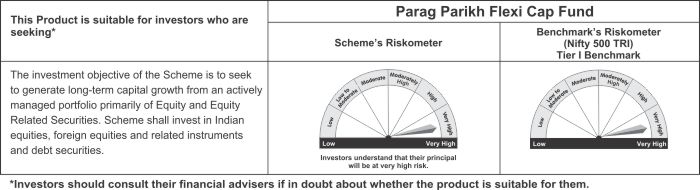

| Name of the fund | Parag Parikh Conservative Hybrid Fund |

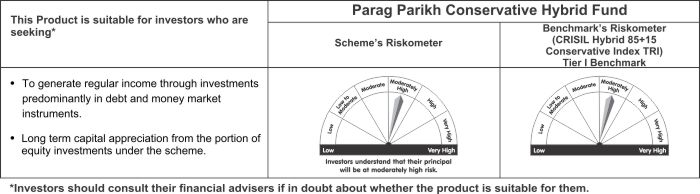

| Investment Objective | To generate regular income through investments predominantly in debt and money market instruments. The Scheme also seeks to generate long term capital appreciation from the portion of equity investments under the scheme. However, there is no assurance or guarantee that the investment objective of the Scheme will be realized. |

| Type of the scheme | An open ended hybrid scheme investing predominantly in debt instruments. |

| Date of Allotment | 26th May 2021 |

| Name of the Fund Managers | Mr. Rajeev Thakkar - Equity Fund Manager (Since Inception)

Mr. Raunak Onkar - Equity Fund Manager (Since Inception) Mr. Raj Mehta - Debt Fund Manager (Since Inception) Mr. Rukun Tarachandani - Equity Fund Manager (Since May 16, 2022) |

| Month End Expense Ratio | Regular Plan: 0.62%* Direct Plan: 0.32%* *Including additional expenses and GST on management fees. Total Expense ratio is as on last business day of the month |

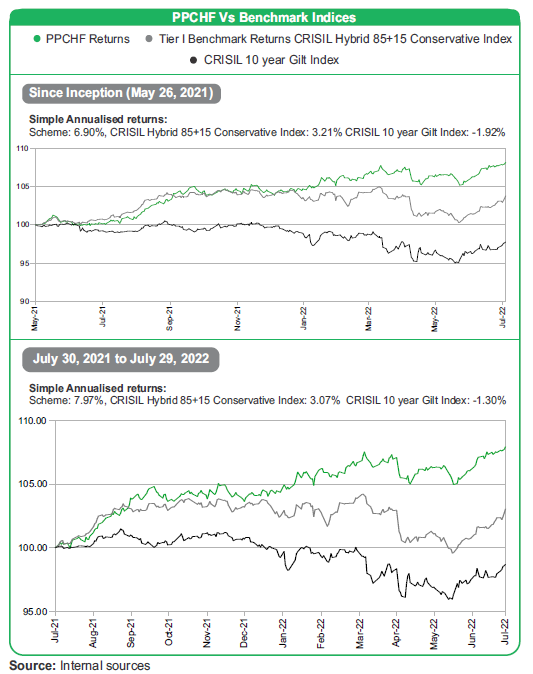

| Tier 1 Benchmark Index | CRISIL Hybrid 85+15 - Conservative Index TRI |

| Additional Benchmark | CRISIL 10 year GILT Index |

| Minimum Application Amount |

New Purchase: ₹ 5000 and in multiples of 1 thereafter. Additional Purchase: ₹ 1000 and in multiples of 1 thereafter. Monthly SIP: ₹ 1000 and Quarterly SIP ₹ 3000 |

There may be a few questions in the minds of unitholders / distributors / advisors regarding a few recent portfolio actions. These are explained briefly below.

Switch from HDFC Bank to HDFC Ltd.

Some time back we switched from HDFC Bank to HDFC Ltd. The background to this is that the two companies have already

announced a merger and the merger ratio is known. Given that they are from the same group and had already sought informal

permission / consultation with the relevant authorities, the merger going through is largely a formality. Today whether one owns

HDFC Bank or HDFC Ltd., eventually one will own HDFC Bank. Given that we intend holding on to HDFC Bank, it makes sense

to invest in the company which is cheaper given the exchange ratio.

There was a 3% difference between the two companies after transaction costs. This position, which is close to ₹ 2,000 crores

(about 8% of the portfolio) gives a benefit of nearly ₹ 60 crores - or a 24 basis points - benefit on the entire portfolio. While this

optically increases the portfolio churn, we are owning the same underlying business.

Rebalancing of ITC weightage

We were buyers in ITC Ltd. and bulk of the purchases were made between a price of ₹ 140 and ₹ 210. While the stock

continues to be reasonably valued, the attractiveness has obviously reduced a bit given the doubling of the stock price from the

lows.

The portfolio weightage was threatening to breach 10% of the portfolio. When a position breaches the 10% limit on account of

price appreciation, it is termed as a passive breach and one has about a one month's time period to bring the weightage down

below 10%. It is prudent not to have a very large position in a single stock. Given this background we have sold some shares and brought

down the weightage.

Coal India Ltd. and covered calls

Our investment in Coal India may have surprised a few people given the following

- The world is moving towards renewable / non fossil sources of energy

- Our preference has been generally towards private sector businesses rather than public sector ones

However the anticipated shift towards renewable energy has resulted in a steep drop in share prices of traditional energy related companies and a huge under-investment in the sector. This has resulted in price spikes and shortages.

We are strong believers in the shift towards renewable sources of energy and we did not view Coal India Ltd as a ‘buy-and-hold for decades’ kind of company. We had the following thesis for a good holding period return in the medium term:

- High dividend yield

- Some volume growth in production and sales to reduce import dependence

- Possibility of some price increase given the steep discount at which Coal India sells coal as compared to global prices (to compensate for wage increases paid by Coal India and to provide some additional profit).

- Low probability of the valuation multiple reducing further and a high probability of some mean reversion in the valuation multiple

- And lastly… Selling 'out-of-the-money' covered call options prudently over time can help us generate additional income. Of course, we write covered calls only on a limited portion of the overall holding. Generating this additional income comes with the trade-off that on the few occasions wherein a stock sees an outsized move, our position in the underlying stock will be sold (at a profit). This happened last month wherein some of the shares that we owned were sold as part of the covered calls at a profit from our purchase price.

Because of our purchase of ITC and Coal India shares, there are questions around our stance on ESG. Firstly we are not deliberately trying to invest in anti ESG companies. Our Fund does not have an ESG mandate but surely we do not want to harm humanity in pursuit of profits.

We want all of our investee companies to be well Governed (the G part of ESG). On the Environmental and Social fronts however, we believe that there is a case for some nuance.

Tobacco is a demerit good and known to cause cancer. Towards this end, there is a ban on advertising, ban on sale of the products to minors, punitive rates of taxation, ban on smoking in public and so on and we are fully supportive of those actions. ITC itself has seen the writing on the wall and has been diversifying into newer areas in FMCG like snacks, beverages, personal care and so on.

Coal India is also preparing for a world where renewable energy will take over from fossil fuels.

However, one cannot wish away current realities by say, suddenly switching off all coal fired power plants. Europe currently is seeing the problems of switching off coal and nuclear plants too early in the eagerness to embrace solar and wind energy.

We will continue to invest in well governed companies and cheer our investee companies in their efforts to improve the society and the planet by their societal and environmental impact. We will also engage with them on account of our stewardship role where required.

Happy investing.

Rajeev Thakkar

Chief Investment Officer and Director

Monday, August 8, 2022

Note: Viewers/readers should note that the objective of this Note is to communicate with our unit-holders and share with them our thought process. It should be noted that views expressed here are based on information available in public domain at this moment. Views expressed here can change depending on change in circumstances. Nothing discussed here constitutes a buy/ sell/ hold recommendation and shall not be considered as a research report as per SEBI (Research Analysts) Regulations.