| Name of the fund | Parag Parikh Conservative Hybrid Fund |

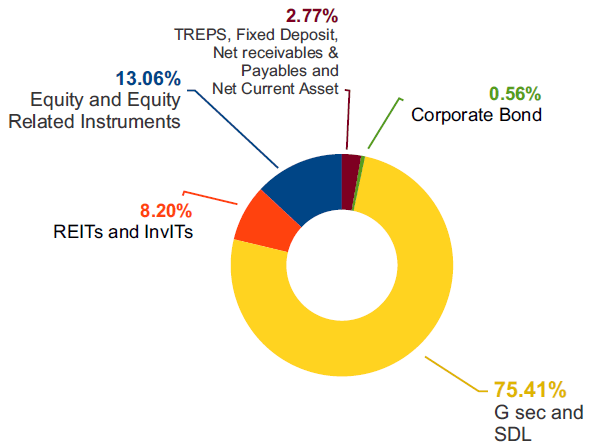

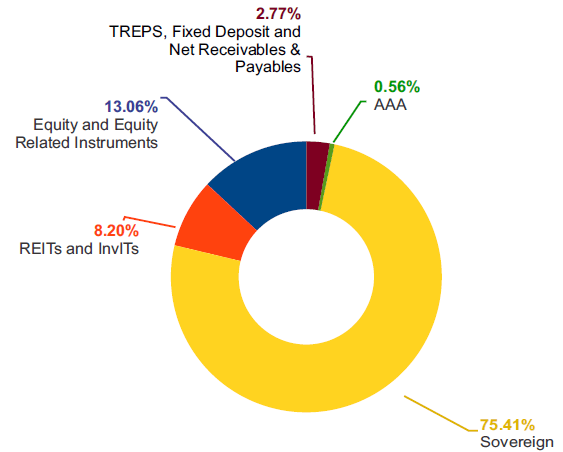

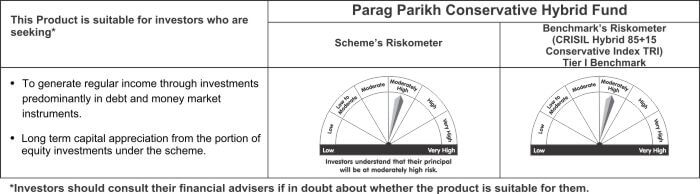

| Investment Objective | To generate regular income through investments predominantly in debt and money market instruments. The Scheme also seeks to generate long term capital appreciation from the portion of equity investments under the scheme. However, there is no assurance or guarantee that the investment objective of the Scheme will be realized. |

| Type of the scheme | An open ended hybrid scheme investing predominantly in debt instruments. |

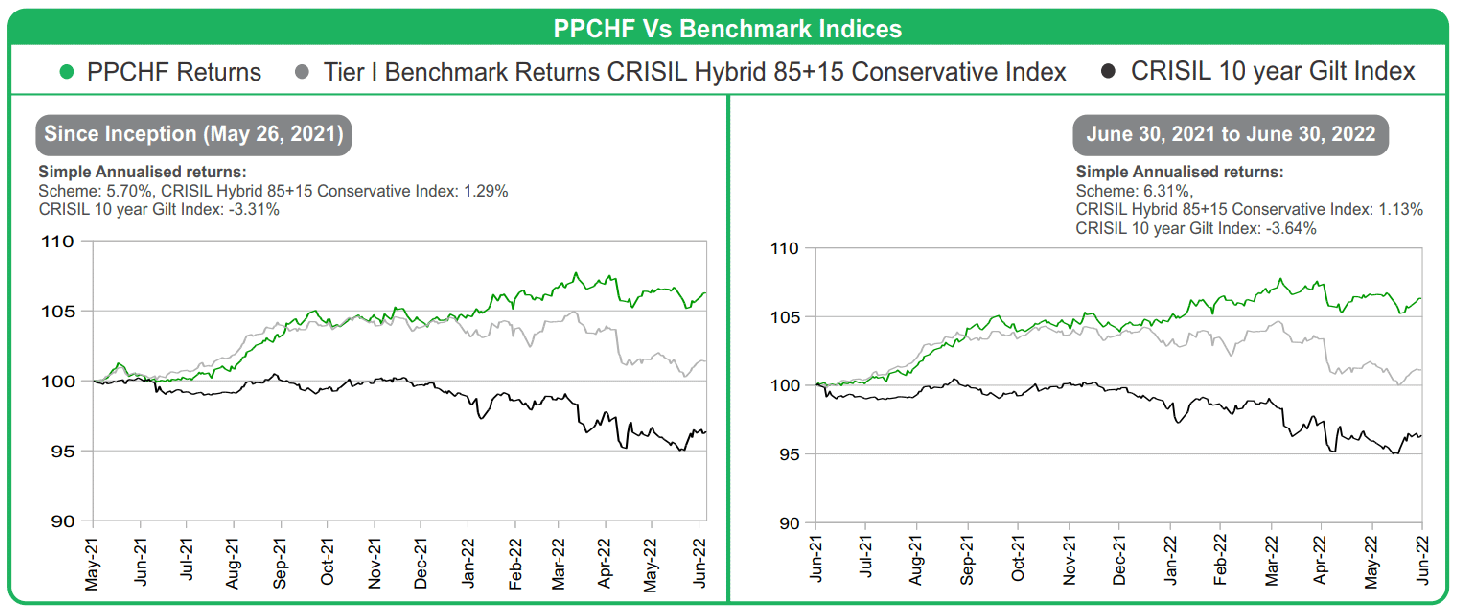

| Date of Allotment | 26th May 2021 |

| Name of the Fund Managers | Mr. Rajeev Thakkar - Equity Fund Manager (Since Inception)

Mr. Raunak Onkar - Equity Fund Manager (Since Inception) Mr. Raj Mehta - Debt Fund Manager (Since Inception) Mr. Rukun Tarachandani - Equity Fund Manager (Since May 16, 2022) |

| Month End Expense Ratio | Regular Plan: 0.62%* Direct Plan: 0.32%* *Including additional expenses and GST on management fees. Total Expense ratio is as on last business day of the month |

| Tier 1 Benchmark Index | CRISIL Hybrid 85+15 - Conservative Index TRI |

| Additional Benchmark | CRISIL 10 year GILT Index |

| Minimum Application Amount |

New Purchase: ₹ 5000 and in multiples of 1 thereafter. Additional Purchase: ₹ 1000 and in multiples of 1 thereafter. Monthly SIP: ₹ 1000 and Quarterly SIP ₹ 3000 |

Wednesday, July 6, 2022

Investors could be of two types. The first type will have noticed that the equity market indices and Net Asset Values (NAVs) of our equity funds are somewhat lower than what were seen between October 2021 and March 2022. The other type of investor would not have noticed the fall or ignored the fall despite noticing it. If you are in the second category, congratulations. You need not read further.

For investors who are closely watching the indices, stock prices and mutual fund NAVs, especially those who are new to equity investing, I will say that it is not unusual for equity prices to fall. In fact it is of utmost importance that equity prices fall steeply over some period in an unpredictable manner!

Why do I say this? The answer is simple. If stock prices only went up, there would be no one investing in bonds or in bank fixed deposits and so on. The reason why equity investments have the potential to deliver higher returns is that periodically they give negative returns as well which scares away short term investors and risk averse investors.

There is a chance that some investors who have recently entered the market may see negative returns on their lumpsum / SIP investments currently. Since our launch in 2013, we have been communicating that equity investments are suitable only for a minimum investment horizon of 5 years. This has been due to the fact that the current situation is quite common and one has to be invested in equity across a bull and bear market cycle to really benefit from equity investing.

The current narrative is driven by discussions around inflation due to high energy and commodity prices, the war between Russia and Ukraine, rising interest rates, quantitative tapering, potential US recession and so on. Reading of the popular media narrative would lead us to believe that something unusual is happening in the world. However if one looks at interest rates, they are back to where they were about 3 to 3.5 years ago and crude oil prices are way below the peak levels seen in late 2007 and early 2008. High / low prices of crude oil, onions and tomatoes make for good news stories but at the end of the day they are subject to supply and demand disruptions (surplus as well as deficit) which are generally short lived and the prices mean revert generally in a short period of time. As I write this today, many commodities like iron ore, aluminum and copper are trading at significantly lower prices as compared to the peak prices seen a few months back.

Today we do not worry about COVID 19 while only a few months back there was nothing else that we could talk or think about. In the same manner, two years hence, it is very likely that we will have different things to worry about. Please do not let the turbulence and headlines distract you from your long term investment journey. Stick to your asset allocation based on your needs, life stage and risk appetite.

Happy investing.

Rajeev Thakkar

Chief Investment Officer and Director