Details of Load Structure (On Ongoing basis):

| Particulars (as a % of Applicable NAV) # | Parag Parikh ELSS Tax Saver Fund |

|---|---|

| Entry Load | Not Applicable In terms of SEBI circular no. SEBI/IMD/CIR No. 4/ 168230/09 dated June 30, 2009 has notified that, w.e.f. August 01, 2009 there will be no entry load charged to the schemes of the Mutual Fund and the upfront commission to distributors will be paid by the investor directly to the ARN Holder (AMFI registered Distributor), based on the investors’ assessment of various factors including the service rendered by the distributor. |

| Exit Load | The Scheme will not charge any Exit Load. |

# Applicable for normal subscriptions / redemptions including transactions under special products such as SIP, STP, SWP, switches, etc. offered by the AMC

Under the Scheme, the Trustee / AMC reserves the right to modify / change the Load structure if it so deems fit in the interest of smooth and efficient functioning of the Mutual Fund. The AMC reserves the right to introduce / modify the Load Structure depending upon the circumstances prevailing at that time subject to maximum limits as prescribed under the SEBI (Mutual Funds) Regulations.

The Load may also be changed from time to time and in the case of an Exit / Redemption Load this may be linked to the period of holding. The investor is requested to check the prevailing load structure of the scheme before investing.

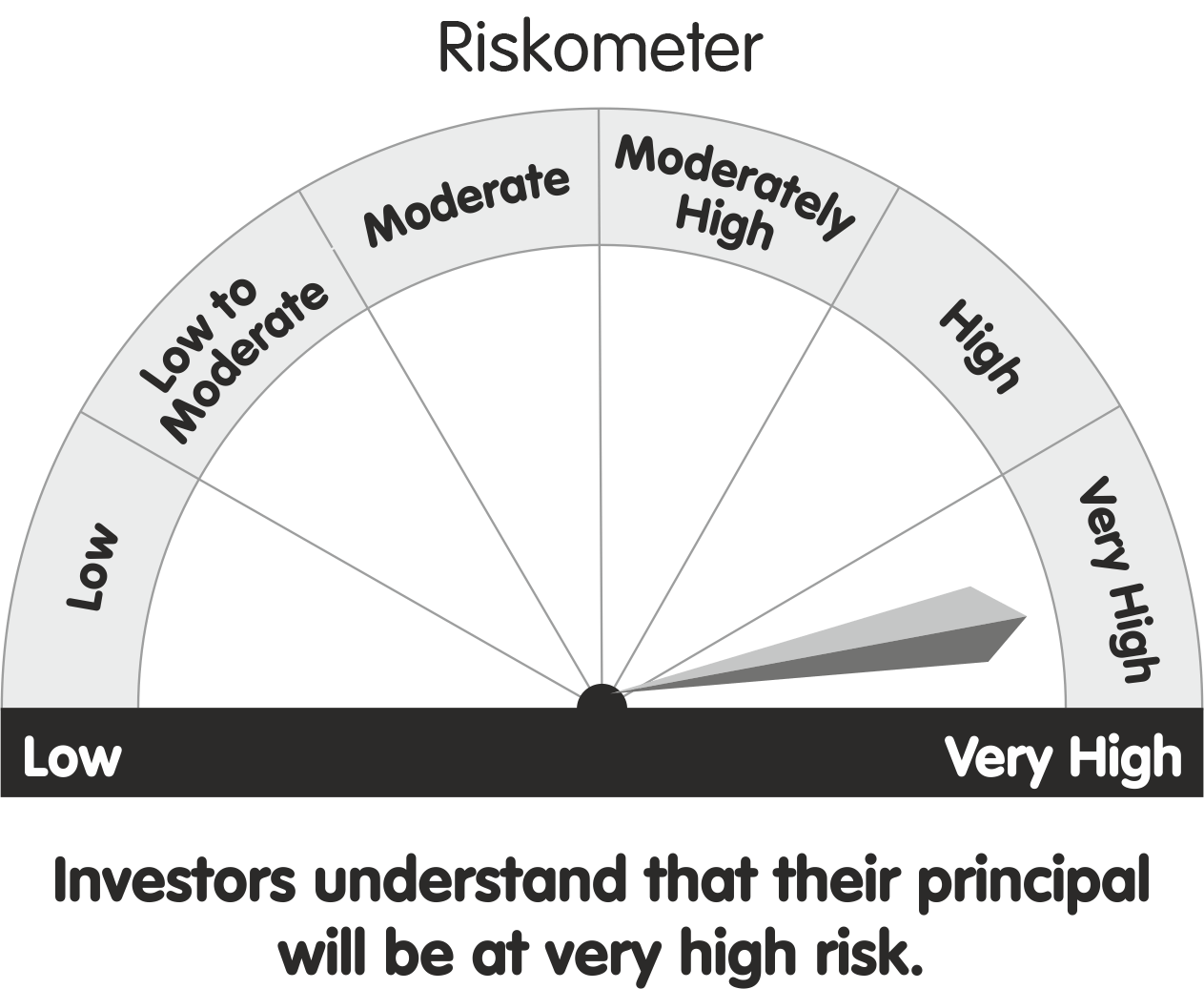

Riskometer This product is suitable for investors who are seeking This product is suitable for investors who are seeking

(I) Long term capital appreciation (II) Investment predominantly in equity and equity related securities. Investors should consult their financial advisers if in doubt about whether this scheme is suitable for them. |

|

| Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |