| Name of the fund | Parag Parikh Liquid Fund |

| Investment Objective | To deliver reasonable market related returns with lower risk and high liquidity through judicious investments in money market and debt instruments. (Non Guaranteed) |

| Type of the scheme | An Open-ended Liquid Scheme |

| Date of Allotment | May 11, 2018 |

| Name of the Fund Managers | Mr. Raj Mehta -

(Since Inception) |

| Month End Expense Ratio | Regular Plan: 0.26%* Direct Plan: 0.16%* *Including additional expenses and GST on management fees. Total Expense ratio is as on last business day of the month |

| Benchmark Index | CRISIL Liquid fund index |

| Additional Benchmark | CRISIL 1 Year T-Bill index |

| Minimum Application Amount | New Purchase: 5,000 Additional Purchase: 1,000 Monthly SIP: 1,000 |

Assets Under Management

(AUM) as on July 30, 2021 |

1,367.86 Crores |

Average AUM

for the Month |

1,356.86 Crores |

Net Asset Value (NAV) as

on July 30, 2021 |

||

| Plan | Direct |

Regular |

| Growth | 1165.2402 |

1161.3642 |

| Daily Reinvestment of Income Distribution cum capital withdrawal option |

1000.5404 |

1000.5404 |

| Weekly Reinvestment of Income Distribution cum capital withdrawal option | 1001.3384 |

1001.3273 |

| Monthly Income Distribution cum capital withdrawal option |

1003.3388 |

1003.3277 |

Dividend History - Monthly Income Distribution cum capital Withdrawal option |

||||

Direct |

Regular |

|||

| Record date | Retail |

Corporate |

Retail |

Corporate |

| 26th July 2021 | 2.54 |

2.54 |

2.46 |

2.46 |

| 30th June 2021 | 2.48 |

2.48 |

2.40 |

2.40 |

| 30th May 2021 | 2.96 |

2.96 |

2.86 |

2.86 |

Entry Load |

Not Applicable |

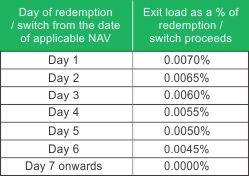

Exit Load |

|

| * For purpose of levying exit load, if subscription (application & funds) is received within cut-off time on a day, Day 1 shall be considered to be the same day, else the day after the date of allotment of units shall be considered as Day 1. | |

| Average Maturity (Days) | 44.41 |

| Modified duration (Years) | 0.1152 |

| Yield to Maturity | 3.34% |

| Macaulay Duration (Years) | 0.1191 |

| * Computed on the invested amount | |

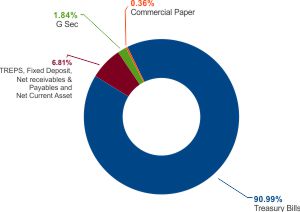

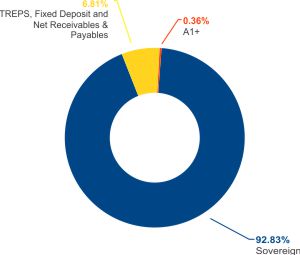

Portfolio Disclosure |

||

Debt and Money Market Instruments |

||

Name |

Rating |

% of Net Assets |

a) Treasury Bills |

||

91 DAY T-BILL 07-Oct-2021 |

Sovereign |

9.08% |

91 DAY T-BILL 05-Aug-2021 |

Sovereign |

7.31% |

91 DAY T-BILL 13-Aug-2021 |

Sovereign |

7.30% |

91 DAY T-BILL 26-Aug-2021 |

Sovereign |

7.29% |

91 DAY T-BILL 02-Sep-2021 |

Sovereign |

7.29% |

182 DAY T-BILL 10-Sep-2021 |

Sovereign |

7.28% |

91 DAY T-BILL 16-Sep-2021 |

Sovereign |

7.28% |

91 DAY T-BILL 23-Sep-2021 |

Sovereign |

7.28% |

91 DAY T-BILL 14-Oct-2021 |

Sovereign |

7.26% |

182 DAY T-BILL 21-Oct-2021 |

Sovereign |

7.26% |

364 DAY T-BILL 19-Aug-2021 |

Sovereign |

5.47% |

91 DAY T-BILL 30-Sep-2021 |

Sovereign |

5.45% |

182 DAY T-BILL 28-Oct-2021 |

Sovereign |

5.44% |

b) Government Securities |

||

8.66% State Government of Uttar Pradesh 21-Sep-2021 |

Sovereign |

1.84% |

c) Commercial Paper |

||

National Bank for Agriculture and Rural Development 31-Aug-2021 |

A1+ |

0.36% |

d) TREPS and Other Receivables and Payables |

||

TREPS Including Net Receivables/Payables and Net Current Asset |

6.34% |

|

e) Fixed Deposits |

||

FDR |

0.47% |

|

Net Assets |

100.00% |

|

Lumpsum Investment Performance (Compounded annual returns) |

||||||

Scheme |

Benchmark |

Additional Benchmark |

Value of Investment of Rs. 10,000/- |

|||

| Date | PPLF (Regular) |

CRISIL Liquid Fund Index |

CRISIL 1 year T-bill Index |

PPLF (Regular) |

CRISIL Liquid Fund Index |

CRISIL 1 year T-bill Index |

| Since Inception (11 May, 2018)* | 4.75% |

5.74% |

6.28% |

11614 |

11971 |

12169 |

| July 23, 2021 to July 30, 2021 (Last 7 Days) | 3.04% |

3.52% |

6.78% |

10006 |

10007 |

10013 |

| July 15, 2021 to July 30, 2021 (Last 15 days) | 3.17% |

3.59% |

6.85% |

10013 |

10015 |

10028 |

| June 30, 2021 to July 30, 2021 (Last 1 Month) | 3.16% |

3.56% |

5.89% |

10026 |

10029 |

10048 |

| April 30, 2021 to July 30, 2021 (Last 3 Months) | 3.11% |

3.54% |

3.93% |

10078 |

10088 |

10098 |

| January 31, 2021 to July 30, 2021 (Last 6 Months) | 3.10% |

3.63% |

4.19% |

10153 |

10179 |

10207 |

| July 31, 2020 to July 30 2021 (Last 1 year) | 3.03% |

3.68% |

3.78% |

10302 |

10367 |

10377 |

| July 31, 2018 to July 30, 2021 (Last 3 year) | 4.65% |

5.60% |

6.41% |

11459 |

11775 |

12048 |

*Since inception returns are calculated on Rs. 1000 (allotment price)

Note:

Different plans shall have different expense structures.

Scheme returns shown are for regular plan.

Past performance may or may not be sustained in the future.

Greater than 1 year returns are CAGR returns.

Data presented here is upto the last calendar month.

Less than 1 year returns are simple annualised returns.

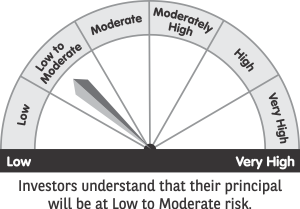

Parag Parikh Liquid Fund

This Product is suitable for investors who are seeking*

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.