Mr. Rajeev Thakkar manages 5 Schemes of PPFAS Mutual Fund since inception.

| Scheme | Date of Allotment |

Date | Scheme return % |

Tier 1 Benchmark Return (%) |

Additional Benchmark Return (%) | Value of investment of Rs. 10,000/- | ||

|---|---|---|---|---|---|---|---|---|

| NIFTY 500 (TRI) | NIFTY 50 (TRI) | Scheme Return (Rs.) (Additional Benchmark) | NIFTY 500 (TRI) | NIFTY 50 (TRI) | ||||

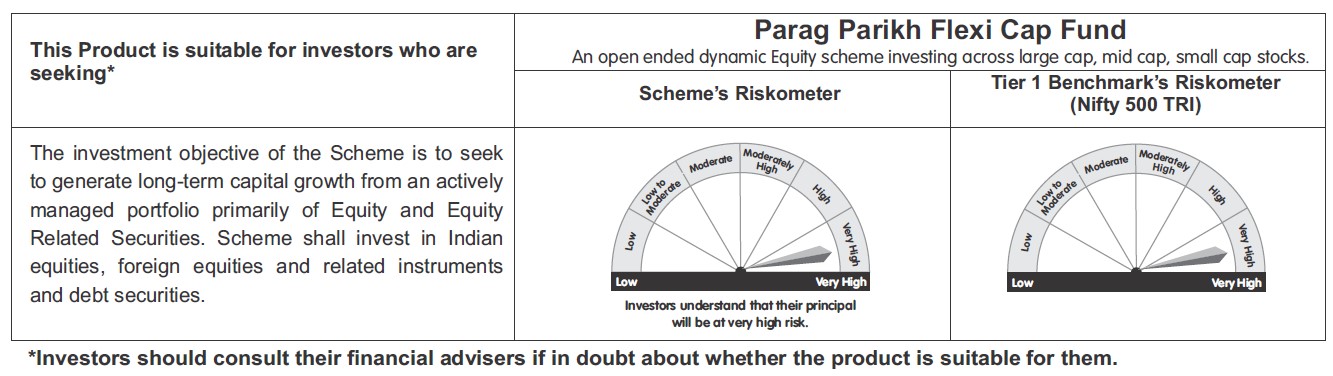

| Parag Parikh Flexi Cap Fund | 24th May, 2013 | Since Inception* | 20.00% | 16.53% | 14.76% | 75,729 | 54,666 | 46,107 |

| 1 Year | 36.50% | 38.79% | 26.74% | 13,639 | 13,867 | 12,666 | ||

| 3 Year | 20.76% | 20.01% | 16.55% | 17,601 | 17,276 | 15,826 | ||

| 5 Year | 24.57% | 19.76% | 16.66% | 30,034 | 24,660 | 21,626 | ||

| 10 Year | 18.33% | 15.11% | 13.55% | 53,826 | 40,873 | 35,660 | ||

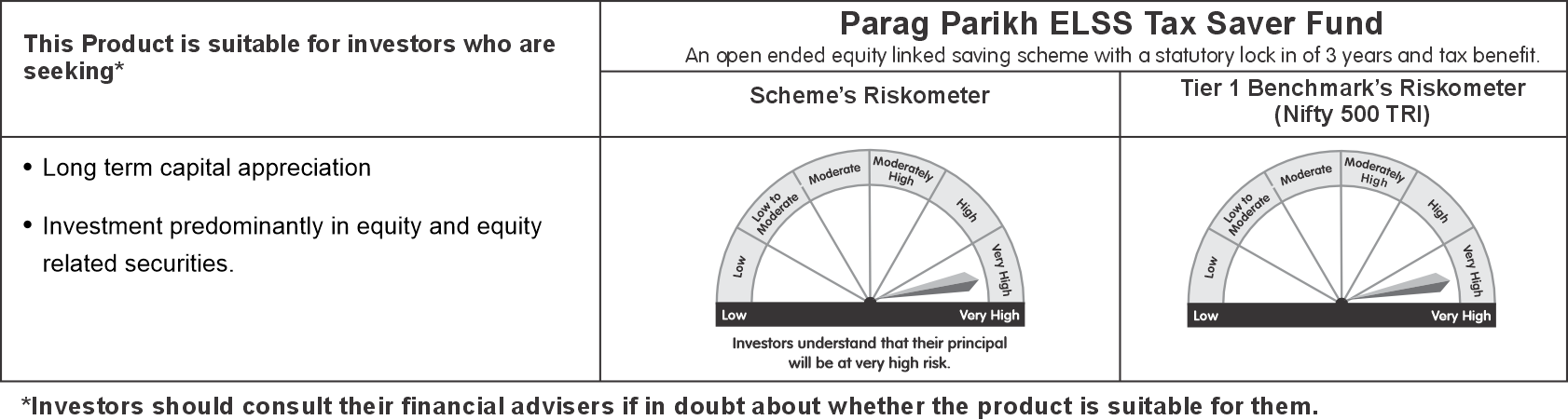

| Parag Parikh ELSS Tax Saver Fund |

24 July, 2019 | Since Inception* | 23.79% | 21.31% | 17.93% | 28,661 | 25,938 | 22,565 |

| 1 Year | 32.43% | 38.79% | 26.74% | 13,233 | 13,867 | 12,666 | ||

| 3 Years | 21.29% | 20.01% | 16.55% | 17,833 | 17,276 | 15,826 | ||

| Scheme | Date of Allotment |

Date | Scheme return % |

Tier 1 Benchmark Return (%) |

Additional Benchmark Return (%) | Value of investment of Rs. 10,000/- | ||

| CRISIL Hybrid 85+15 Conservative Index | CRISIL 10 year Gilt Index | Scheme Return (Rs.) | Tier I benchmark return CRISIL Hybrid 85+15 Conservative Index | CRISIL 10 year Gilt Index | ||||

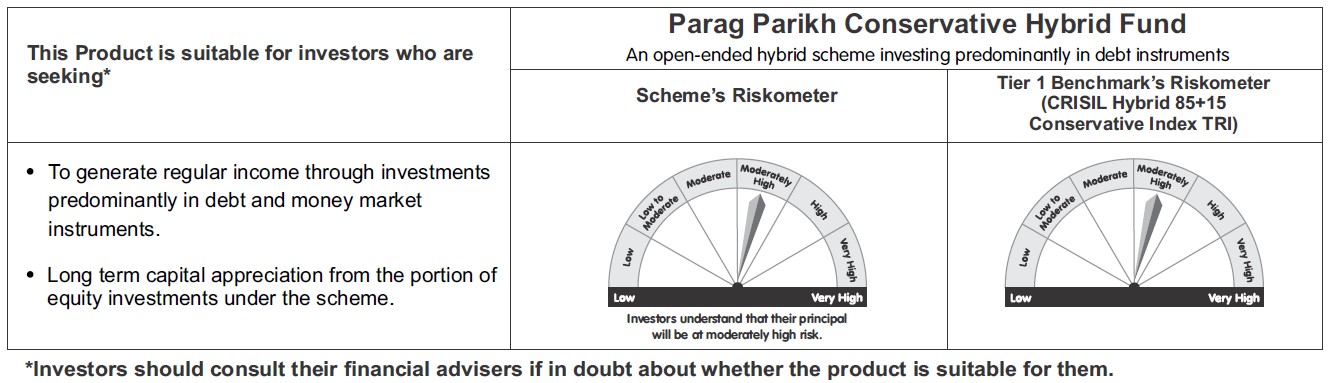

| Parag Parikh Conservative Hybrid Fund |

May 26, 2021 | Since Inception# | 10.86% | 7.54% | 4.02% | 13,756 | 12,521 | 11,298 |

| 1 year | 17.77% | 11.59% | 7.30% | 11,771 | 11,156 | 10,728 | ||

| Data as on 30 June, 2024 | ||||||||

*Since inception returns are calculated on Rs. 10 (allotment price)

#Since inception returns are calculated on Rs. 1000 (allotment price)

Mr. Raunak Onkar manages 5 Schemes of PPFAS Mutual Fund since inception.

| Scheme | Date of Allotment |

Date | Scheme return % |

Tier 1 Benchmark Return (%) |

Additional Benchmark Return (%) | Value of investment of Rs. 10,000/- | ||

|---|---|---|---|---|---|---|---|---|

| NIFTY 500 (TRI) | NIFTY 50 (TRI) | Scheme Return (Rs.) (Additional Benchmark) | NIFTY 500 (TRI) | NIFTY 50 (TRI) | ||||

| Parag Parikh Flexi Cap Fund | 24th May, 2013 | Since Inception* | 20.00% | 16.53% | 14.76% | 75,729 | 54,666 | 46,107 |

| 1 Year | 36.50% | 38.79% | 26.74% | 13,639 | 13,867 | 12,666 | ||

| 3 Year | 20.76% | 20.01% | 16.55% | 17,601 | 17,276 | 15,826 | ||

| 5 Year | 24.57% | 19.76% | 16.66% | 30,034 | 24,660 | 21,626 | ||

| 10 Year | 18.33% | 15.11% | 13.55% | 53,826 | 40,873 | 35,660 | ||

| Parag Parikh ELSS Tax Saver Fund |

24 July, 2019 | Since Inception* | 23.79% | 21.31% | 17.93% | 28,661 | 25,938 | 22,565 |

| 1 Year | 32.43% | 38.79% | 26.74% | 13,233 | 13,867 | 12,666 | ||

| 3 Years | 21.29% | 20.01% | 16.55% | 17,833 | 17,276 | 15,826 | ||

| Scheme | Date of Allotment |

Date | Scheme return % |

Tier 1 Benchmark Return (%) |

Additional Benchmark Return (%) | Value of investment of Rs. 10,000/- | ||

| CRISIL Hybrid 85+15 Conservative Index | CRISIL 10 year Gilt Index | Scheme Return (Rs.) | Tier I benchmark return CRISIL Hybrid 85+15 Conservative Index | CRISIL 10 year Gilt Index | ||||

| Parag Parikh Conservative Hybrid Fund |

May 26, 2021 | Since Inception# | 10.86% | 7.54% | 4.02% | 13,756 | 12,521 | 11,298 |

| 1 year | 17.77% | 11.59% | 7.30% | 11,771 | 11,156 | 10,728 | ||

| Data as on 30 June, 2024 | ||||||||

*Since inception returns are calculated on Rs. 10 (allotment price)

#Since inception returns are calculated on Rs. 1000 (allotment price)

Mr. Raj Mehta managing Parag Parikh Flexi Cap Fund since January 2016 and other 5 Schemes of PPFAS Mutual Fund since inception.

| Scheme | Date of Allotment |

Date | Scheme return % |

Tier 1 Benchmark Return (%) |

Additional Benchmark Return (%) | Value of investment of Rs. 10,000/- | ||

|---|---|---|---|---|---|---|---|---|

| NIFTY 500 (TRI) | NIFTY 50 (TRI) | Scheme Return (Rs.) (Additional Benchmark) | NIFTY 500 (TRI) | NIFTY 50 (TRI) | ||||

| Parag Parikh Flexi Cap Fund | 24th May, 2013 | Since Inception* | 20.00% | 16.53% | 14.76% | 75,729 | 54,666 | 46,107 |

| 1 Year | 36.50% | 38.79% | 26.74% | 13,639 | 13,867 | 12,666 | ||

| 3 Year | 20.76% | 20.01% | 16.55% | 17,601 | 17,276 | 15,826 | ||

| 5 Year | 24.57% | 19.76% | 16.66% | 30,034 | 24,660 | 21,626 | ||

| 10 Year | 18.33% | 15.11% | 13.55% | 53,826 | 40,873 | 35,660 | ||

| Parag Parikh ELSS Tax Saver Fund |

24 July, 2019 | Since Inception* | 23.79% | 21.31% | 17.93% | 28,661 | 25,938 | 22,565 |

| 1 Year | 32.43% | 38.79% | 26.74% | 13,233 | 13,867 | 12,666 | ||

| 3 Years | 21.29% | 20.01% | 16.55% | 17,833 | 17,276 | 15,826 | ||

| Scheme | Date of Allotment |

Date | Scheme return % |

Tier 1 Benchmark Return (%) |

Additional Benchmark Return (%) | Value of investment of Rs. 10,000/- | ||

|---|---|---|---|---|---|---|---|---|

| CRISIL Liquid Debt A-I Index | CRISIL 1 year T-bill Index | Scheme Return (Rs.) | CRISIL Liquid Debt A-I Index | CRISIL 1 year T-bill Index | ||||

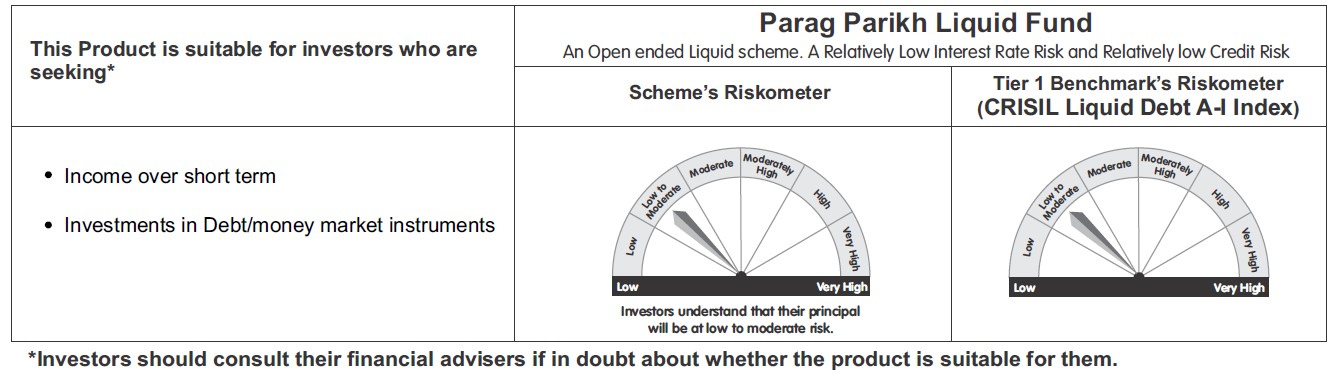

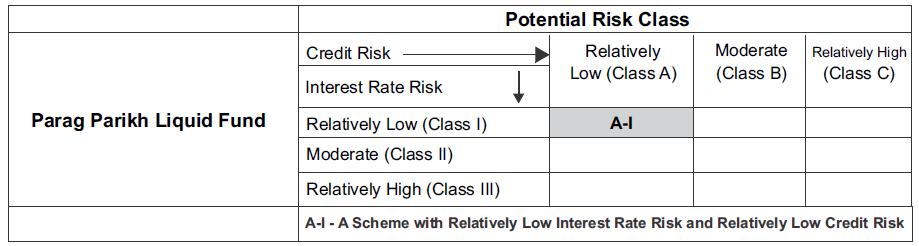

| Parag Parikh Liquid Fund |

11 May, 2018 | Since Inception# | 5.09% | 5.65% | 5.90% | 13,565 | 14,012 | 14,224 |

| 1 Year | 6.87% | 7.29% | 7.13% | 10,689 | 10,731 | 10,715 | ||

| 3 Years | 5.40% | 5.85% | 5.50% | 11,711 | 11,862 | 11,745 | ||

| 5 Years | 4.81% | 5.29% | 5.55% | 12,651 | 12,945 | 13,105 | ||

| Scheme | Date of Allotment |

Date | Scheme return % |

Tier 1 Benchmark Return (%) |

Additional Benchmark Return (%) | Value of investment of Rs. 10,000/- | ||

| CRISIL Hybrid 85+15 Conservative Index | CRISIL 10 year Gilt Index | Scheme Return (Rs.) | Tier I benchmark return CRISIL Hybrid 85+15 Conservative Index | CRISIL 10 year Gilt Index | ||||

| Parag Parikh Conservative Hybrid Fund |

May 26, 2021 | Since Inception# | 10.86% | 7.54% | 4.02% | 13,756 | 12,521 | 11,298 |

| 1 year | 17.77% | 11.59% | 7.30% | 11,771 | 11,156 | 10,728 | ||

| Data as on 30 June, 2024 | ||||||||

*Since inception returns are calculated on Rs. 10 (allotment price)

#Since inception returns are calculated on Rs. 1000 (allotment price)

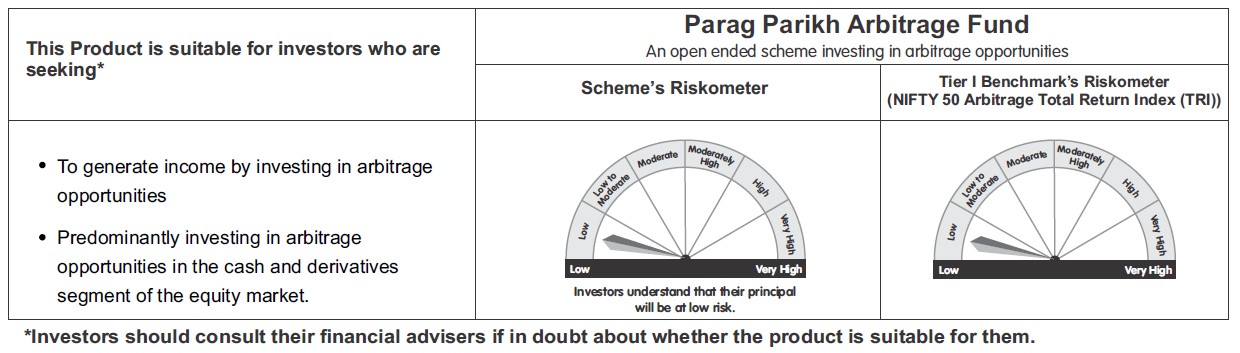

Mr. Rukun Tarachandani manages 3 Schemes of PPFAS Mutual Fund since 16 May 2022, Parag Parikh Arbitrage Fund and Parag Parikh Dynamic Asset Allocation Fund since inception.

| Scheme | Date of Allotment |

Date | Scheme return % |

Tier 1 Benchmark Return (%) |

Additional Benchmark Return (%) | Value of investment of Rs. 10,000/- | ||

|---|---|---|---|---|---|---|---|---|

| NIFTY 500 (TRI) | NIFTY 50 (TRI) | Scheme Return (Rs.) (Additional Benchmark) | NIFTY 500 (TRI) | NIFTY 50 (TRI) | ||||

| Parag Parikh Flexi Cap Fund | 24th May, 2013 | Since Inception* | 20.00% | 16.53% | 14.76% | 75,729 | 54,666 | 46,107 |

| 1 Year | 36.50% | 38.79% | 26.74% | 13,639 | 13,867 | 12,666 | ||

| 3 Year | 20.76% | 20.01% | 16.55% | 17,601 | 17,276 | 15,826 | ||

| 5 Year | 24.57% | 19.76% | 16.66% | 30,034 | 24,660 | 21,626 | ||

| 10 Year | 18.33% | 15.11% | 13.55% | 53,826 | 40,873 | 35,660 | ||

| Parag Parikh ELSS Tax Saver Fund |

24 July, 2019 | Since Inception* | 23.79% | 21.31% | 17.93% | 28,661 | 25,938 | 22,565 |

| 1 Year | 32.43% | 38.79% | 26.74% | 13,233 | 13,867 | 12,666 | ||

| 3 Years | 21.29% | 20.01% | 16.55% | 17,833 | 17,276 | 15,826 | ||

| Scheme | Date of Allotment |

Date | Scheme return % |

Tier 1 Benchmark Return (%) |

Additional Benchmark Return (%) | Value of investment of Rs. 10,000/- | ||

| CRISIL Hybrid 85+15 Conservative Index | CRISIL 10 year Gilt Index | Scheme Return (Rs.) | Tier I benchmark return CRISIL Hybrid 85+15 Conservative Index | CRISIL 10 year Gilt Index | ||||

| Parag Parikh Conservative Hybrid Fund |

May 26, 2021 | Since Inception# | 10.86% | 7.54% | 4.02% | 13,756 | 12,521 | 11,298 |

| 1 year | 17.77% | 11.59% | 7.30% | 11,771 | 11,156 | 10,728 | ||

| Data as on 30 June, 2024 | ||||||||

*Since inception returns are calculated on Rs. 10 (allotment price)

#Since inception returns are calculated on Rs. 1000 (allotment price)

Ms. Mansi Kariya manages 5 Schemes of PPFAS Mutual Fund since 22nd December 2023 and Parag Parikh Dynamic Asset Allocation Fund since inception.

| Scheme | Date of Allotment |

Date | Scheme return % |

Tier 1 Benchmark Return (%) |

Additional Benchmark Return (%) | Value of investment of Rs. 10,000/- | ||

|---|---|---|---|---|---|---|---|---|

| NIFTY 500 (TRI) | NIFTY 50 (TRI) | Scheme Return (Rs.) (Additional Benchmark) | NIFTY 500 (TRI) | NIFTY 50 (TRI) | ||||

| Parag Parikh Flexi Cap Fund | 24th May, 2013 | Since Inception* | 20.00% | 16.53% | 14.76% | 75,729 | 54,666 | 46,107 |

| 1 Year | 36.50% | 38.79% | 26.74% | 13,639 | 13,867 | 12,666 | ||

| 3 Year | 20.76% | 20.01% | 16.55% | 17,601 | 17,276 | 15,826 | ||

| 5 Year | 24.57% | 19.76% | 16.66% | 30,034 | 24,660 | 21,626 | ||

| 10 Year | 18.33% | 15.11% | 13.55% | 53,826 | 40,873 | 35,660 | ||

| Parag Parikh ELSS Tax Saver Fund |

24 July, 2019 | Since Inception* | 23.79% | 21.31% | 17.93% | 28,661 | 25,938 | 22,565 |

| 1 Year | 32.43% | 38.79% | 26.74% | 13,233 | 13,867 | 12,666 | ||

| 3 Years | 21.29% | 20.01% | 16.55% | 17,833 | 17,276 | 15,826 | ||

| Scheme | Date of Allotment |

Date | Scheme return % |

Tier 1 Benchmark Return (%) |

Additional Benchmark Return (%) | Value of investment of Rs. 10,000/- | ||

| CRISIL Liquid Debt A-I Index | CRISIL 1 year T-bill Index | Scheme Return (Rs.) | CRISIL Liquid Debt A-I Index | CRISIL 1 year T-bill Index | ||||

| Parag Parikh Liquid Fund |

11 May, 2018 | Since Inception# | 5.09% | 5.65% | 5.90% | 13,565 | 14,012 | 14,224 |

| 1 Year | 6.87% | 7.29% | 7.13% | 10,689 | 10,731 | 10,715 | ||

| 3 Years | 5.40% | 5.85% | 5.50% | 11,711 | 11,862 | 11,745 | ||

| 5 Years | 4.81% | 5.29% | 5.55% | 12,651 | 12,945 | 13,105 | ||

| Scheme | Date of Allotment |

Date | Scheme return % |

Tier 1 Benchmark Return (%) |

Additional Benchmark Return (%) | Value of investment of Rs. 10,000/- | ||

| CRISIL Hybrid 85+15 Conservative Index | CRISIL 10 year Gilt Index | Scheme Return (Rs.) | Tier I benchmark return CRISIL Hybrid 85+15 Conservative Index | CRISIL 10 year Gilt Index | ||||

| Parag Parikh Conservative Hybrid Fund |

May 26, 2021 | Since Inception# | 10.86% | 7.54% | 4.02% | 13,756 | 12,521 | 11,298 |

| 1 year | 17.77% | 11.59% | 7.30% | 11,771 | 11,156 | 10,728 | ||

| Data as on 30 June, 2024 | ||||||||

*Since inception returns are calculated on Rs. 10 (allotment price)

#Since inception returns are calculated on Rs. 1000 (allotment price)