| Name of the fund | Parag Parikh Conservative Hybrid Fund (PPCHF) |

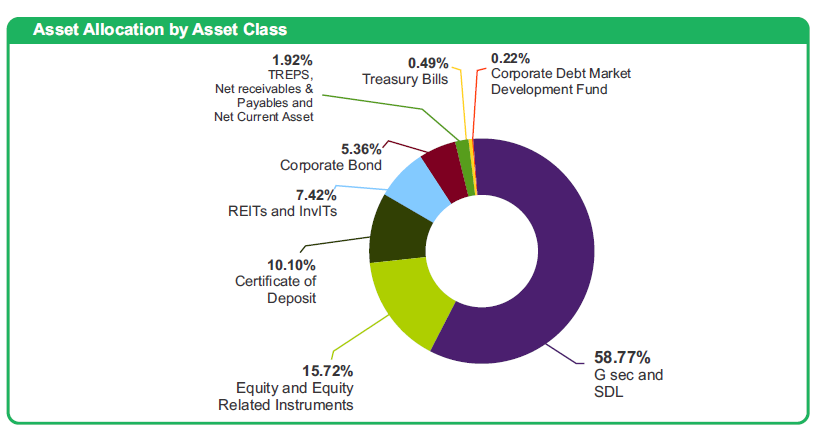

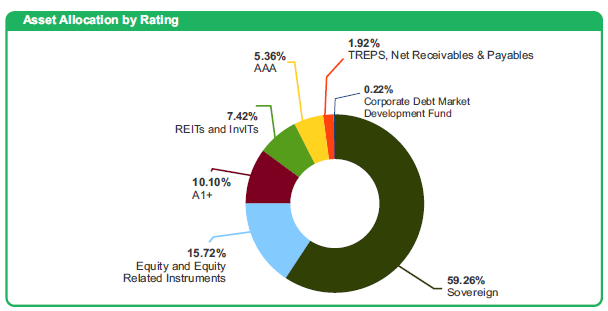

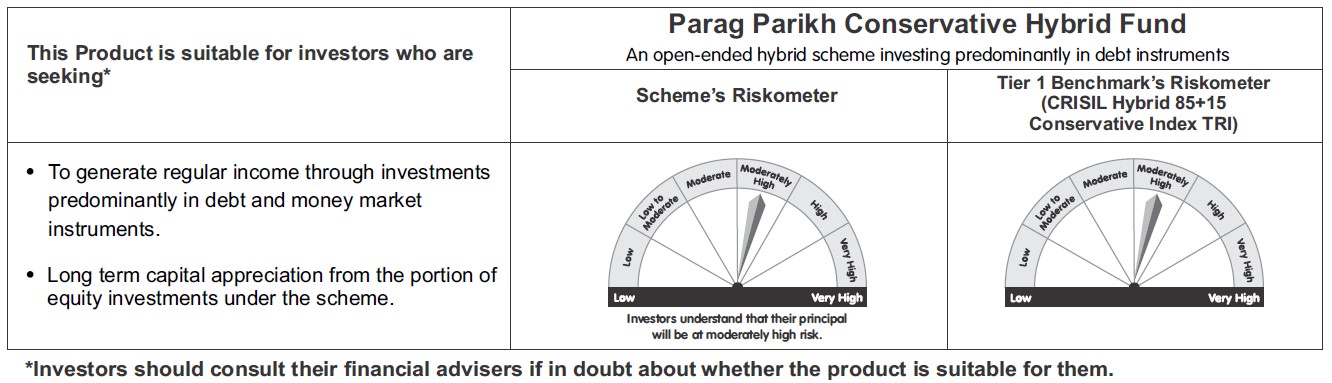

| Investment Objective | To generate regular income through investments predominantly in debt and money market instruments. The Scheme also seeks to generate long term capital appreciation from the portion of equity investments under the scheme. However, there is no assurance or guarantee that the investment objective of the Scheme will be realized. |

| Type of the scheme | An open ended hybrid scheme investing predominantly in debt instruments. |

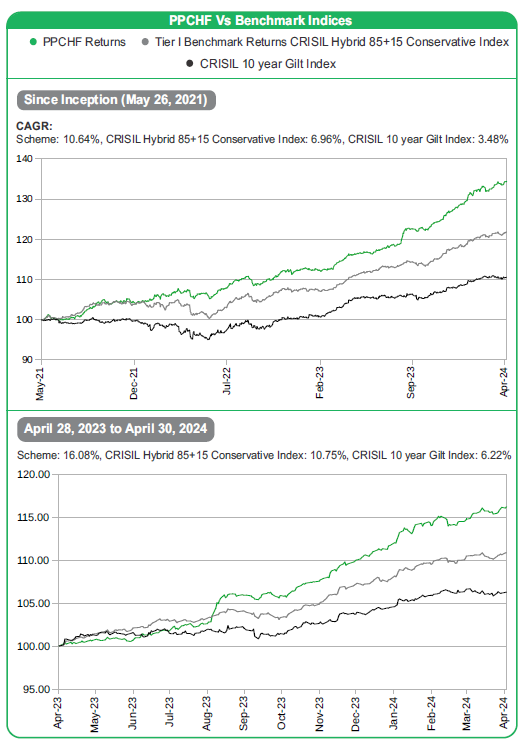

| Date of Allotment | 26th May 2021 |

| Name of the Fund Managers | Mr. Rajeev Thakkar - Equity Fund Manager (Since Inception)

|

| Month End Expense Ratio | Regular Plan: 0.63%* Direct Plan: 0.33%* *Including additional expenses and GST on management fees. Total Expense ratio is as on last business day of the month |

| Tier 1 Benchmark Index | CRISIL Hybrid 85+15 - Conservative Index TRI |

| Additional Benchmark | CRISIL 10 year GILT Index |

| Minimum Application / Additional Purchase Amount |

New Purchase: ₹ 5000 and in multiples of ₹ 1

thereafter. Additional Purchase: ₹ 1000 and in multiples of ₹ 1 thereafter. |

| Minimum SIP Investment Amount | Monthly SIP: ₹ 1,000, Quarterly SIP: ₹ 3,000 |

About Parag Parikh Flexi Cap Fund

Here is a bit of a technical discussion and not very material. Investors can ignore the following if they are not very familiar with

derivatives and it does not meaningfully impact the way the portfolio is constructed.

1. Currency hedging: We have usually been hedging a majority of the dollar rupee exposure for our overseas investments

using currency futures contracts on exchanges. There has been a recent regulatory change because of which trading

volumes on the exchanges and open interest in these contracts has significantly come down. While our transactions were

for hedging purposes and we could continue to do them even under the new regulations, the market for these contracts

has become very illiquid. To illustrate, the average trading volume on the last 3 trading days in January 2024 was about Rs.

24,494 crores per day. This has come down to about Rs. 8,695 crores per day in the last 3 trading days of April 2024. Given

the drying up of volumes, we are no longer hedging the currency exposure. This is not expected to meaningfully affect the

portfolio returns. There may be a slight change in the volatility profile because of currency fluctuations. The impact of this

will be very marginal.

2. NIFTY call options: The implied volatility on longer dated (December 2024) Nifty Call options had fallen to very low levels.

This meant that instead of buying equities, one could buy the options and invest the rest of the money in money market

securities. Here the interest income on the money market securities will make up most of the premium paid for the call

options. At the end of the period (December 2024) one will get the upside of equities - if markets are up. And if for some

reason, the markets were to fall, the downside is limited. The amount invested in this is not very significant, neither in terms

of the premium paid nor in terms of the underlying Nifty value. The underlying NIFTY value is roughly 0.13% of the portfolio

value.

Disclaimer: Views expressed here are based on information available in the public domain currently. Views expressed here can change depending on change in circumstances. Nothing discussed here constitutes a buy/ sell/ hold recommendation.

Rajeev Thakkar

Chief Investment Officer and Director

Distributor Helpline:

1800-266-8909 [Toll-free] or 91-22-6140-6538[email protected] [For queries/complaints]