When veteran value-styled investor Parag Parikh and his firm Parag Parikh Financial Advisory Services set up a mutual fund company, called PPFAS Asset Management Co. (AMC) Ltd in early 2013, it set out to do something different. The firm said it would launch only one equity scheme. It pledged that its top management would invest a sizeable portion of its investible surplus in the scheme and disclose the same publicly. Parag Parikh passed away in a car crash in the US in May 2015 but his legacy continues. That apart, the fund house is set to complete 5 years in May 2018. With assets of just under ₹ 1,000 crore, has PPFAS Asset Management been a success? Or, given the overall size of the mutual funds industry of close to ₹ 21 trillion, has the growth been slow? Rajeev Thakkar, the fund house’ chief investment officer and the chief fund manager of its sole scheme, discusses this and more. Edited excerpts:

The year of 2017 saw huge inflows into mutual funds. In your assessment, are these healthy inflows? Do investors understand their as well as the investment’s risk quotient?

Part of the flows are surely not healthy. This is the part coming into the dividend plans of balanced funds. Anecdotally, people are being sold these as replacement to bank fixed deposits (FDs). Clearly, both equity and debt securities can go up and down in prices and an equity-heavy scheme with dividend payouts is not a replacement for a product like bank FD. Also there would be those who are investing based on recent returns.

However, fund houses, Amfi (the Association of Mutual Funds of India), the capital market regulator Securities and Exchange Board of India (Sebi) and the financial media have done quite a bit for investor education and at least that part of the inflows would be healthy. These would be people investing as per their asset allocation based on their needs and risk appetite. The exact proportion of healthy versus unhealthy flows, unfortunately, will be known only when the bull market ends.

In October, Sebi reclassified equity and debt mutual fund scheme across categories. Those in favour of this move say that this will ensure true-to-label schemes and that is good news. Others say that there are far too many categories, especially on the debt side. Where do you stand?

There is no denying that the current product offering landscape is too confusing and there are far too many schemes without too much underlying difference. Sebi had been nudging fund houses for a while to simplify their offerings. However in the absence of movement on the part of the industry, there has been this new circular. We may not reach an ideal situation but hopefully it will simplify things a bit for the end investor.

PPFAS AMC will complete 5 years next year. You came with an idealistic mindset. But not many fund houses copied you. You don’t seem to have made too much of an impact?

We’ve made a huge impact. What did we say we would do? We had said we would launch only one equity scheme. We would have limited number of products. It would be easy, therefore, for our investors to choose. Then, we said that we would have our skin in the game. We will align our interests with the unitholders; invest in our own schemes and disclose the same.

In the first case, the capital market regulator recently issued a circular re-classifying mutual fund scheme categories and asking fund houses to consolidate their portfolios and reduce the number of schemes….

But that happened because the Sebi mutual funds committee recommended that, after a lot of deliberation over a period of time….

Sure. For whatever reason. The second one (‘skin in the game’), in terms of senior management putting our money in our scheme…. Sebi had come out with a circular about that too some time ago. Now, all fund managers have to disclose what they are putting in. As a result, you now know even reputed fund managers like Prashant Jain (executive director and chief investment officer, HDFC Asset Management Co. Ltd) invest a sizeable portion in their own schemes. He may have done it even before but such disclosures are out in public domain.

That has made a huge impact and we did it even before the regulation came into force. When we launched our first fund, we never expected that we’ll become 15-20% of the market. That’s completely unrealistic to expect. When we used to manage our portfolio management services (PMS) product, our assets under management were ₹ 285 crore. When we launched our first mutual fund scheme, a bulk of our PMS money came to mutual funds, when most of our investors chose to shift to mutual funds. Today, that number is around Rs960 crore. That’s a combination of appreciation and fresh inflows. Growth has happened.

Remember, we are not a retail brand like the HDFCs and ICICIs of the world, so people don’t know us well. We also don’t have multiple branches or a large distributor network. We largely piggyback on the network of our registrar and transfer agent (Computer Age Management Services Ltd) and digital. Given that, our growth is decent.

Again, many analyst, advisers and online portals do not opine about you in the first 3 years. Once we complete 3-5 years and have some minimum corpus, many of them start looking at us. Those have been the constraints. We have not been in a tearing hurry. We have gone step by step.

Your scheme Parag Parikh Long Term Equity Fund (PPLTEF), a multicap scheme, doesn’t seem to have performed as well as the category average consistently (the other multi–cap schemes we considered were as per Value Research’s categorization). It has been in the top quintile on a 3-year basis, but for time periods less than 3 years, PPLTEF seems to have lagged behind. Why?

PPLTEF invests in Indian as well as international markets. In fact, among diversified equity funds in the market, this has one of the highest allocation (close to 30% during normal times) in international equities. Our performance has to be seen in that context.

Between 1992 and 2003, the Indian markets didn’t do well. Similarly, between 2007 and 2014, the Indian markets didn’t do well. But in these times, the US markets did much better. Therefore, an exposure of 30% to the US markets balances out returns (in PPLTEF).

It’s important to see when you compare the returns. Before 2013, when Indian markets were benign, PPLTEF would have looked far more attractive than its peers. Post 2014, when Indian equity markets shot up, equity funds that invest 100% in Indian equities would have outperformed PPLTEF. Same happened post demonetization.

PPLTEF’s volatility is almost half that of its category average, though. Our modest returns make sense on a risk-adjusted basis and that is very important from the investor’s point of view. We also invest in a diversified asset class, instead of chasing the same type of stocks. For such a low correlation scheme that comes with such a dramatically lower volatility, and where on an average the fund has done well, why do we care so much about 1-month, 6-month or a 1-year performance?

You’ve consistently held international equities in your portfolio. Have you had the opportunity to book profits in these holdings?

Yes, we have exited some. This month, we sold Apple Inc. In a year and half, that stock doubled. So, we exited it. Similarly, we have exited some other small positions.

Agreed that you wanted to break new ground. But trying to be radically different (having just one scheme) in a start-up phase when you don’t have a branch network and seeing the way the mutual fund industry works, has the differentiated strategy been worth it?

We would not have done anything differently. It is not slow growth, though. Our assets have grown from ₹ 285 crore to ₹ 960 crore in less than 5 years. That’s three times growth. This is beyond what we had expected.

For us, the choice was: do we want to grow organically step-by-step in a profitable manner or do we want to become big fast? We chose the former. The discussion with large national distributors, even some of the large banks; their game plan simple…pay us upfront commissions and high trail commissions. They say that people managing investments are mere commodities and that they themselves are the only people adding value in the whole chain. If the total expense ratio we charge to the scheme is 2%, they demand 1.75% to make us ‘big’. That’s the kind of conversations that happens. We chose to avoid going down that path.

How do you find value in this market? Most of the sectors are said to be overvalued. PPLTEF is a value-oriented fund, so isn’t picking stocks in this market, tough?

As far as our existing holdings are concerned, we stay invested in them if it makes sense. If it is attractive, we buy more of our existing holdings. If those companies look expensive, we sell them. We don’t have a particular cash holding target; our weightages reflect our level of confidence in our underlying holdings.

Our holdings in cash and arbitrage positions of 22% reflect the expensive valuations and the difficulty in finding value in equity markets. But wherever possible, we have added some stocks. Lupin Ltd was a recent addition. The pharmaceutical sector hasn’t participated in the equity market rally. A lot of these companies are well managed and going through a temporary difficult phase. The generic opportunity has not gone away and once the issues are behind them, they’ll rebound.

Information technology is going through almost the same phase. There is no optimism built into stock prices and valuations are somewhat lower. So we have been selectively picking new stocks. To sum up, adding new stocks selectively, adding to existing holdings in some cases, trimming exiting holdings in many cases and a mix of cash and arbitrage holdings is our response to the current market scenario.

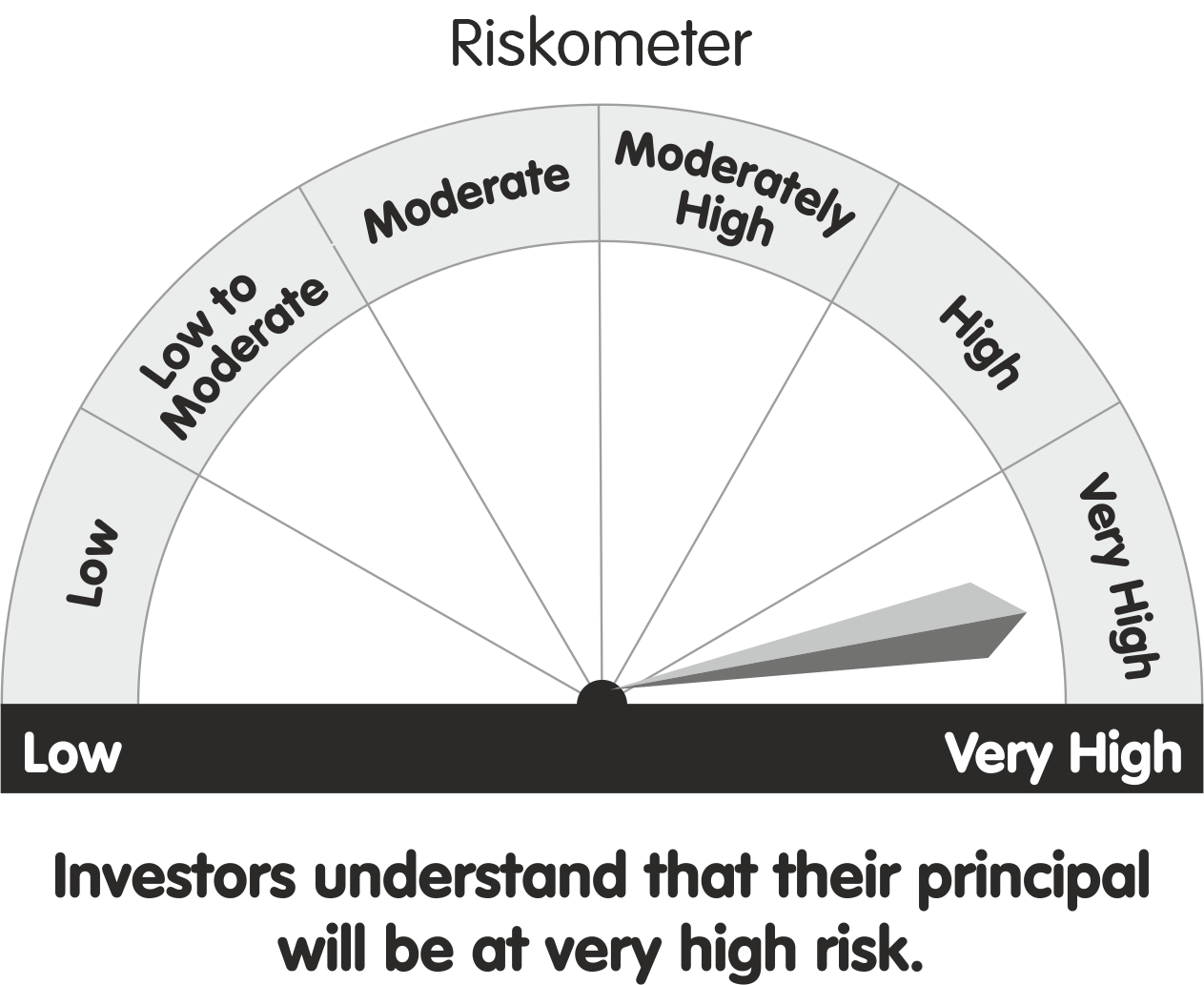

Riskometer This product is suitable for investors who are seeking* This product is suitable for investors who are seeking* The investment objective of the Scheme is to seek to generate long-term capital growth from an actively managed portfolio primarily of Equity and Equity Related Securities. Scheme shall invest in Indian equities, foreign equities and related instruments and debt securities. Investors should consult their financial advisers if in doubt about whether this scheme is suitable for them. Download SID/SAI and KIM here. |

The original interview could be seen here.