| Factsheet for July 2019 is out now. Download it here... The business model of ride hailing - Uber, Lyft etc. At Financial Opportunities Forum, earlier previous month, Mr. Rajeev Thakkar asks, "Whether Uber is a bubble"...and most of the audience say 'No".

|

|

|

|

|

September 2019

|

|

Factsheet - August 2019 |

|

Return of the boy who cried wolf

Outlook based on the current market conditions

|

|

|

|

|

|

|

|

Know more about the Financial Opportunities Forum

|

|

|

|

|

Media Coverage |

|

Articles, blog posts and interviews in the media from last month. |

|

|

Behavioral Finance |

|

Every month we will include two relevant articles in association with Morningstar India

|

|

August 19, 2019 |

|

The lost art of delayed gratification

|

This week, I came across two examples of delayed gratification. One was a conversation with a friend. Arun is an entrepreneur. As with any start-up, he faced his share of struggles and obstacles. During such phases, he and his family would cut down on visiting restaurants, going out for movies and other social events. But the compromise was never, ever on his savings. His savings rate continued unhindered, and the sacrifices manifested in other areas.

Read here →

|

|

|

|

|

|

August 05, 2019 |

|

Why the Recency Bias is your enemy

|

Consider these scenarios. A passenger on the observation deck of a cruise ship spots precisely equal numbers of green boats and blue boats over the duration of her trip. However, the green boats pass by more frequently toward the end of the cruise while the passing of blue boats were concentrated toward the beginning. Following the cruise, there is a high probability that the recency bias could influence the passenger to recall that more green than blue boats sailed by.

Read here →

|

|

|

|

|

|

| |

Note: Viewers/readers should note that objective of these articles/interviews is to communicate with our unit-holders and share with them our thought process. It should be noted that views expressed here are based on information available in public domain at this moment. Views expressed here can change depending on change in circumstances. Nothing discussed here, constitute a buy/ sell/ hold recommendation.

|

|

|

|

| |

Parag Parikh ELSS Tax Saver Fund

|

|

|

This product is suitable for investors who are seeking

- Long term capital appreciation

- Investment predominantly in equity and equity related securities.

|

|

Investors should consult their financial advisers if in doubt about whether this scheme is suitable for them.

|

|

Investors understand that their principal will be at Moderately High risk.

|

|

|

|

|

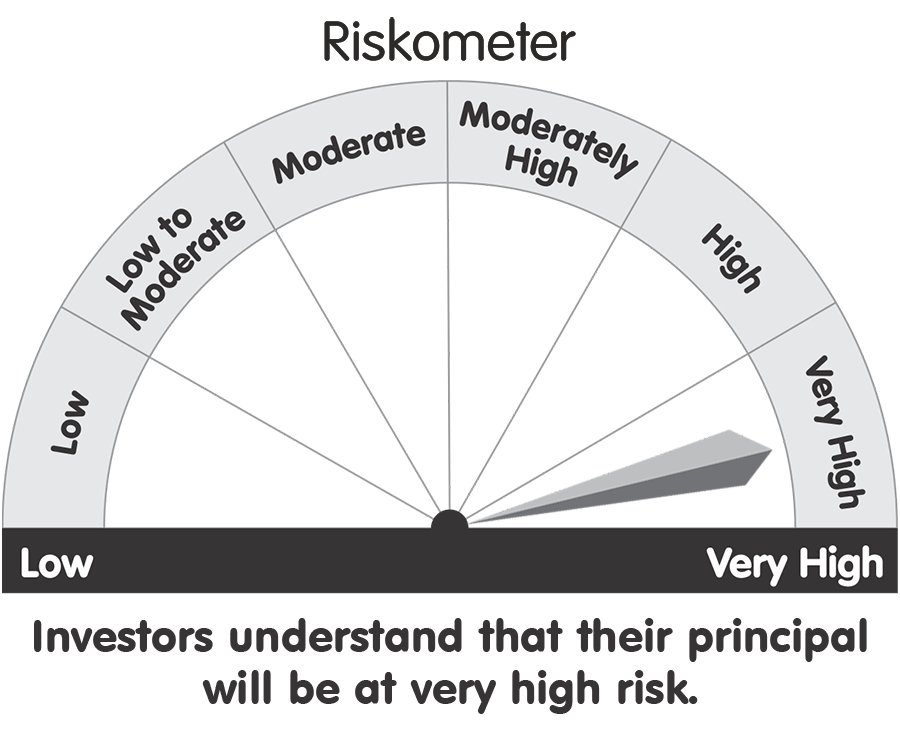

Parag Parikh Flexi Cap Fund

|

|

|

|

The investment objective of the Scheme The investment objective of the Scheme is to seek to generate long-term capital growth from an actively managed portfolio primarily of Equity and Equity Related Securities. Scheme shall invest in Indian equities, foreign equities and related instruments and debt securities.

|

Investors should consult their financial advisers if in doubt about whether this scheme is suitable for them.

Download SID/SAI and KIM here.

|

|

|

|

Investors understand that their principal will be at Moderately High risk.

|

|

|

|

|

|

|

|

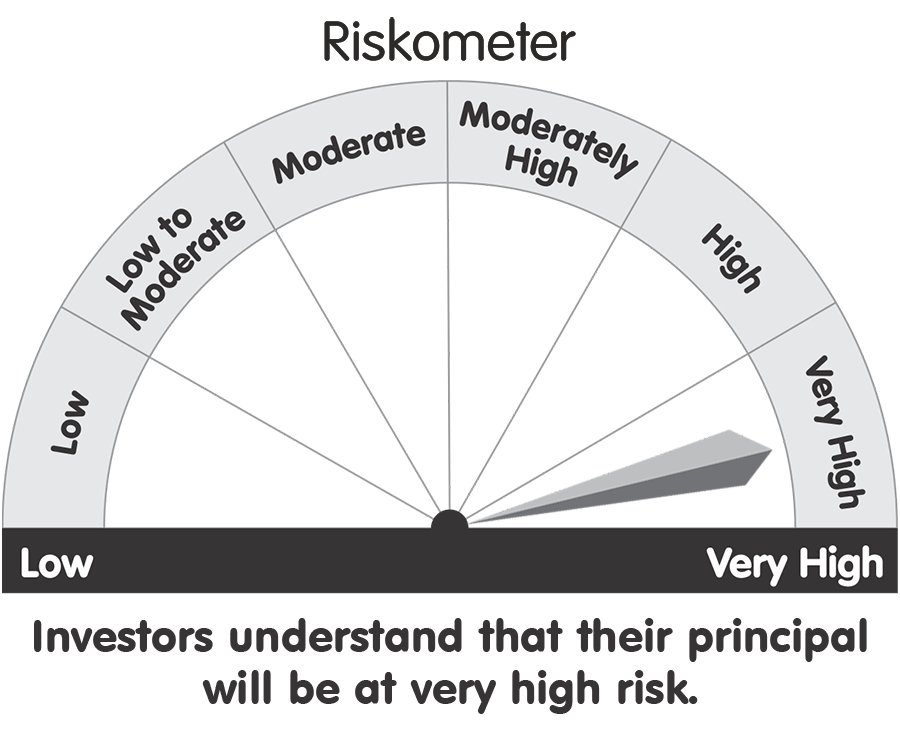

Parag Parikh Liquid Fund

|

|

|

| This product is suitable for investors who are seeking |

|

(I) Income over the short term

(II) Investment in debt / money market instruments.

Investors should consult their financial advisers if in doubt about whether this scheme is suitable for them.

|

Investors understand that their principal will be at Low risk. |

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

|

|

|

|

|

|

| |

'Partner Login' |

|

|

|

Visit this page on our website and :

|

- View Folio-wise Holdings of your clients

- Your clients' Transaction history

- Help your clients create a new Folio via an e-mailed 'link' mapped to your ARN.

|

|

|

|

|

Please help us improve your online experience... |

Thank you for choosing to partner with us and help spread the message of long-term investing among your clients.

We are also delighted to see the rising number of empanelments and transactions being conducted online. Over the past year, we have been receiving several suggestions on how we could improve your online experience and sincerely thank you for the same. While we have been able to implement some of these quickly, we are continuously working on those which are more long-drawn. Unfortunately, feedback received at irregular intervals can be difficult to collate and review. Hence we thought of developing a central repository for your suggestions. We believe this will help us decide the order of priority with respect to new feature additions / improvements in User Interface (UI), both on our website and the 'Partner App.' which we intend to launch in due course.

If yes, we thank you for doing so. We request you to please provide your suggestions, below.

|

|

|

|

|

|

|

| |

'PPFAS Selfinvest' |

|

|

|

|

Consistent with our preference for 'digital over terrestrial', we have launched our Mobile and Web Apps. titled 'PPFAS SelfInvest'.

|

|

Through this you can currently: |

- Create a new Folio

- Make additional purchases, redeem and switch.

- Undertake SIP, STP and SWP transactions

- View your investments

- Fetch your Account Statement

- Invest in the NFO of Parag Parikh ELSS Tax Saver Fund

More features will be added soon...

|

|

|

|

|

|

|

|

| Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

|

|

| Download PPFAS SelfInvest |

|

|

|

|

|

|