| Particulars | 65% and above | Less than 65% |

|---|---|---|

| LTCG Tax | 10% without indexation | 20% after indexation |

| Qualifying period | One year | Three years |

Parag Parikh Flexi Cap Fund

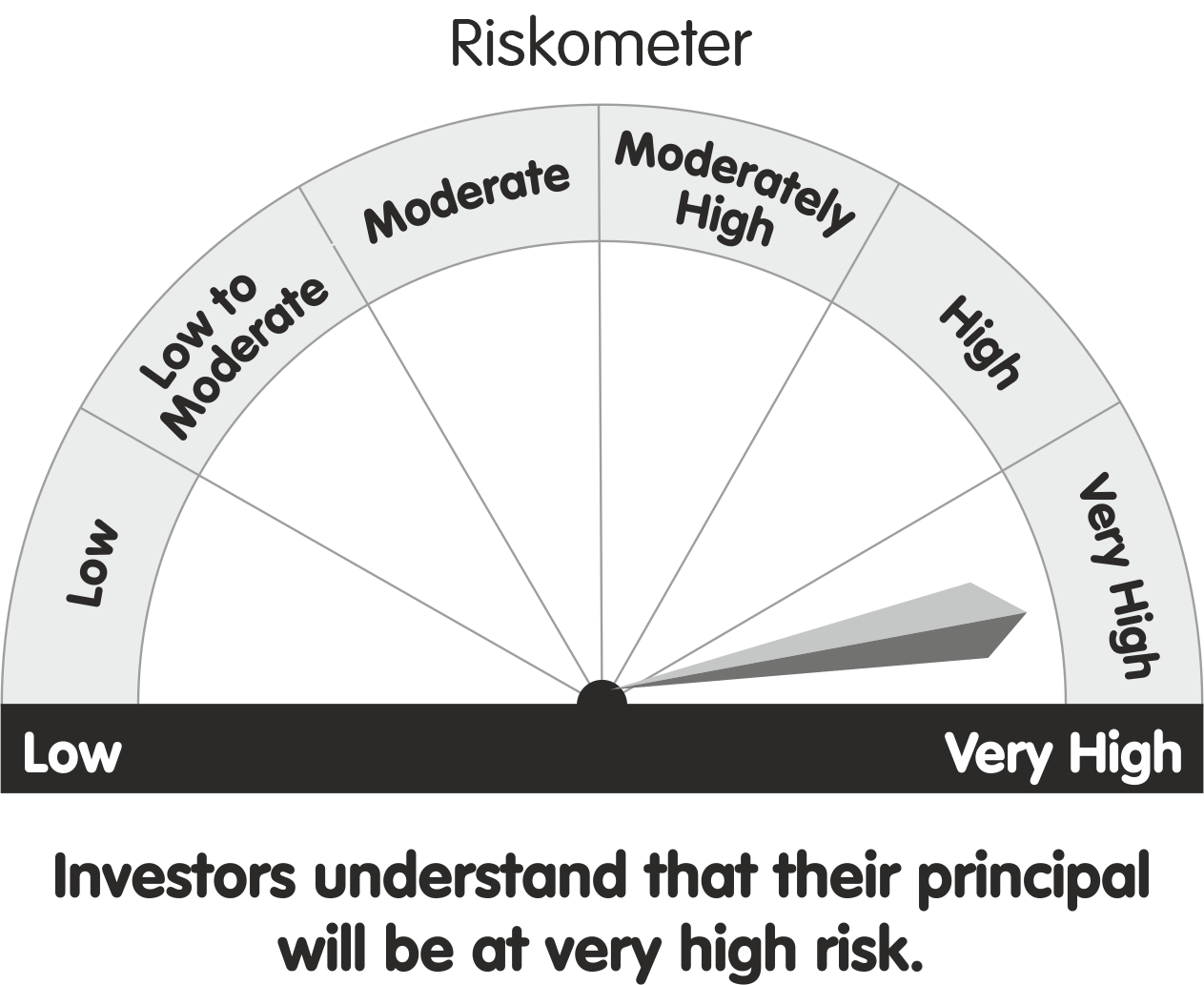

This product is suitable for investors who are seeking* This product is suitable for investors who are seeking* The investment objective of the Scheme is to seek to generate long-term capital growth from an actively managed portfolio primarily of Equity and Equity Related Securities. Scheme shall invest in Indian equities, foreign equities and related instruments and debt securities. Investors should consult their financial advisers if in doubt about whether this scheme is suitable for them. |

Name of the Scheme

Parag Parikh Flexi Cap Fund

Investment Objective

To seek to generate long term capital growth from an actively managed portfolio of equity and equity related securities.

Type of the scheme

An open-ended dynamic equity scheme investing across large cap, mid cap, small cap stocks.

Date of Allotment

May 24, 2013

Minimum Application Amount

New Purchase: ₹ 1,000;

Additional Purchase: ₹ 1,000;

Monthly SIP: ₹ 1,000;

Quarterly SIP: ₹ 3,000;

Expense Ratio *

Please visit this link

Entry Load

Not Applicable

Exit Load*

In respect of each purchase / switch-in of Units, 10% of the units (“the limit”) may be redeemed without any exit load from the date of allotment.

Any redemption or switch-out in excess of the limit shall be subject to the following exit load:

2.00 % if the investment is redeemed on or before 365 days from the date of allotment of units.

1.00 % if the investment is redeemed after 365 days but on or before 730 days from the date of allotment of units.

No Exit Load will be charged if investment is redeemed after 730 days from the date of allotment of units.

No exit load will be charged, in case of switch transactions between Regular Plan and Direct Plan of the Scheme for existing as well as prospective investors.

* Above exit load structure is applicable prospectively, for all investments (including SIP/STP and SWP registered) with effect from 15th Nov 2021.