| Name of the fund | Parag Parikh Conservative Hybrid Fund |

| Investment Objective | To generate regular income through investments predominantly in debt and money market instruments. The Scheme also seeks to generate long term capital appreciation from the portion of equity investments under the scheme. However, there is no assurance or guarantee that the investment objective of the Scheme will be realized. |

| Type of the scheme | An open ended hybrid scheme investing predominantly in debt instruments. |

| Date of Allotment | 26th May 2021 |

| Name of the Fund Managers | Mr. Rajeev Thakkar - Equity Fund Manager (Since Inception) Mr. Raunak Onkar - Equity Fund Manager (Since Inception) Mr. Raj Mehta - Debt Fund Manager (Since Inception) |

| Month End Expense Ratio | Regular Plan: 0.60%* Direct Plan: 0.30%* *Including additional expenses and GST on management fees. Total Expense ratio is as on last business day of the month |

| Benchmark Index | CRISIL Hybrid 85+15 - Conservative Index TRI |

| Additional Benchmark | CRISIL 10 year GILT Index |

| Minimum Application Amount | New Purchase: 5000 and in multiples of 1

thereafter. Additional Purchase: 1000 and in multiples of 1 thereafter. Monthly SIP: 1000 and Quarterly SIP 3000 |

Assets Under Management

(AUM) as on July 30, 2021 |

329.82 Crores |

Average AUM

for the Month |

310.70 Crores |

Net Asset Value (NAV) as

on July 30, 2021 |

|

| Regular Plan | 10.0201 |

| Direct Plan | 10.0255 |

| Regular Plan - Monthly IDCW | 9.996 |

| Direct Plan - Monthly IDCW | 9.9991 |

Entry Load |

Not Applicable |

Exit Load |

10% of the units (“the limit”) may be redeemed

without any exit load from the date of allotment.

1% for redemption within 1 Year and Nil for

redemption beyond 1 Year from the date of

allotment. |

| Average Maturity (Years)* | 6.39 |

| Modified Duration (Years)* | 4.8694 |

| Yield to Maturity*^ | 6.71% |

| Macaulay duration* | 5.0382 |

| *Calculated on amount invest in debt securities (including accrued interest), deployment of funds in TREPS & Reverse Repo and net receivables/payables. ^YTM is calculated on the basis of annualised yield for all securities. |

|

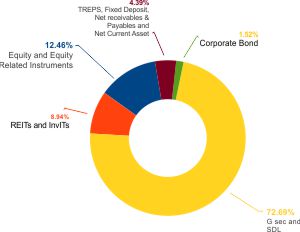

Equity and Equity Related Instruments |

||

Name |

Industry |

% of Net Assets |

Bajaj Auto Ltd. |

Auto |

2.51% |

Petronet LNG Ltd. |

Gas |

2.50% |

Coal India Ltd. |

Minerals/Mining |

2.50% |

Power Grid Corporation of India Ltd. |

Power |

2.48% |

ITC Ltd. |

Consumer Non Durables |

2.47% |

Sub total |

12.46% |

|

Units issued by REITs & InvITs |

||

Listed / awaiting listing on the stock exchanges

|

||

Name |

Industry |

% of Net Assets |

Brookfield India REIT |

Construction |

3.92% |

Embassy Office Parks REIT |

Construction |

2.51% |

Mindspace Business Parks REIT |

Construction |

2.51% |

Sub total |

8.94% |

|

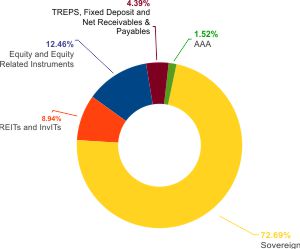

Debt and Money Market Instruments |

||

Name |

Rating |

% of Net Assets |

a) Corporate Bond/NCD |

||

7.70% India Grid Trust 06-May-2028 |

CRISIL AAA |

1.52% |

b) Government Securities |

||

8.16% State Government of Rajasthan 2028 |

Sovereign |

8.13% |

8.00% State Government of Kerala 2028 |

Sovereign |

8.07% |

7.92% State Government of Uttar Pradesh 2028 |

Sovereign |

8.06% |

7.88% State Government of Madhya Pradesh 2028 |

Sovereign |

6.43% |

8.42% State Government of Madhya Pradesh 2028 |

Sovereign |

4.95% |

6.99% State Government of Telangana 2028 |

Sovereign |

4.61% |

8.08% State Government of Tamil Nadu 2028 |

Sovereign |

3.26% |

8.08% State Government of Maharashtra 2028 |

Sovereign |

3.26% |

7.99% State Government of Punjab 2028 |

Sovereign |

3.23% |

8.49% State Government of Uttarakhand 2028 |

Sovereign |

1.66% |

8.45% State Government of Uttar Pradesh 2028 |

Sovereign |

1.65% |

8.34% State Government of Tamil Nadu 2028 |

Sovereign |

1.65% |

8.41% State Government of Kerala 2028 |

Sovereign |

1.65% |

8.33% State Government of Kerala 2028 |

Sovereign |

1.64% |

8.29% State Government of Haryana 2028 |

Sovereign |

1.64% |

8.15% State Government of Tamil Nadu 2028 |

Sovereign |

1.63% |

8.09% State Government of West Bengal 2028 |

Sovereign |

1.63% |

8.11% State Government of Chhattisgarh 2028 |

Sovereign |

1.62% |

7.98% State Government of Uttar Pradesh 2028 |

Sovereign |

1.61% |

7.86% State Government of Haryana 2027 |

Sovereign |

1.61% |

7.65% State Government of Karnataka 2027 |

Sovereign |

1.60% |

7.53% State Government of West Bengal 2027 |

Sovereign |

1.58% |

6.79% State Government of West Bengal 2028 |

Sovereign |

1.52% |

c) TREPS and Other Receivables and Payables |

||

TREPS Including Cash & Cash Equivalent and Net Current Asset |

3.04% |

|

d) Fixed Deposits |

||

4.90% HDFC Bank Ltd. (Duration 365 Days) |

0.45% |

|

5.10% Axis Bank Ltd. (Duration 367 Days) |

0.30% |

|

4.90% HDFC Bank Ltd. (Duration 368 Days) |

0.30% |

|

4.90% HDFC Bank Ltd. (Duration 365 Days) |

0.30% |

|

Sub total |

78.60% |

|

Net Assets |

100.00% |

|

Source: Internal sources

Source: Internal sources

Note: Total Dividend (Net) declared during the period ended July 31, 2021 - Nil

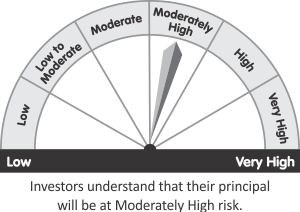

Parag Parikh Conservative Hybrid Fund

This Product is suitable for investors who are seeking*

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

We have our Skin in the Game

The combined holding of 'Insiders' in Parag Parikh Conservative Hybrid Fund amounts

to 5.50 Crores of AUM as at July 30, 2021. For more details please visit the 'Scheme' section of our website

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.