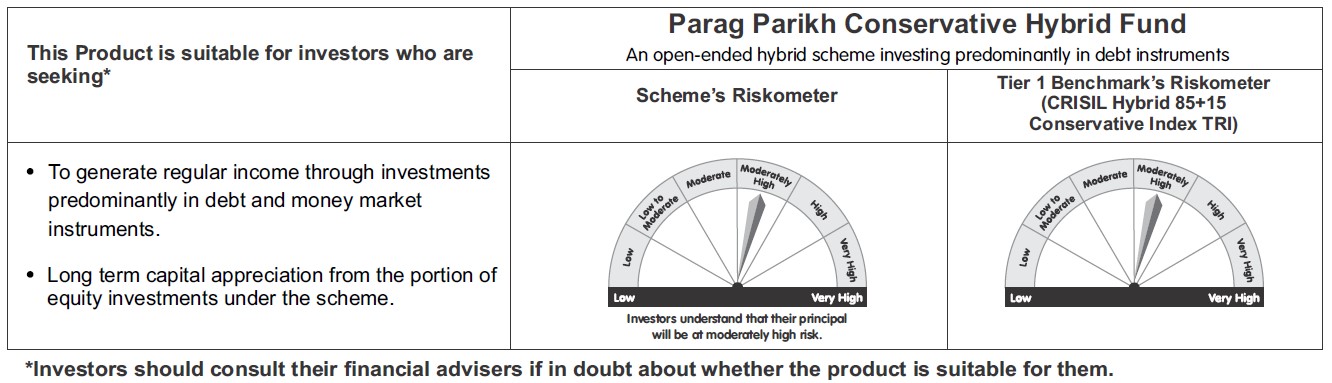

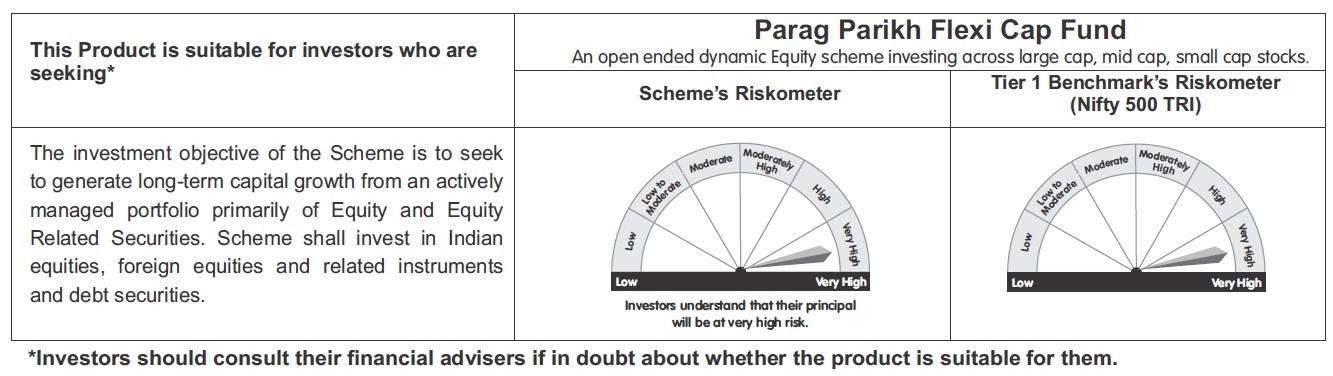

| Name of the fund | Parag Parikh Conservative Hybrid Fund |

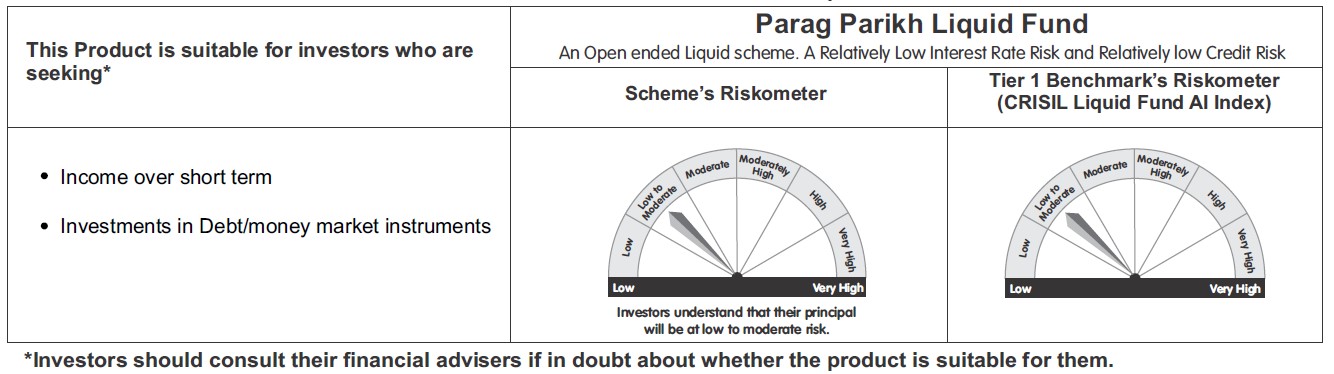

| Investment Objective | To generate regular income through investments predominantly in debt and money market instruments. The Scheme also seeks to generate long term capital appreciation from the portion of equity investments under the scheme. However, there is no assurance or guarantee that the investment objective of the Scheme will be realized. |

| Type of the scheme | An open ended hybrid scheme investing predominantly in debt instruments. |

| Date of Allotment | 26th May 2021 |

| Name of the Fund Managers | Mr. Rajeev Thakkar - Equity Fund Manager (Since Inception)

Mr. Raunak Onkar - Equity Fund Manager (Since Inception) Mr. Raj Mehta - Debt Fund Manager (Since Inception) Mr. Rukun Tarachandani - Equity Fund Manager (Since May 16, 2022) |

| Month End Expense Ratio | Regular Plan: 0.63%* Direct Plan: 0.33%* *Including additional expenses and GST on management fees. Total Expense ratio is as on last business day of the month |

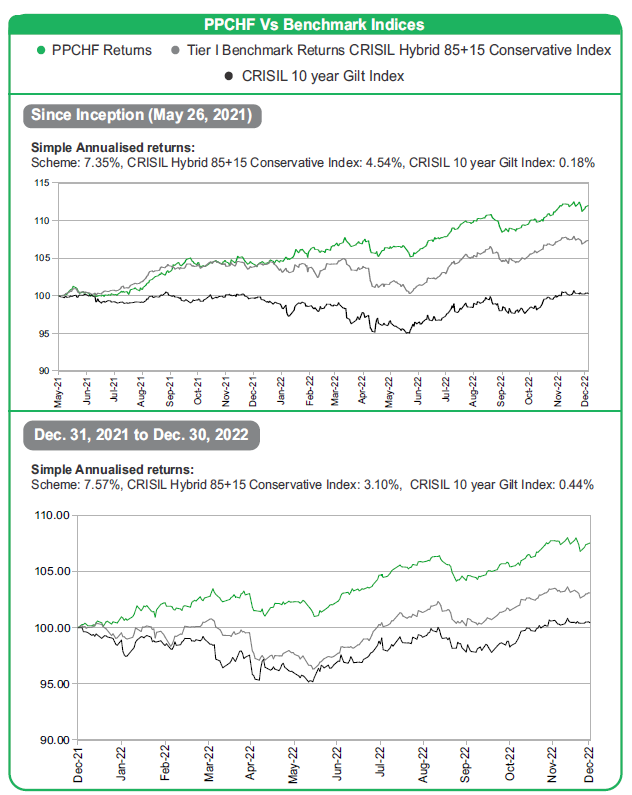

| Tier 1 Benchmark Index | CRISIL Hybrid 85+15 - Conservative Index TRI |

| Additional Benchmark | CRISIL 10 year GILT Index |

| Minimum Application / Additional Purchase Amount |

New Purchase: ₹ 5000 and in multiples of ₹ 1

thereafter. Additional Purchase: ₹ 1000 and in multiples of ₹ 1 thereafter. |

| Minimum SIP Investment Amount | Monthly SIP: ₹ 1,000, Quarterly SIP: ₹ 3,000 |

Fund Manager |

An employee of the asset management company such as a mutual fund or life insurer, who manages investment of the scheme. He is usually part of a larger team of fund managers and research analysts. |

Application amount for fresh subscription |

This is the minimum investment amount for a new investor in a mutual fund scheme. |

Minimum additional amount |

This is the minimum investment amount for an existing investor in a mutual fund scheme. |

SIP |

SIP or systematic investment plan work on the principle of making periodic investments of a fixed sum. It works similar to a recurring bank deposit. For instance, an investor may opt for an SIP that invests Rs 500 every 15 th of the month in an equity fund for a period of three years. |

NAV |

The NAV or the net asset value is the total asset value per unit of the mutual fund after deducting all related and permissible expenses. The NAV is calculated at the end of every business day. It is the value at which the investor enters or exits the mutual fund. |

Benchmark |

A group of securities, usually a market index whose performance is used as a standard or benchmark to measure investment performance of mutual funds, among other investments. Some typical benchmark include the Nifty, Sensex, BSE 200, BSE 500, 10-year Gsec. |

Entry Load |

A mutual fund may have a sales charge or load at the time of entry and/or exit to compensate the distributor/agent. Entry load is charged at the time an investor purchase the units of a mutual fund. The entry load is added to the prevailing NAV at the time of investment. For instance, if the NAV is 100 and the entry load is 1%, the investor will enter the fund at 101. |

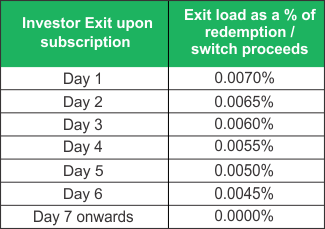

Exit Load |

Exit load is charged at the time of redeeming (or transferring an investment between schemes). The exit load percentage is deducted from the NAV at the time of redemption (or transfer between schemes). This amount goes to the respective scheme and gets added to the AUM of that Scheme |

Standard Deviation |

Standard deviation is a statistical measure of the range of an investment’s performance. When a mutual fund Scheme has a high standard deviation, its range of performance is wide implying greater volatility. |

Sharpe Ratio |

The Sharpe Ratio named after its founder, the Nobel Laureate William Sharpe is a measure of risk-adjusted returns. It is calculated using standard deviation and excess return to determine reward per unit of risk. |

Beta |

Beta is a measure of an investment's volatility vis-a-vis the market. Beta of less than 1 means that the security will be less volatile than the market. A beta of greater than 1 implies that the security's price will be more volatile than the market. |

AUM |

AUM or assets under management refers to the recent / updated cumulative market value of investments managed by a mutual fund or any investment firm. |

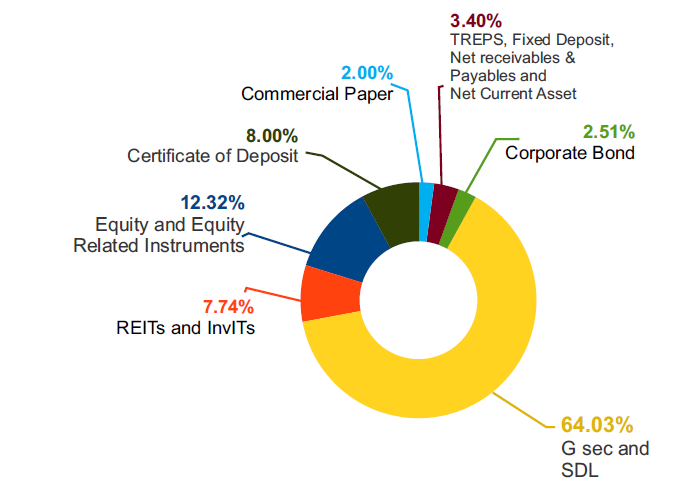

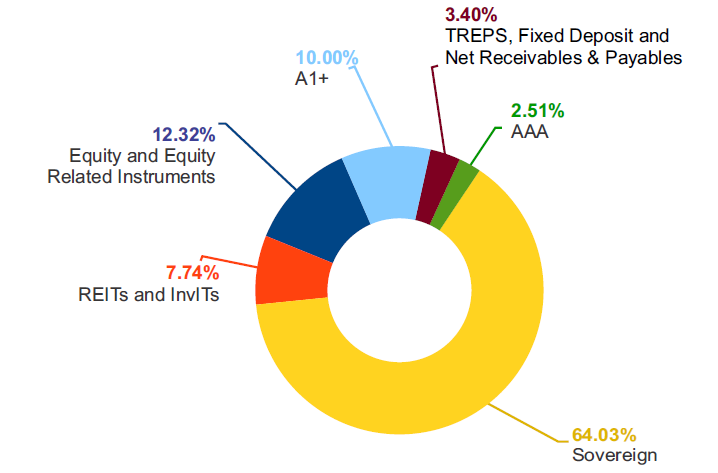

Holdings |

The holding or the portfolio is a mutual fund's latest or updated reported statement of investments/securities. These are usually displayed in term of percentage to net assets or the rupee value or both. The objective is to give investors an idea of where their money is being invested by the fund manager. |

Nature of Scheme |

The investment objective and underlying investments determine the nature of the mutual fund scheme. For instance a mutual fund that aims at generating capital appreciation by investing in stock markets is an equity fund or growth fund. Likewise a mutual fund that aims at capital preservation by investing in debt markets is a debt fund or income fund. Each of these categories may have sub-categories. |

Portfolio Turnover Ratio |

A measure of how frequently assets within a fund are bought and sold by the managers. Portfolio turnover is calculated by taking either the total amount of new securities purchased or the amount of securities sold - whichever is less - over a particular period, divided by the total net asset value (NAV) of the fund. The measurement is usually reported for a 12-month time period. |

Yield to Maturity (YTM) |

The yield to maturity (YTM) of a bond or other fixed-interest security, such as gilts, is the (theoretical) internal rate of return (IRR, overall interest rate) earned by an investor who buys the bond today at the market price, assuming that the bond is held until maturity, and that all coupon and principal payments are made on schedule. |

Modified Duration |

Modified duration is a formula that expresses the measurable change in the value of a security in response to a change in interest rates. Modified duration follows the concept that interest rates and bond prices move in opposite directions. |

Total Expense ratio |

The total expense ratio (TER) is a measure of the total cost of a fund to the investor. Total costs may include various fees (purchase, redemption, auditing) and other expenses. The TER, calculated by dividing the total annual cost by the fund'stotal assets averaged over that year, is denoted as a percentage. |