|

|

|

|

|---|---|---|

| Equities & Equity related instruments | 0-100 | Very High |

| Debt securities & Money Market instruments including Units of Debt oriented mutual fund schemes | 0-100 | Low to Moderate |

The fund will predominantly invest in debt instruments and endeavour to maintain equity allocation between 35% and 65% (some of it will be hedged via approved derivative instruments as permitted by SEBI from time to time)

Note: Please refer to the Scheme Information Document (SID) of the scheme for detailed asset allocation.

|

|

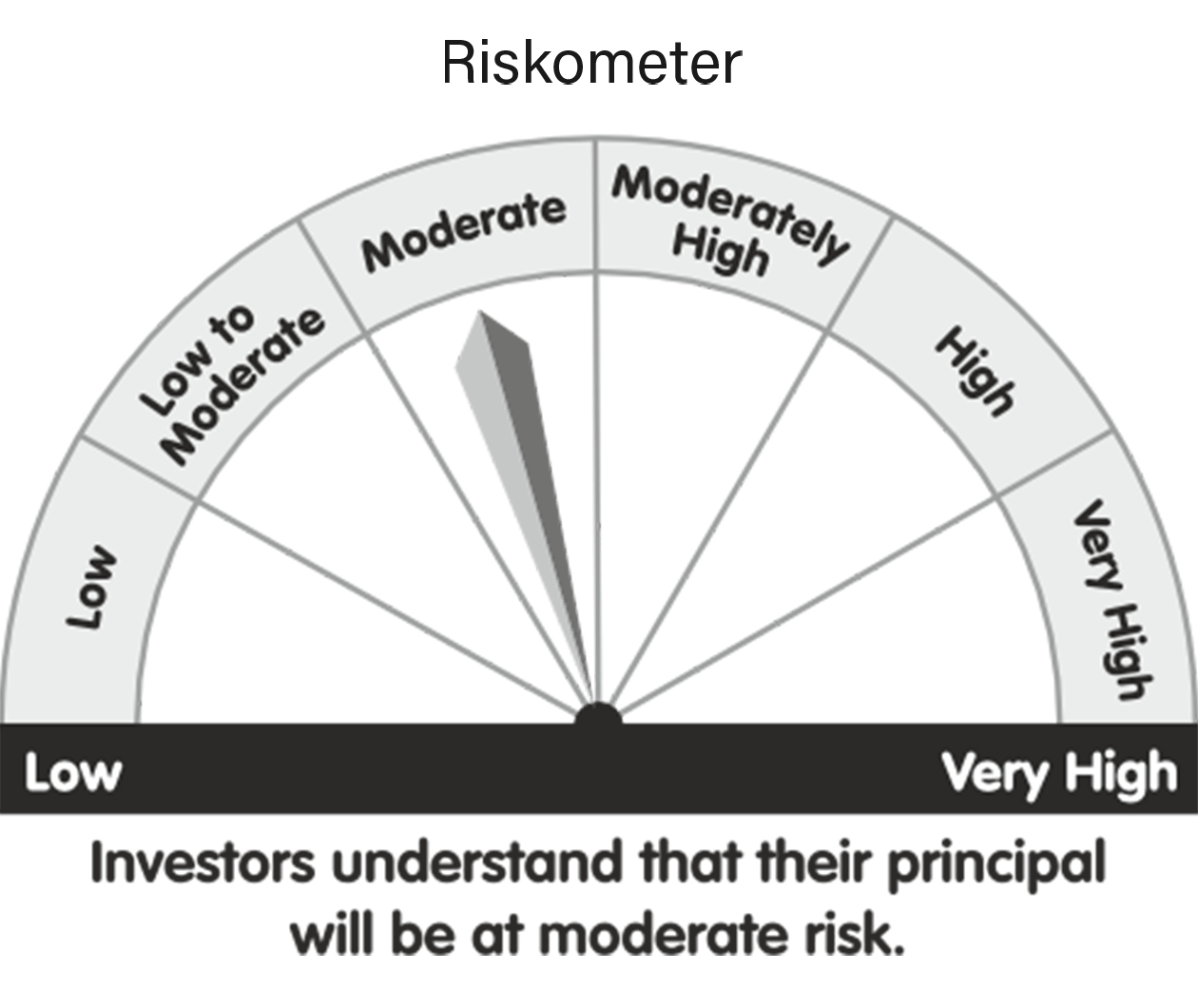

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.