Consider investing in Parag Parikh ELSS Tax Saver Fund if:

- You are eligible to save income tax u/s 80C of the Income Tax Act, 1961.

- You have not fully utilised the limit of Rs. 1.50 lakhs u/s 80C.

- You are comfortable investing in Equity Mutual Fund Schemes

- You are comfortable with the mandatory lock-in period of three years from the date of Investment for every instalment.

This Scheme may not be suitable:

- If you require to redeem within three years period from date of the investment.

- If you are not comfortable with volatility in the Net Asset Value

- If you depend on periodic income in the form of mutual fund dividends

We suggest you consult your Financial Advisor before investing.

Parag Parikh ELSS Tax Saver Fund

This product is suitable for investors who are seeking*

- Long term capital appreciation

- Investment predominantly in equity and

equity related securities.

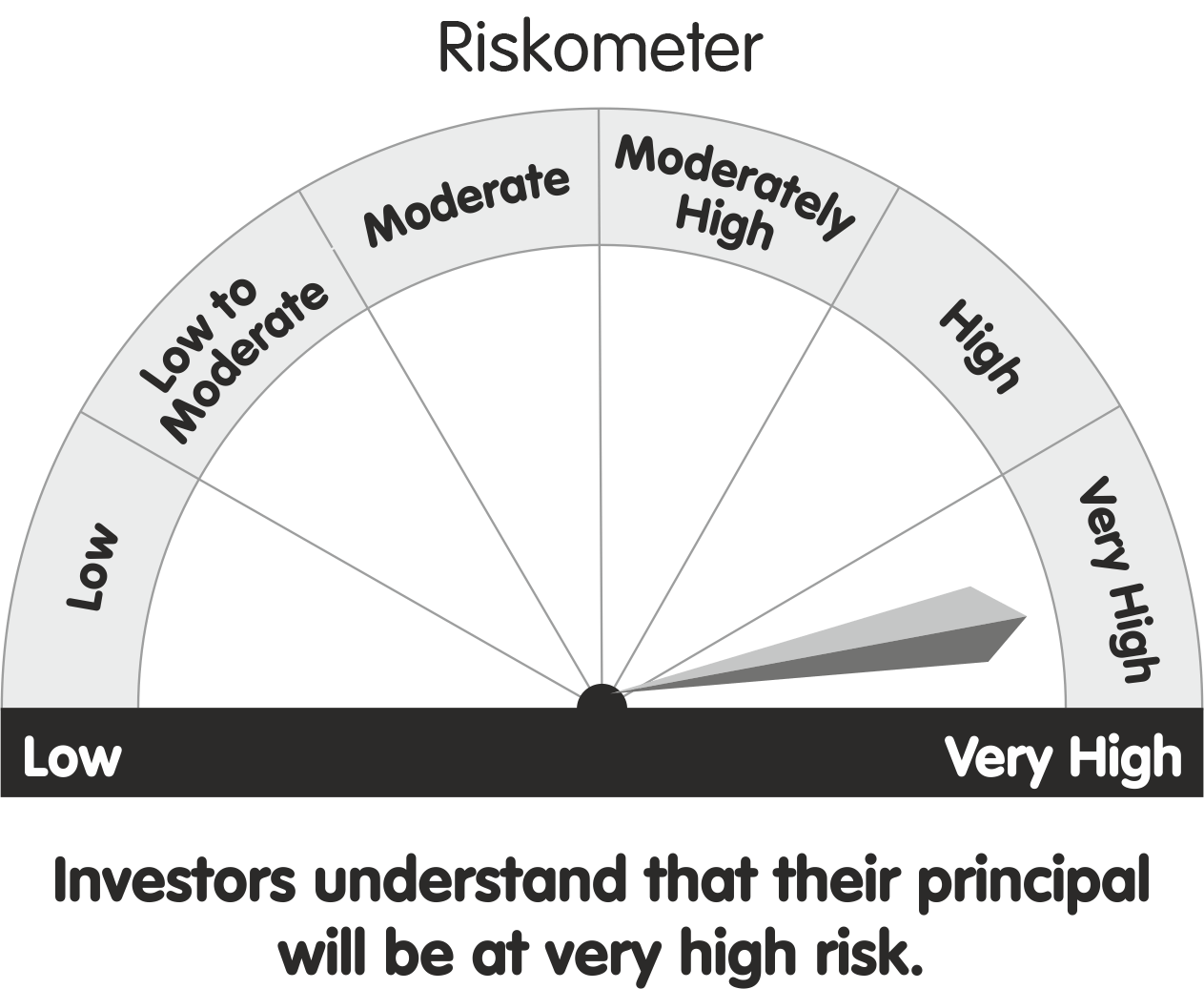

|

|

Investors should consult their financial advisers if in doubt about whether this scheme is suitable for them.

|