Parag Parikh Liquid Fund (PPLF) is An Open ended Liquid scheme. A Relatively Low Interest Rate Risk and Relatively low Credit Risk whose primary investment objective is to deliver reasonable market related returns with lower risk and high liquidity through judicious investments in money market and debt instruments. However, there is no assurance that the investment objective of the scheme will be realized and the scheme does not assure or guarantee any returns.

PPLF is a suitable option for investors who are seeking a low risk savings solution for short periods (usually, less than a year).

The key advantages of PPLF are:

| Options |

Sub-Options/ Facilities |

Frequency of Income Distribution cum Capital Withdrawal Option | Record Date |

|---|---|---|---|

| Growth | NA | NA | NA |

| Income Distribution cum Capital Withdrawal Option |

Daily Re-investment |

Daily |

All days for which NAV is published on www.amfiindia.com and http://amc.ppfas.com websites. |

| Weekly Re-investment | Weekly | Every Monday | |

| Monthly Re-investment and Payout | Monthly | Last Monday of the Month |

The Trustee/AMC reserves the right to change the record date from time to time

| Purchase | Additional Purchase |

|---|---|

| ₹ 5,000 and in multiple of Re. 1 thereafter. |

₹ 1,000 and in multiple of Re. 1 thereafter. |

In case you desire to transfer funds via NEFT/RTGS, the Bank details are provided below:

| Bank Name |

Type of Account |

A/c Number | Name of Account | IFSC Code |

|---|---|---|---|---|

| AXIS Bank | COLLECTION |

918020038138452 | PARAG PARIKH LIQUID FUND COLLECTION A/C | UTIB0000004 |

| HDFC Bank | COLLECTION | 57500000144502 |

PARAG PARIKH LIQUID FUND COLLECTION A/C | HDFC0000060 |

| ICICI Bank | COLLECTION |

000405116530 | PARAG PARIKH LIQUID FUND COLLECTION A/C | ICIC0000004 |

| Kotak Mah Bank | COLLECTION |

3113187781 | PARAG PARIKH LIQUID FUND COLLECTION A/C | KKBK0000958 |

| State Bank of India | COLLECTION |

37669770012 | PARAG PARIKH LIQUID FUND COLLECTION A/C | SBIN0011777 |

| Yes Bank | COLLECTION |

000485700001305 | PPFAS MUTUAL FUND COLLECTION ACCOUNT | YESB0000004 |

| Investor Exit upon subscription |

Exit Load as a % of redemption proceeds |

|---|---|

| Day 1 | 0.0070% |

| Day 2 | 0.0065% |

| Day 3 | 0.0060% |

| Day 4 | 0.0055% |

| Day 5 |

0.0050% |

| Day 6 | 0.0045% |

| Day 7 Onwards | 0.0000% |

| Sr. No. | Type of Instruments | Normal allocation (% of Net Assets) | Risk Profile |

|---|---|---|---|

| 1 | Money Market instruments (including cash, repo, CPs, CDs, Treasury Bills, TREPs/CBLO and Government Securities with maturity/residual maturity up to 91 days) | 80-100 | Low |

| 2 | Debt instruments (including Floating rate debt instruments and securitised debt with maturity/residual maturity up to 91 days) | 0-20 | Low to Medium |

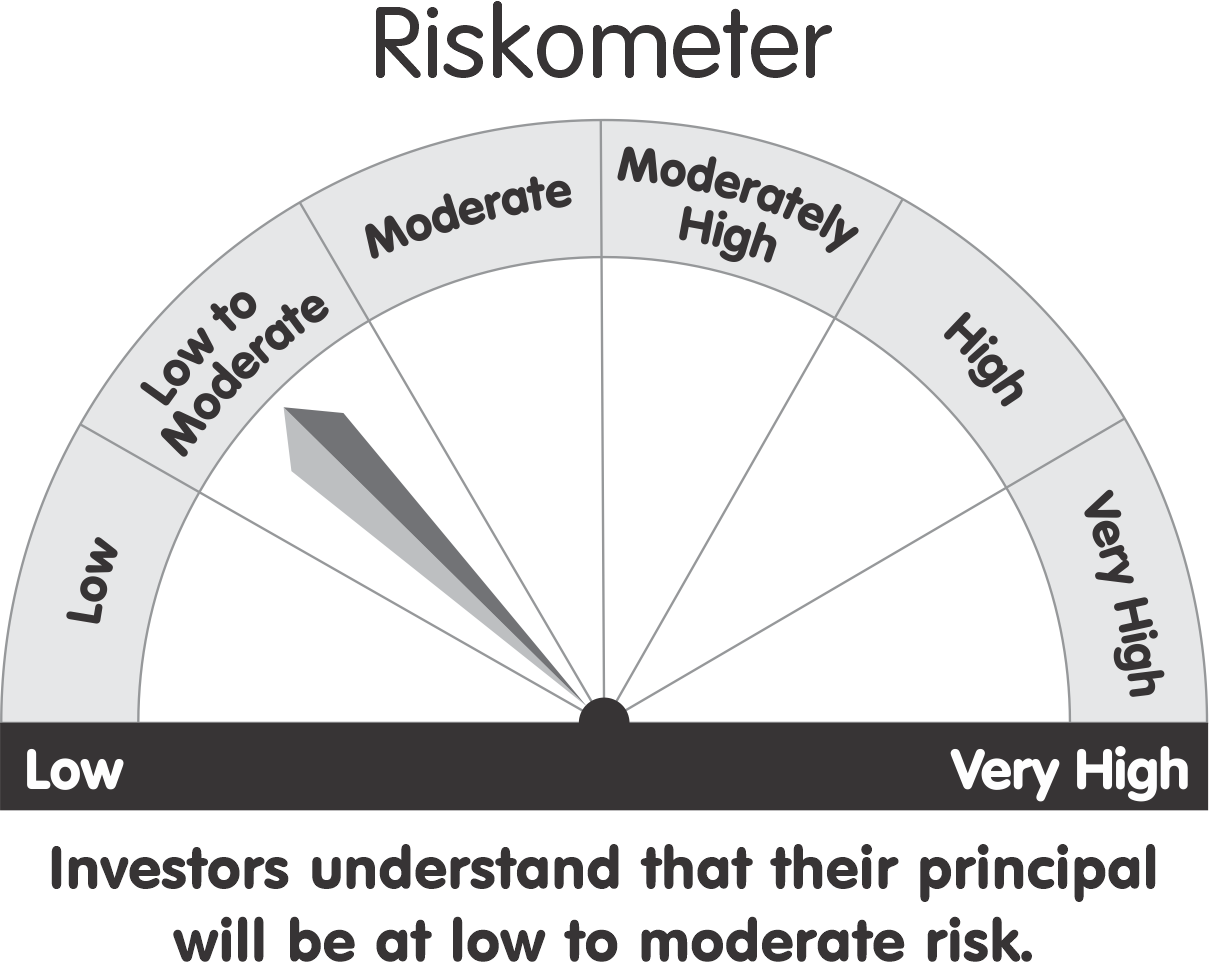

Parag Parikh Liquid Fund This product is suitable for investors who are seeking*

This product is suitable for investors who are seeking*

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them. |

|

| Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |