Under normal circumstances, the asset allocation (% of Net Assets) of the Scheme’s portfolio will be as follows:

| Type of Instruments | Normal Allocation (% of Net Assets) | Risk Profile |

|---|---|---|

| Equity and Equity related instruments* # | 80 - 100 | High |

| Debt Instruments & Money Market Instruments* * | 0 - 20 | Low to Medium |

* * Money Market Instruments include CMBs, T-Bills, and Government securities with an unexpired maturity upto one year, Tri Party REPO & Repo/ Reverse Repo.

# The Scheme may invest in derivative products from time to time only if permitted under ELSS Rules. In such event, the exposure to derivative instruments shall not exceed 50% of the total Net Assets of Scheme. The Scheme may use derivatives for such purposes as maybe permitted by the Regulations, including for the purpose of hedging and portfolio balancing, based on the opportunities available and subject to guidelines issued by SEBI from time to time. The cumulative gross exposure through equity, debt and derivative positions should not exceed 100% of the net assets of the scheme. Investment in Foreign Securities would be made only if permitted under ELSS Rules. The Scheme may seek investment opportunities in foreign securities including ADRs / GDRs / Foreign equity subject to SEBI (MF) Regulations. Such Investment shall not exceed 35% of the net assets of the Scheme. The scheme may invest in maximum of 20% in securitised debt subject to necessary approvals from the SEBI, RBI and under ELSS Guidelines.

* Equity related instruments shall mean equities, cumulative convertible preference shares and fully convertible debentures and bonds of companies. Investment may also be made in partly convertible issues of debentures and bonds including those issued on rights basis subject to the condition that, as far as possible, the non-convertible portion of the debentures so acquired or subscribed, shall be disinvested within a period of 12 (twelve) months.

In accordance with the ELSS, investments by the Scheme in equity and equity related Securities will not fall below 80% of the net assets of the Scheme. As per the ELSS, pending deployment of funds, the Scheme may invest in short-term money market instruments or other liquid instruments or both. After three years of the date of allotment of the units, the Mutual Fund may hold upto twenty percent of net assets of the Scheme in short-term money market instruments and other liquid instruments to enable redemption of investment of those unit holders who would seek to tender the units for repurchase.

The Scheme shall not engage into securities lending and borrowing, corporate debt repo and corporate reverse repo.

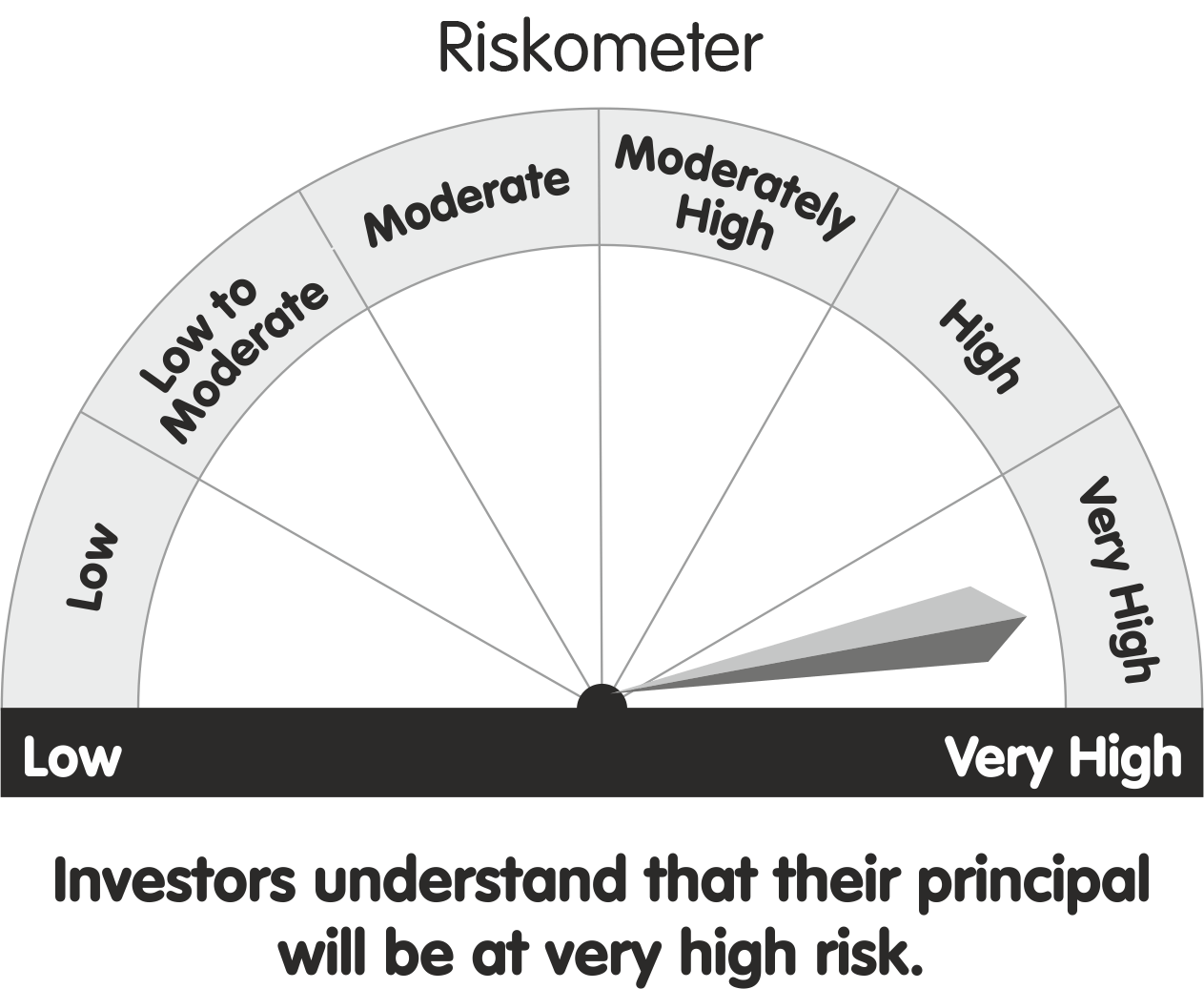

Riskometer This product is suitable for investors who are seeking This product is suitable for investors who are seeking

(I) Long term capital appreciation (II) Investment predominantly in equity and equity related securities. Investors should consult their financial advisers if in doubt about whether this scheme is suitable for them. |

|

| Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |