|

|

Now you can convert your Distribution Commission in to units of

. |

|

|

|

|

Now, empanel with our Fund with just a few clicks.

No there is no need to fill up tedious Forms or send us supporting documents. Complete your empanelment process online through a simple One-Time-Password (OTP) based process, over here

|

|

|

|

|

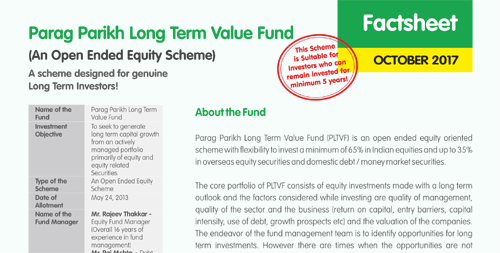

| Factsheet » July 2017 |

| We added 'Facebook' to our portfolio last month. Our top three holdings are... Alphabet (11.21%), HDFC Bank (8.09%) and Bajaj Holdings (7.15%). Facebook comprises 1.89%. The top 10 equity holdings amount to 55.52% of the core portfolio. These include two stocks listed overseas, viz. Alphabet, and UPS. |

|

|

|

|

|

| Around the Blog and Media |

| Articles, blog posts, interviews and Quotes in the media from last month. |

|

|

| 9 financial tasks to do when a parent dies |

| Jayant Pai's quote in The Economic Times Wealth, Julu 10, 2017 |

| Read More → |

|

|

|

| Sensex at new high again: What is driving the rally? |

| Rajeev Thakkar's quote in The Times of India, Julu 12, 2017 |

| Read More → |

|

|

|

|

|

.gif) |

| Balancing your options |

| Article by Jayant Pai in Afternoon DC, July 17, 2017 |

| Read More → |

|

|

.jpg) |

| Largely cautious on midcap IT; see more pain for telecom space: PPFAS MF |

| Rajeev Thakkar interviews in Moneycontrol, July 19, 2017 |

| Read More → |

|

|

|

|

|

|

| Exercise caution in new listings mid & small-caps |

| Rajeev Thakkar interviews in Hindu Business Line, July 31, 2017 |

| Read More → |

|

|

|

|

|

|

|

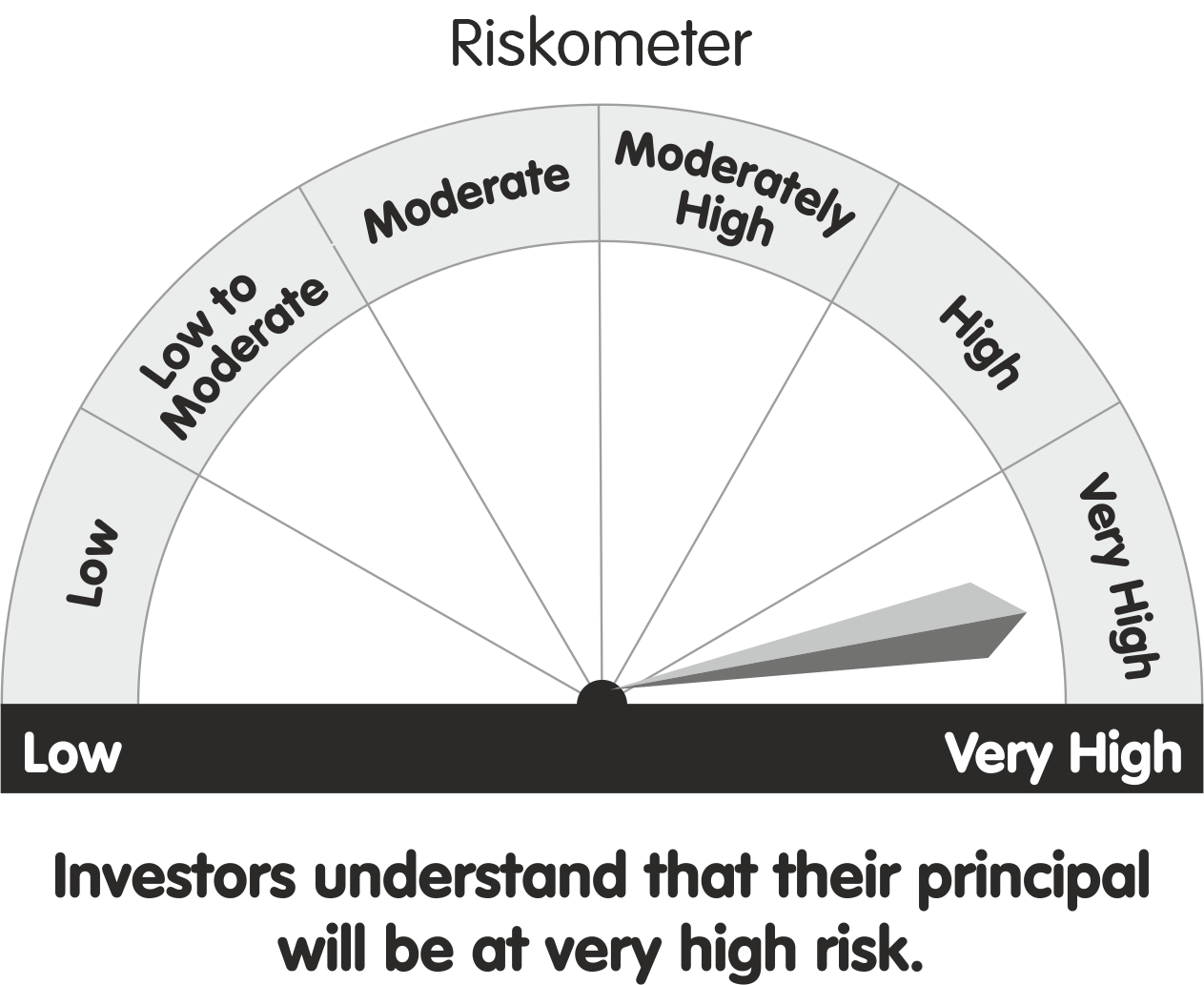

| Riskometer |

This product is suitable for investors who are seeking* This product is suitable for investors who are seeking*

The investment objective of the Scheme is to seek to generate long-term capital growth from an actively managed portfolio primarily of Equity and Equity Related Securities. Scheme shall invest in Indian equities, foreign equities and related instruments and debt securities.

Investors should consult their financial advisers if in doubt about whether this scheme is suitable for them.

Download SID/SAI and KIM here.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

|

|

| Download PPFAS SelfInvest |

|

|

|

|

|

|

PPFAS Asset Management Private Limited

81/82, 8th Floor, Sakhar Bhavan, Ramnath Goenka Marg, 230, Nariman Point,

Mumbai - 400 021. INDIA. Tel: 91 22 6140 6555, Fax: 91 22 6140 6590

Distributor Helpline:

91 22 61406538 SMS/Whats App 77770 05775

Email: [email protected] Website: www.amc.ppfas.com.

Sponsor: Parag Parikh Financial Advisory Services Limited.

CIN: U67190MH1992PLC068970,

Trustee: PPFAS Trustee Company Private Limited. CIN: U65100MH2011PTC221203,

Investment Manager (AMC): PPFAS Asset Management Private Limited. CIN: U65100MH2011PTC220623

|

|