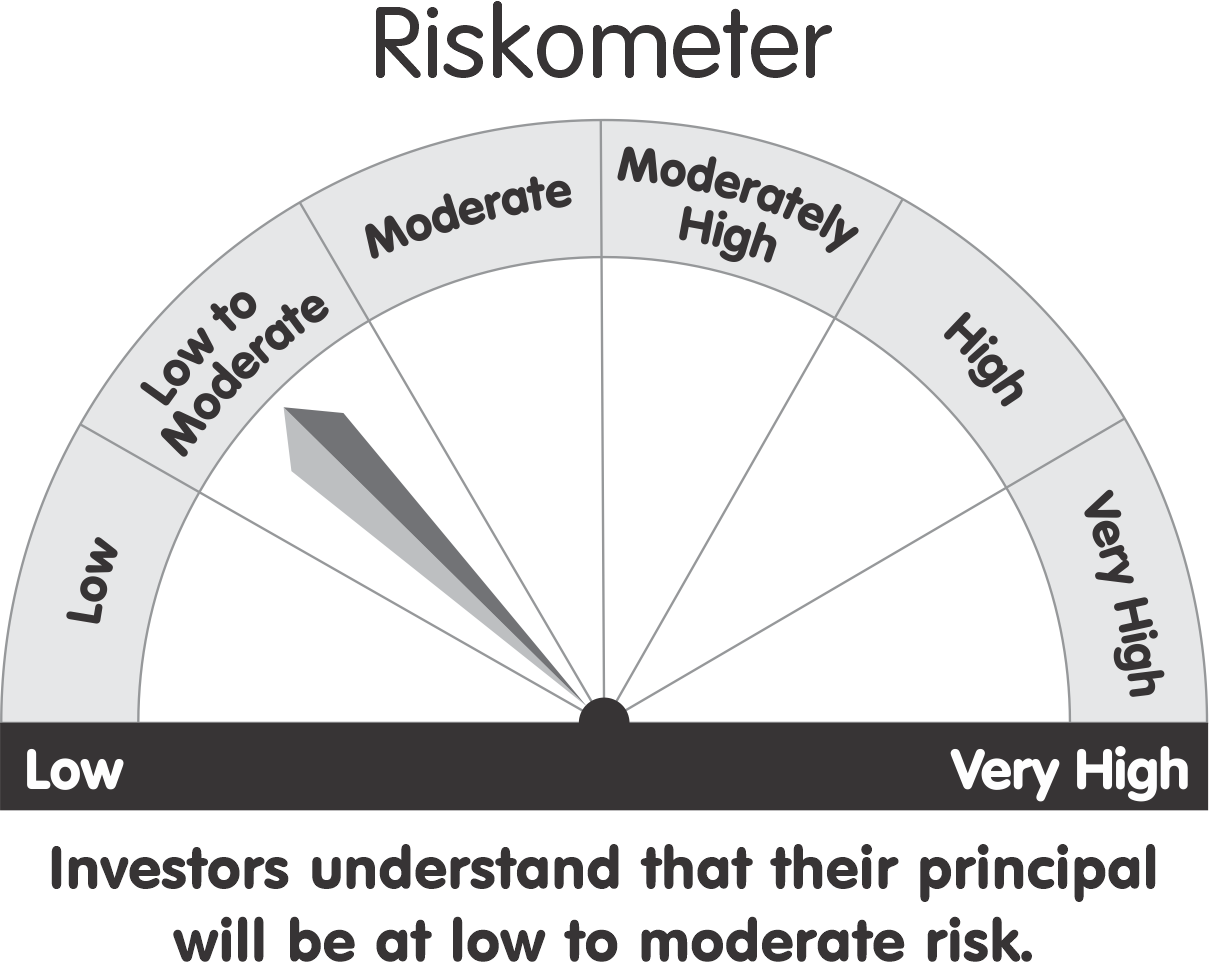

Parag Parikh Liquid Fund This product is suitable for investors who are seeking*

This product is suitable for investors who are seeking*

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them. |

|

| Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |