Parag Parikh Dynamic Asset Allocation Fund

In case of online applications, your money is usually debited as soon as you complete the application process. However, we often receive it only on the next working day (T+1) as all collections are pooled together and sent to us at one stroke by our payment gateway provider.

However, we currently offer the 'Direct Credit Facility' to Account Holders of the following Banks (Net Banking Transactions only):

- Axis Bank

- HDFC Bank

- ICICI Bank

- Kotak Bank

- State Bank of India

- Yes Bank

This ensures that monies transferred by the Account holders of these Banks in the usual course via the Payment Gateway, will reach us virtually instantaneously. Consequently, your units can be allotted on the same day (for all Purchases undertaken prior to 3:00 PM).

We intend to extend this facility to other Banks in due course.

In case of other banks, you may choose to first transfer money via

NEFT/RTGS to our Collection Accounts and then apply online, quoting the Unique Transaction Receipt (UTR) No. in your Application. Monies transferred via this method usually reach us within a couple of hours. However, there may be delays at times on account of issues within the banking system.

Please

contact us in case you have any queries in this regard.

General Disclaimer : Delays in the banking system may cause delay in us receiving Credit in our Collection Accounts.

| Subscription Request (Fresh/Additional Purchase) |

| Transaction Type |

Amount |

Cut off Time |

Credit confirmation |

Applicable NAV |

| Application Received (Mon-Fri.)* |

Any Amount |

Before 3:00 PM |

Mandatory |

If credit and time stamped date and time is confirmed before 3:00 PM then same day NAV. |

| Application Received (Mon-Fri.)* |

Any Amount |

After 3:00 PM |

Mandatory |

If credit and time stamped date and time is confirmed after 3:00 PM then NAV of the day and time when such credit is received. |

| * : Working Days only |

All transactions submitted on non-working days will be processed on the next working day. |

^NAV will be based on Funds available in Scheme accounts or time stamped date and time whichever is later.

|

| Redemption Request |

| Transaction Type |

Amount |

Cut off Time |

Applicable NAV (Day 'T') |

Payout Schedule |

| Received (Mon–Fri)* |

Any Amount |

Before 3:00 PM |

Same day |

T+2 Working Days |

| Received (Mon-Fri) |

Any Amount |

After 3.00 PM |

Next business day |

T+2 Working Days |

| * : Working Days only |

All transactions submitted on non-working days will be processed on the next working day. |

|

|

| Switch/Systematic Transfer Plan (STP) |

| Transaction Type |

Amount |

Cut off Time |

Applicable NAV |

| Liquid to PPDAAF |

Any amount |

Before 3:00 PM* |

Switch out scheme (Liquid) :same day NAV and Switch In scheme (PPDAAF) :switch out settlement NAV date. |

| Liquid to PPDAAF |

Any amount |

After 3:00 PM* |

Switch out scheme (Liquid): Next Business day NAV and Switch In scheme (PPDAAF) :switch out settlement NAV date. |

|

| PPDAAF to Liquid |

Any amount |

Before 3:00 PM* |

Switch out scheme (PPDAAF): same day NAV and Switch In scheme (Liquid): switch out settlement day minus one day NAV |

| PPDAAF to Liquid |

Any amount |

After 3:00 PM* |

Switch out scheme (PPDAAF): next business day NAV and Switch In scheme (Liquid) :switch out settlement day minus one day NAV |

|

| PPDAAF to PPTSF & PPFCF |

Any amount |

Before 3:00 PM* |

Switch out scheme (PPDAAF) :same day NAV and Switch In scheme (PPTSF & PPFCF): switch out settlement NAV date. |

| PPDAAF to PPTSF & PPFCF |

Any amount |

After 3:00 PM* |

Switch out scheme (PPDAAF): next business day NAV and Switch In scheme (PPTSF & PPFCF) :switch out settlement NAV date. |

| PPFCF & PPTSF to PPDAAF |

Any amount |

Before 3:00 PM* |

Switch out scheme (PPFCF & PPTSF): same day NAV and Switch In scheme (PPDAAF): switch out settlement NAV date. |

| PPFCF & PPTSF to PPDAAF |

Any amount |

After 3:00 PM* |

Switch out scheme (PPFCF & PPTSF): next business day NAV and Switch In scheme (PPDAAF) :switch out settlement NAV date. |

| PPDAAF to PPCHF |

Any amount |

After 3:00 PM* |

Switch out scheme (PPDAAF): next business day NAV and Switch In scheme (PPCHF): switch out settlement NAV date. |

| PPDAAF to PPCHF |

Any amount |

Before 3:00 PM* |

Switch out scheme (PPDAAF): same day NAV and Switch In scheme (PPCHF): switch out settlement NAV date. |

| PPCHF to PPDAAF |

Any amount |

After 3:00 PM* |

Switch out scheme (PPCHF): next business day NAV and Switch In scheme (PPDAAF) :switch out settlement NAV date. |

| PPCHF to PPDAAF |

Any amount |

After 3:00 PM* |

Switch out scheme (PPCHF): next business day NAV and Switch In scheme (PPDAAF): switch out settlement NAV date. |

| * : Working Days only |

All transactions submitted on non-working days will be processed on the next working day. |

|

|

Parag Parikh Dynamic Asset Allocation Fund

An open ended dynamic asset allocation fund.

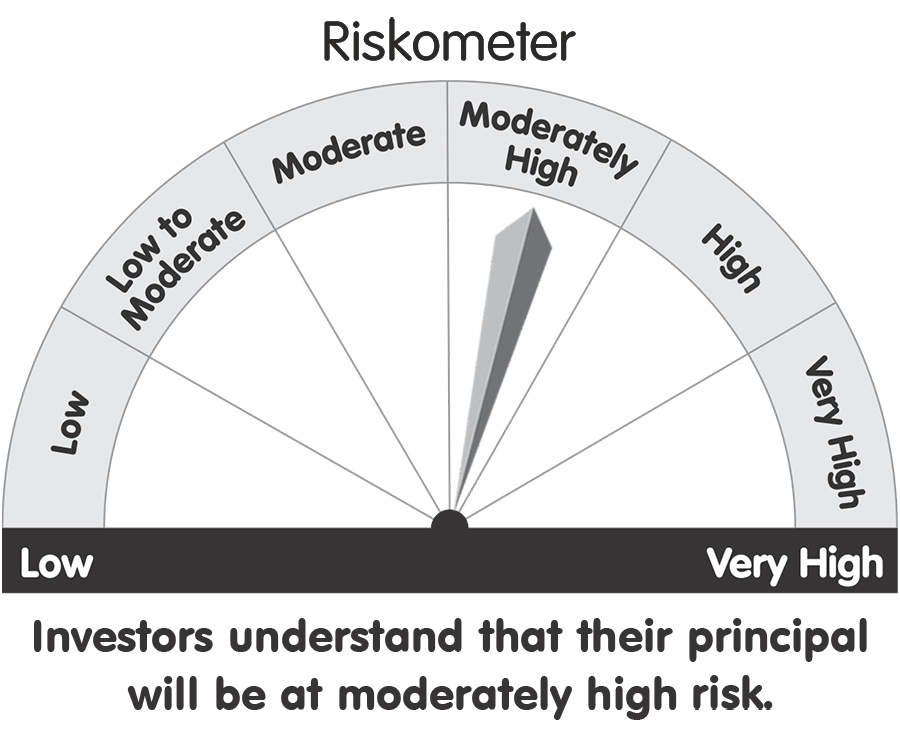

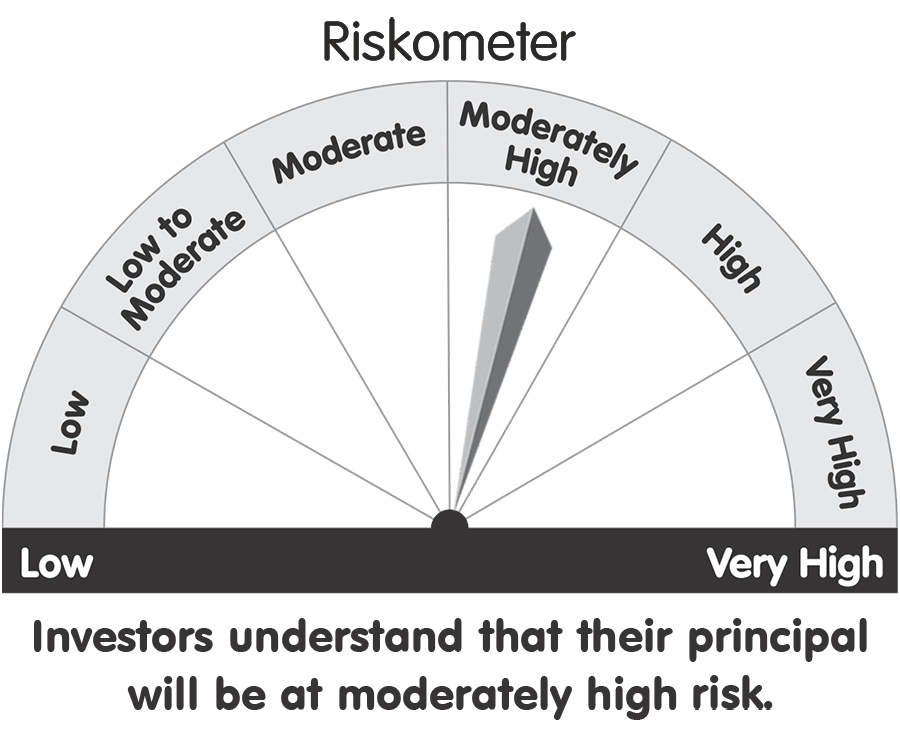

This product is suitable for investors who are seeking*

- Capital Appreciation & Income generation over medium to long term.

- Investment in equity and equity related instruments as well as debt and money market instruments while managing risk through active asset allocation

|

|

*Investors should consult their financial advisers if in doubt about whether the product is suitable

for them.