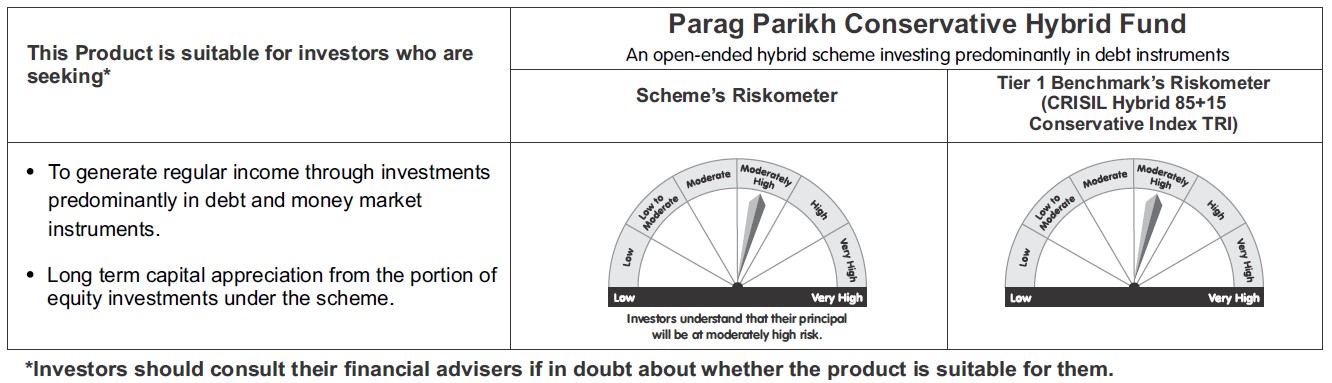

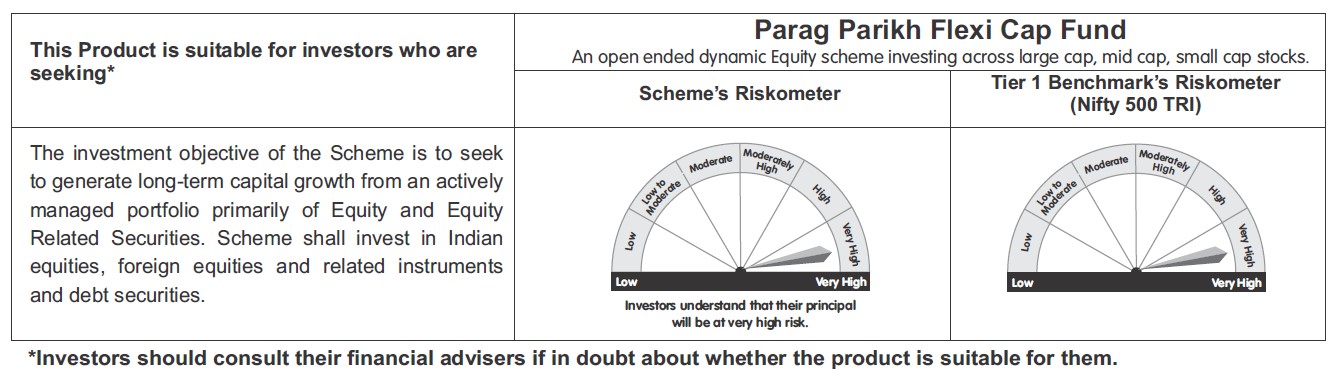

| Name of the fund | Parag Parikh Conservative Hybrid Fund |

| Investment Objective | To generate regular income through investments predominantly in debt and money market instruments. The Scheme also seeks to generate long term capital appreciation from the portion of equity investments under the scheme. However, there is no assurance or guarantee that the investment objective of the Scheme will be realized. |

| Type of the scheme | An open ended hybrid scheme investing predominantly in debt instruments. |

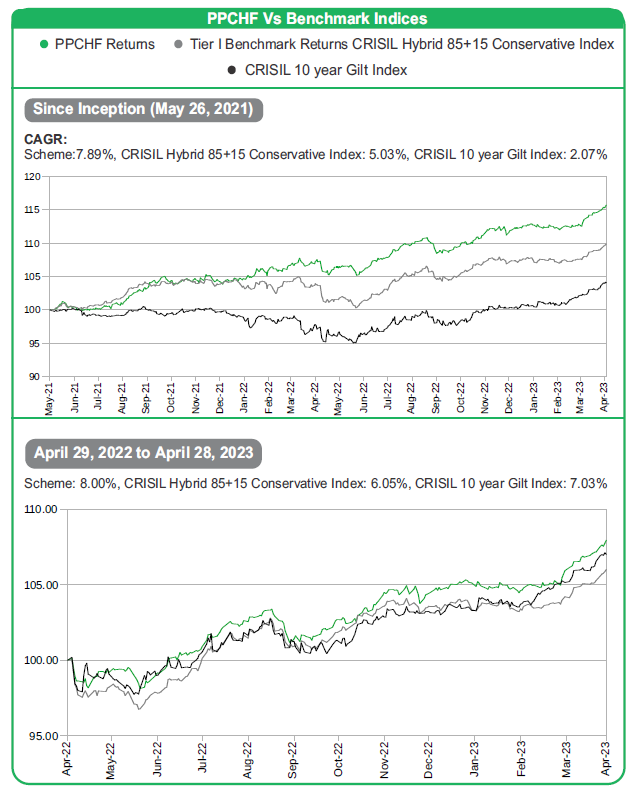

| Date of Allotment | 26th May 2021 |

| Name of the Fund Managers | Mr. Rajeev Thakkar - Equity Fund Manager (Since Inception)

Mr. Raunak Onkar - Equity Fund Manager (Since Inception) Mr. Raj Mehta - Debt Fund Manager (Since Inception) Mr. Rukun Tarachandani - Equity Fund Manager (Since May 16, 2022) |

| Month End Expense Ratio | Regular Plan: 0.63%* Direct Plan: 0.33%* *Including additional expenses and GST on management fees. Total Expense ratio is as on last business day of the month |

| Tier 1 Benchmark Index | CRISIL Hybrid 85+15 - Conservative Index TRI |

| Additional Benchmark | CRISIL 10 year GILT Index |

| Minimum Application / Additional Purchase Amount |

New Purchase: ₹ 5000 and in multiples of ₹ 1

thereafter. Additional Purchase: ₹ 1000 and in multiples of ₹ 1 thereafter. |

| Minimum SIP Investment Amount | Monthly SIP: ₹ 1,000, Quarterly SIP: ₹ 3,000 |

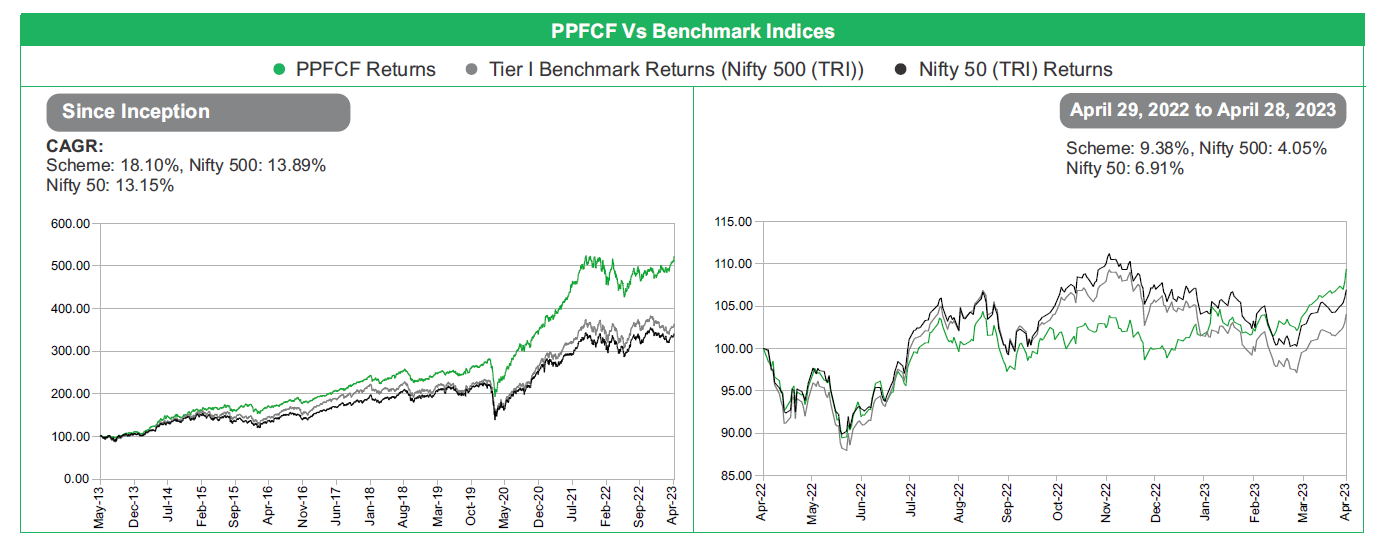

About Parag Parikh Flexi Cap Fund

Parag Parikh Flexi Cap Fund (PPFCF) is an open ended equity oriented scheme with flexibility to invest a minimum of

65% in Indian equities and up to 35% in overseas equity security and domestic debt / money market securities.

The core portfolio consists of equity investments made with a long term outlook and the factors considered while

investing are quality of management, quality of the sector and the business (return on capital, entry barriers, capital

intensity, use of debt, growth prospects etc) and the valuation of the companies. The endeavor of the fund

management team is to identify opportunities for long term investments. However there are times when the opportunities

are not attractive enough. While waiting for attractive opportunities, the fund invests in arbitrage opportunities between

the cash and futures equity markets and special situations arbitrage where open offers / delisting / merger events have

been announced. Investments are also made in money market / debt securities while waiting for deployment in core

equity investments.

Foreign equity investment

The fund invests in foreign equity securities. Since investors in PPFCF look for capital investment and returns in Rupee

terms, PPFCF also looks at delivering in Rupee terms. PPFCF hedges most of the currency exposure using currency

futures.

Outlook

We continue to look at individual investments on their own merits and will not hesitate to invest if an opportunity looks

attractive. As usual, our investment stance does not depend much on the macro-economic situation but is focussed on

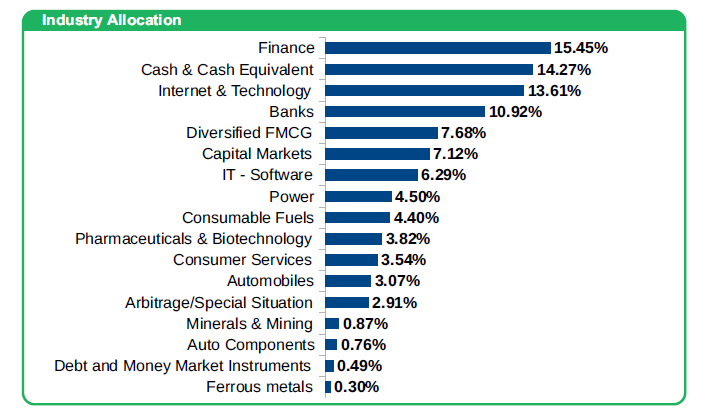

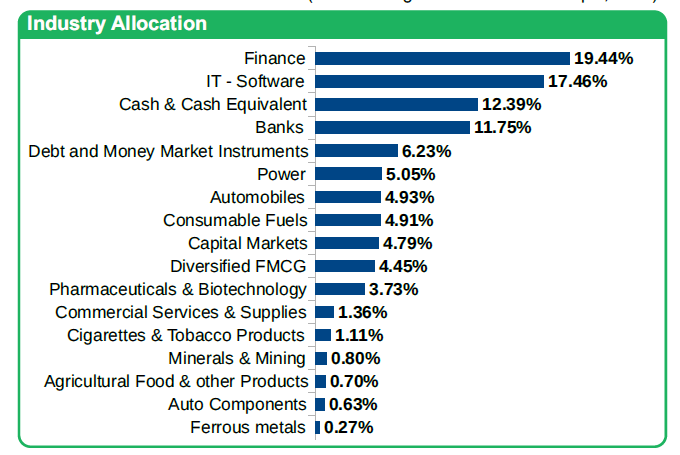

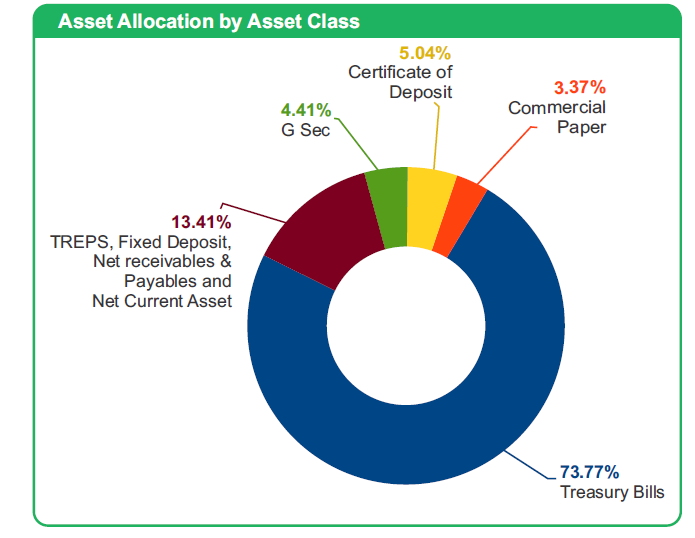

individual companies. We have about 17.67% in cash holdings, debt & money market instruments and arbitrage

positions which can be deployed in long term investments at appropriate levels.