|

Dear Investor,

Greetings from PPFAS Mutual Fund.

Investors are requested to note that, pursuant to SEBI circular dated September 17, 2020 and December 31, 2020, the cut off timing for subscriptions / switch-in application for all scheme(s) of PPFAS Mutual Fund (except Parag Parikh Liquid Fund) is revised with effect from February 1, 2021.

PPFAS Mutual Fund

|

Dear Investor,

Greetings from PPFAS Mutual Fund.

Investors are requested to note that, pursuant to SEBI circular dated September 17, 2020 and December 31, 2020, in respect of all Scheme(s) except Parag Parikh Liquid Fund ("the Scheme"), for purchase application (including switch-in) received within cut-off time on a Business Day, irrespective of the amount, the closing Net Asset Value (NAV) of the day on which the funds are available for utilization shall be applicable with effect from February 1, 2021 ("Effective Date").

The provisions shall also be applicable to systematic transactions like Systematic Investment Plan, Systematic Transfer Plan, etc offered by scheme(s).

It may be noted that the existing provisions on NAV applicability for Parag Parikh Liquid Fund and cut-off timings for ALL schemes remain unchanged.

Kindly click Addendum and Notice on Extension to read relevant notice cum addendums.

Investors are requested to kindly take note of the above.

Warm Regards,

Team PPFAS Mutual Fund

|

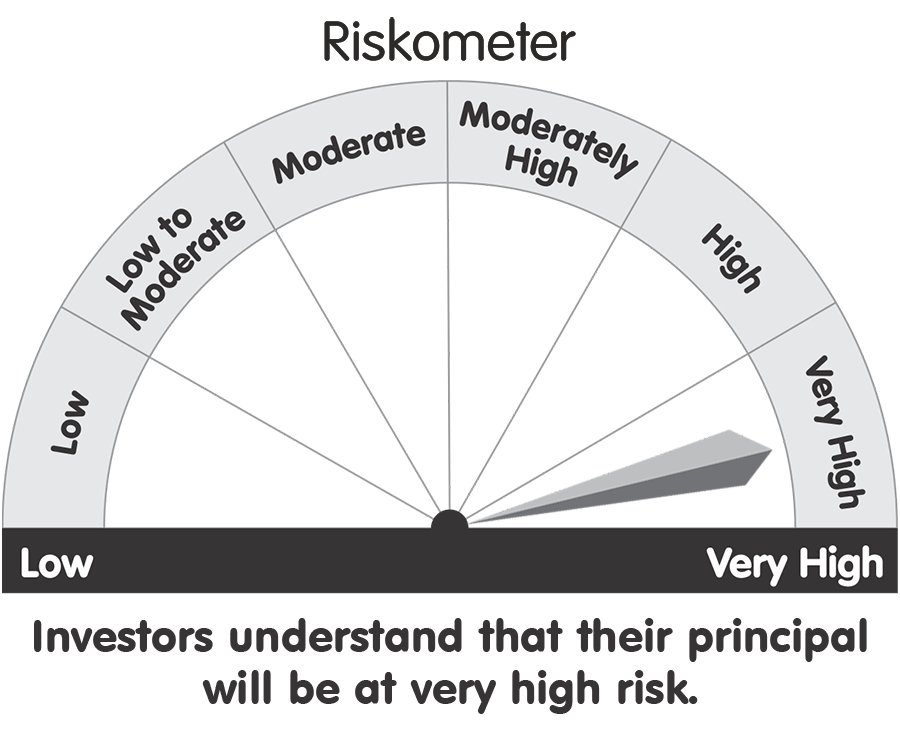

Parag Parikh Flexi Cap Fund

This product is suitable for investors who are seeking*

The investment objective of the Scheme is to seek to generate long-term capital growth from an actively managed portfolio primarily of Equity and Equity Related Securities. Scheme shall invest in Indian equities, foreign equities and related instruments and debt securities.

|

|

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Download SID/SAI and KIM here.

|

|

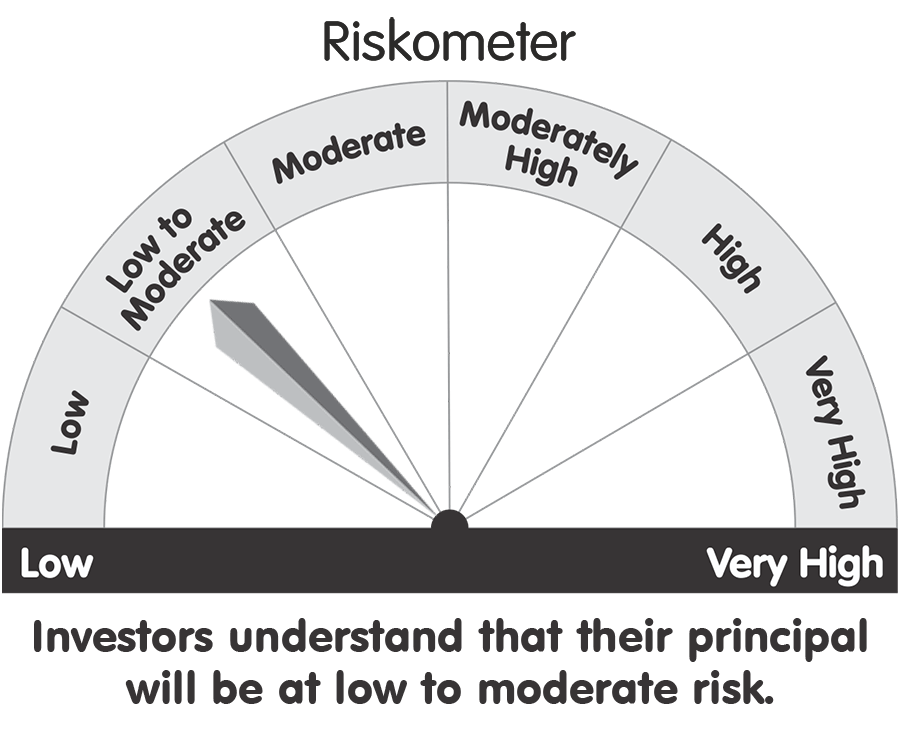

Parag Parikh Liquid Fund

This product is suitable for investors who are seeking*

- Income over short term

- Investments in Debt/money market instruments

|

|

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Download SID/SAI and KIM here.

|

|

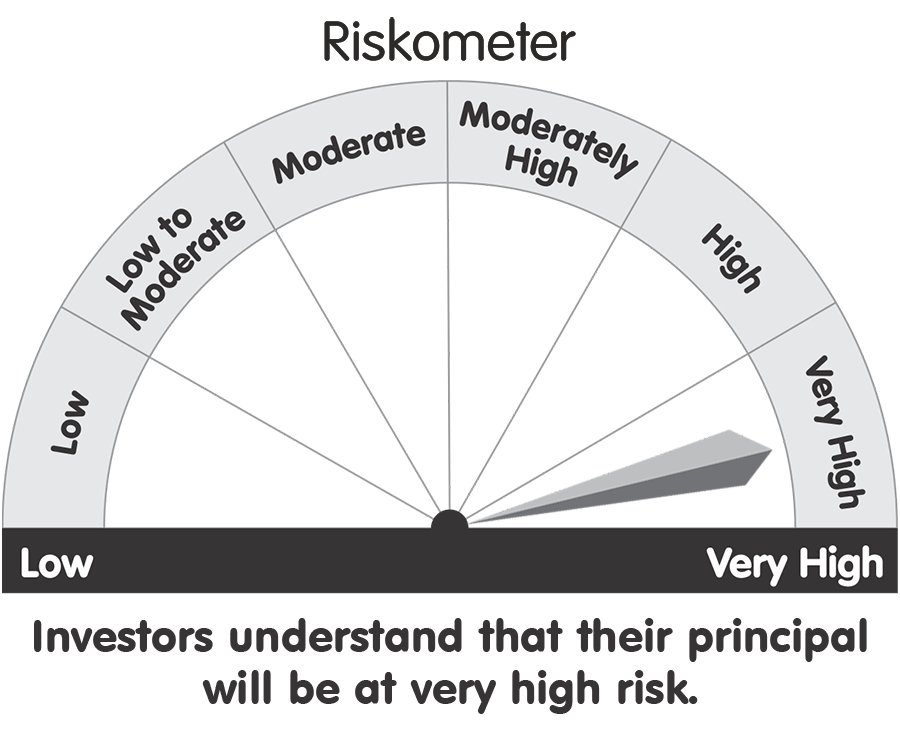

Parag Parikh ELSS Tax Saver Fund

This product is suitable for investors who are seeking*

- Long term capital appreciation

- Investment predominantly in equity and equity related securities.

|

|

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Download SID/SAI and KIM here.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

|

|

|

Registered Office: 81/82, 8th Floor, Sakhar Bhavan, Ramnath Goenka Marg, 230, Nariman Point,

Mumbai - 400 021. INDIA. Tel: 91 22 6140 6555, Fax: 91 22 6140 6590

Toll Free 1800 266 7790, SMS / Whats app: 90046 16537,

Email: [email protected] Website: amc.ppfas.com.

Sponsor: Parag Parikh Financial Advisory Services Limited.

CIN: U67190MH1992PLC068970

Trustee: PPFAS Trustee Company Private Limited. CIN: U65100MH2011PTC221203

Investment Manager (AMC): PPFAS Asset Management Private Limited.

CIN: U65100MH2011PTC220623

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Download PPFAS SelfInvest

|

| |