| Name of the fund | Parag Parikh Conservative Hybrid Fund |

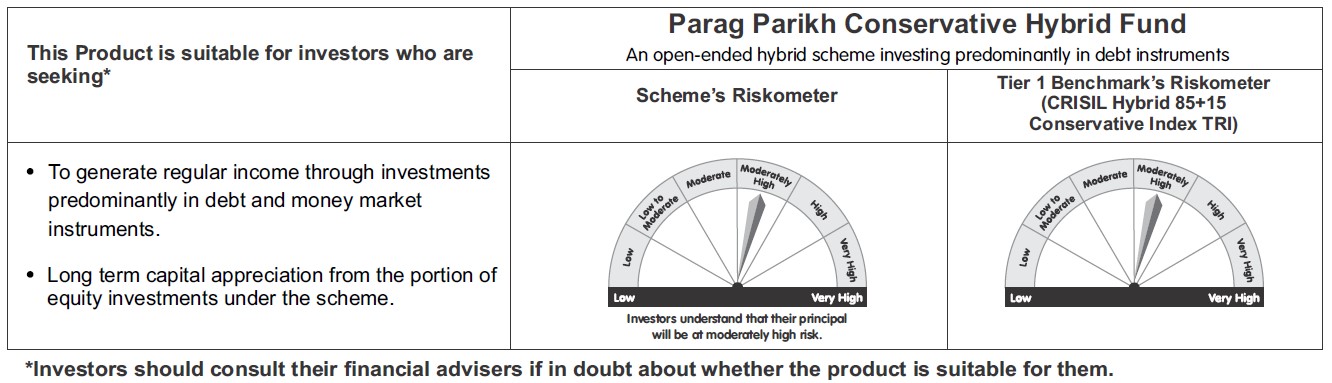

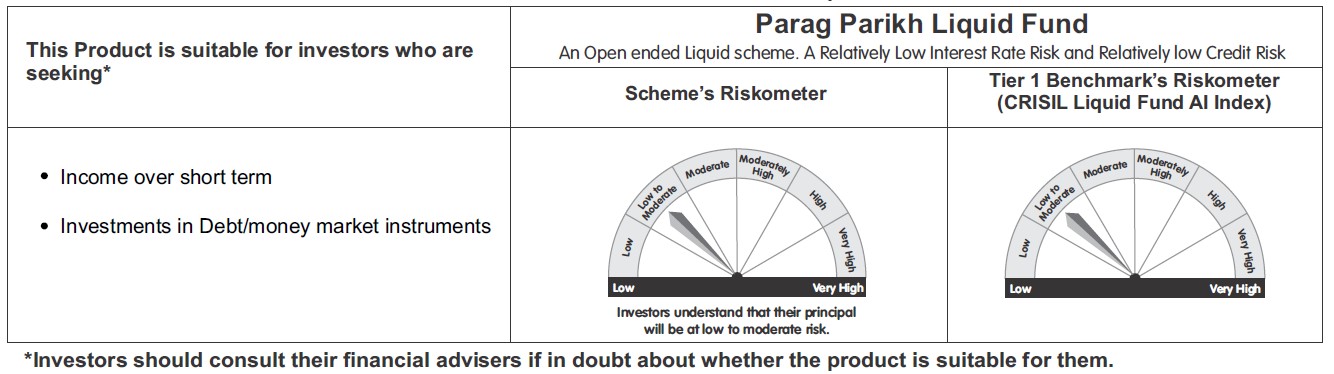

| Investment Objective | To generate regular income through investments predominantly in debt and money market instruments. The Scheme also seeks to generate long term capital appreciation from the portion of equity investments under the scheme. However, there is no assurance or guarantee that the investment objective of the Scheme will be realized. |

| Type of the scheme | An open ended hybrid scheme investing predominantly in debt instruments. |

| Date of Allotment | 26th May 2021 |

| Name of the Fund Managers | Mr. Rajeev Thakkar - Equity Fund Manager (Since Inception)

Mr. Raunak Onkar - Equity Fund Manager (Since Inception) Mr. Raj Mehta - Debt Fund Manager (Since Inception) Mr. Rukun Tarachandani - Equity Fund Manager (Since May 16, 2022) |

| Month End Expense Ratio | Regular Plan: 0.63%* Direct Plan: 0.33%* *Including additional expenses and GST on management fees. Total Expense ratio is as on last business day of the month |

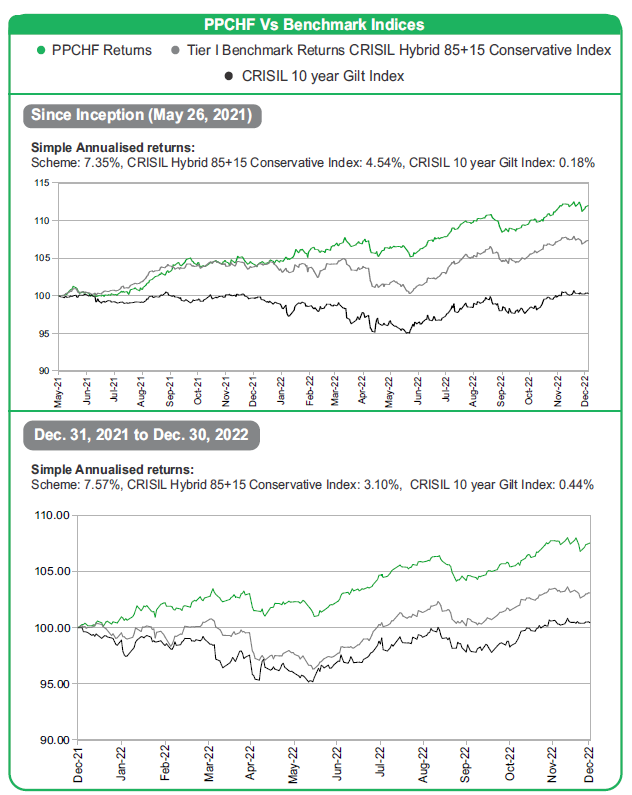

| Tier 1 Benchmark Index | CRISIL Hybrid 85+15 - Conservative Index TRI |

| Additional Benchmark | CRISIL 10 year GILT Index |

| Minimum Application / Additional Purchase Amount |

New Purchase: ₹ 5000 and in multiples of ₹ 1

thereafter. Additional Purchase: ₹ 1000 and in multiples of ₹ 1 thereafter. |

| Minimum SIP Investment Amount | Monthly SIP: ₹ 1,000, Quarterly SIP: ₹ 3,000 |

Digital Factsheet - December 2022

Note on Parag Parikh Conservative Hybrid Fund (PPCHF):

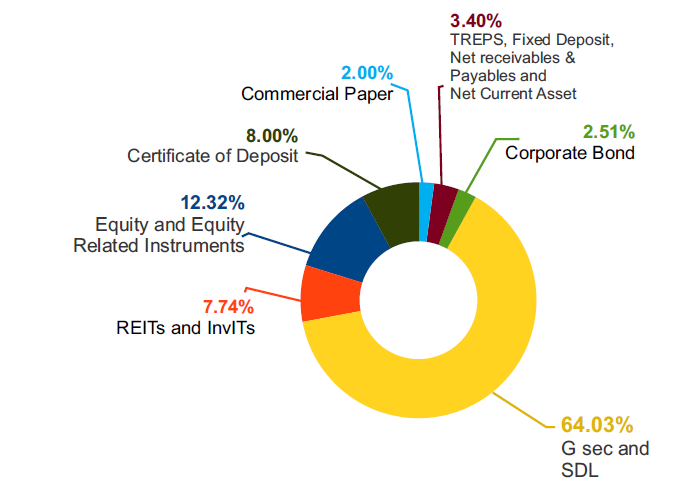

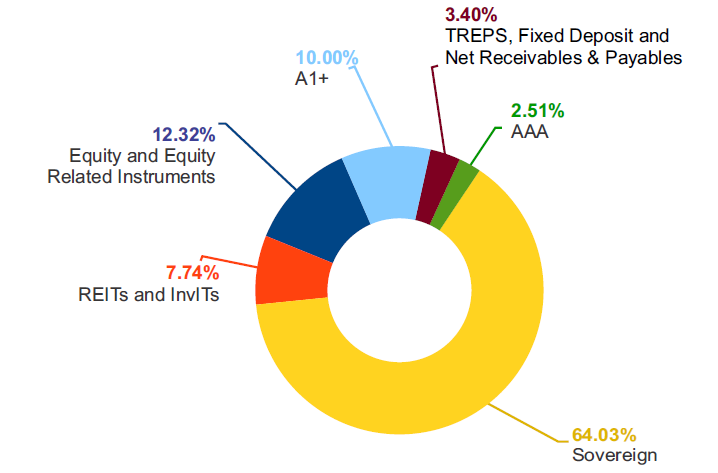

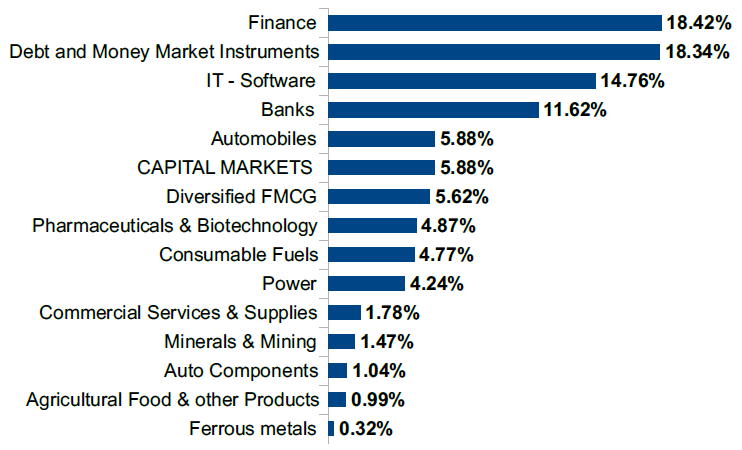

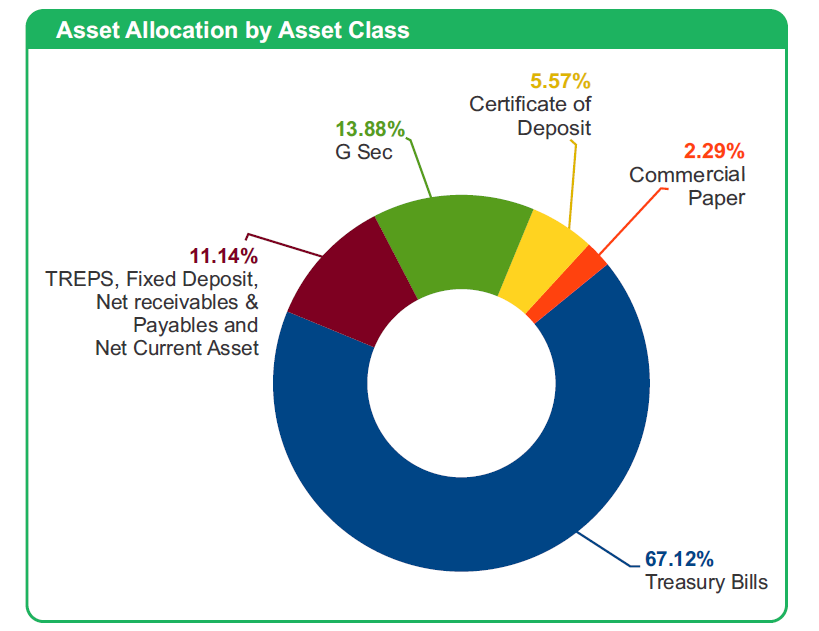

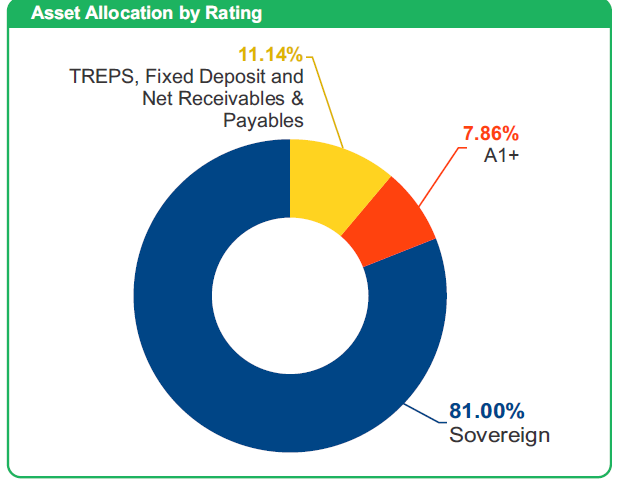

At the time of the launch of PPCHF, we were of the opinion that long duration Sovereign State Development Loans were the most attractive space. These are backed by the taxing power of the Government - and indirectly the monetisation power of the Reserve Bank of India (RBI). We were not investing in corporate papers as the yields were lower than sovereign papers. We had also stated that in the future, if quality AAA corporate papers would trade at a decent spread over sovereign paper, we may choose to invest in them. Given the steepness of the yield curve at that time, we were of the opinion that if interest rates are hiked, longer term yields won’t move in the same quantum as shorter term yields.

Based on the current market scenario, we see short term highly rated corporate papers as a very attractive space. The yield curve is now relatively flat from 1 year to 7 years maturity. One year bank Certificate of Deposits (CDs) and Commercial Papers (CPs) are yielding higher than 3-4 years State Development loans. Hence it makes sense to shift some allocation from medium dated State Development Loans (SDLs) to short term corporate papers at slightly higher yields. This will help us in reducing the modified duration of the portfolio and at the same time enhancing the yield. Between November and December end, the modified duration has reduced from 4.04 years to 3.63 years. Wherever we choose to invest in non sovereign paper, we will keep individual exposure to issuers limited rather than buy huge chunks of individual papers so as to reduce the risk to individual entities. The credit risk of the issuers is examined by our team and also the issuers carry the highest credit ratings from external rating agencies.

Raj Mehta

January 2, 2023