Investment Objective:

The investment objective of the scheme is to generate capital

appreciation and income by predominantly investing in arbitrage

opportunities in the cash and derivatives segment of the equity market,

and by investing the balance in debt and money market instruments.

However, there is no assurance that the investment objective of the

Scheme will be realized and the Scheme does not assure or guarantee

any returns.

| Initial purchase: | Rs. 1,000 and in multiples of Re 1 thereafter. |

| Additional purchase: | Rs. 1,000 and in multiples of Re 1 thereafter. |

| Monthly SIP: | Rs. 1,000 and in multiples of Re. 1 thereafter. |

| Quarterly SIP: | Rs. 3,000 and in multiples of Re. 1 thereafter. |

| Redemption: | Rs. 1,000 or 1 units or account balance whichever is lower. |

While arbitrage can take various forms, 'Arbitrage' mutual fund schemes usually choose to undertake a type known as 'Cash-Futures Arbitrage'.

This involves simultaneous purchase and sale of equivalent quantity of the same security in the 'cash' / spot market and 'Futures' markets with the aim of profiting from price differences between the two markets.

Spot prices - the ones which are continuously flashed on the stock price ticker on TV - are usually lower than the ones prevailing in the Futures market. There may be many Futures contracts for the same stock ... with each one expiring on a specific date.

Buy equity shares of XYZ for Rs. 300/- on September 15, 2023.

Simultaneously sell Futures contract of XYZ expiring on September 28, 2023 for Rs. 305/-.

On September 28, 2023 the spot and futures price converges.

Hence a relatively ‘low risk’ profit of Rs. 5/- can be earned.

Disclaimer: The above model is for illustration purposes only and should not be constructed as a promise/minimum returns/ safeguard of capital. Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

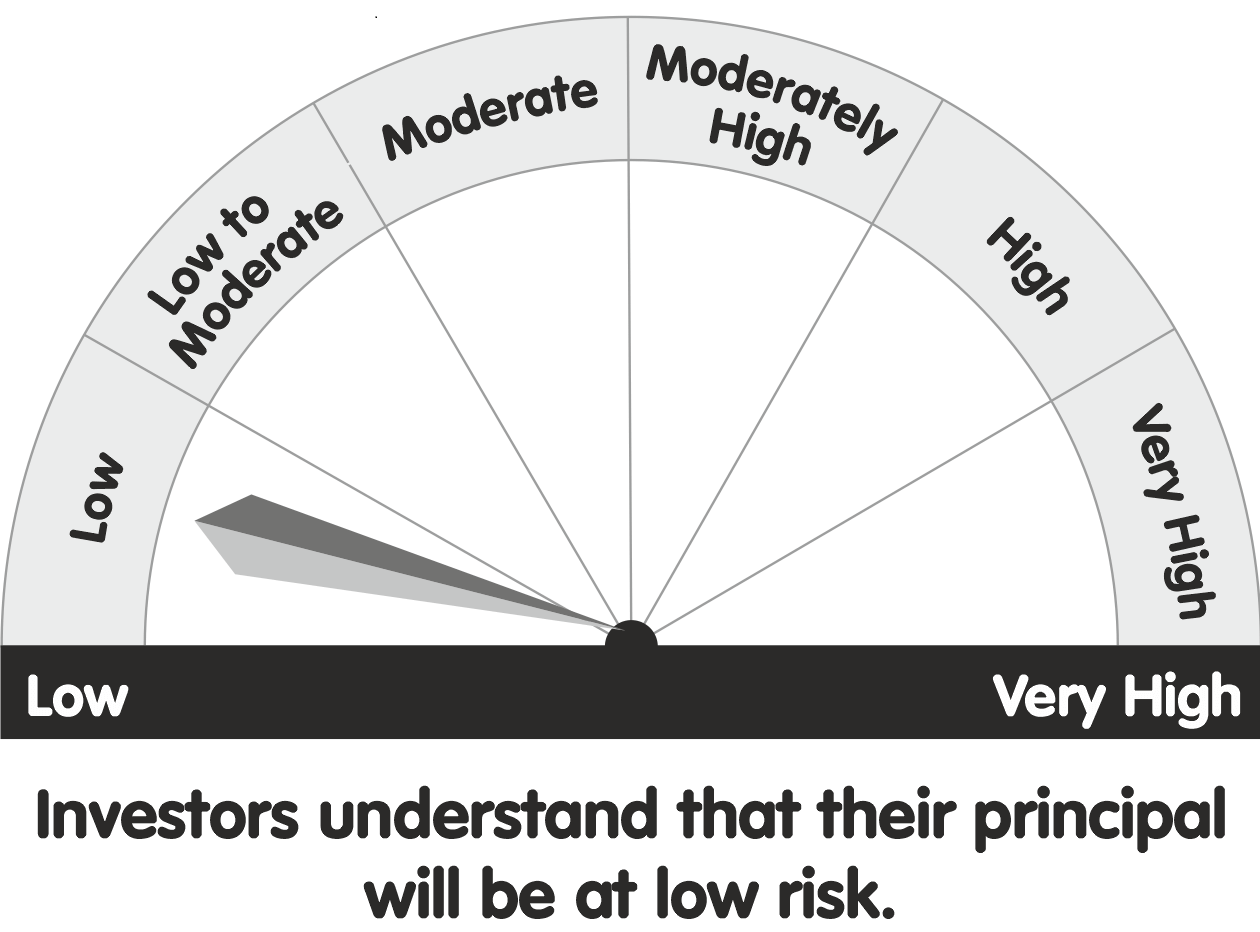

Parag Parikh Arbitrage Fund (PPAF) aims to replicate this process by undertaking simultaneous buy & sell transactions in spot and futures markets whenever feasible, thereby generating relatively ‘low risk’ pre-tax profit for its unitholders.

|

|

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.