Dear Investors,

Greetings!

In light of a recent SEBI circular on Scheme Categorisation and Rationalisation, we have changed the name of our Scheme from Parag Parikh Long Term Value Fund to Parag Parikh Flexi Cap Fund.

The gist of the Circular was that Mutual Fund houses should not clutter the offering landscape and should have fewer schemes which are 'true to label'. Also, fund houses can offer only one scheme in each category.

While this does not effect us much, considering we offer only one equity scheme, the Fund, in consultation with the Board of Directors, Trustees and interaction with the Regulator decided to classify itself as a 'Multi Cap' Fund.

There is no change in the investment objective or pattern or nature of the fund.

The new name is effective from Friday, February 16, 2018.

Please click here to read the relevant Addendum.

Our Chairman and CEO, Mr. Neil Parag Parikh underscores the prime motivators behind this move:

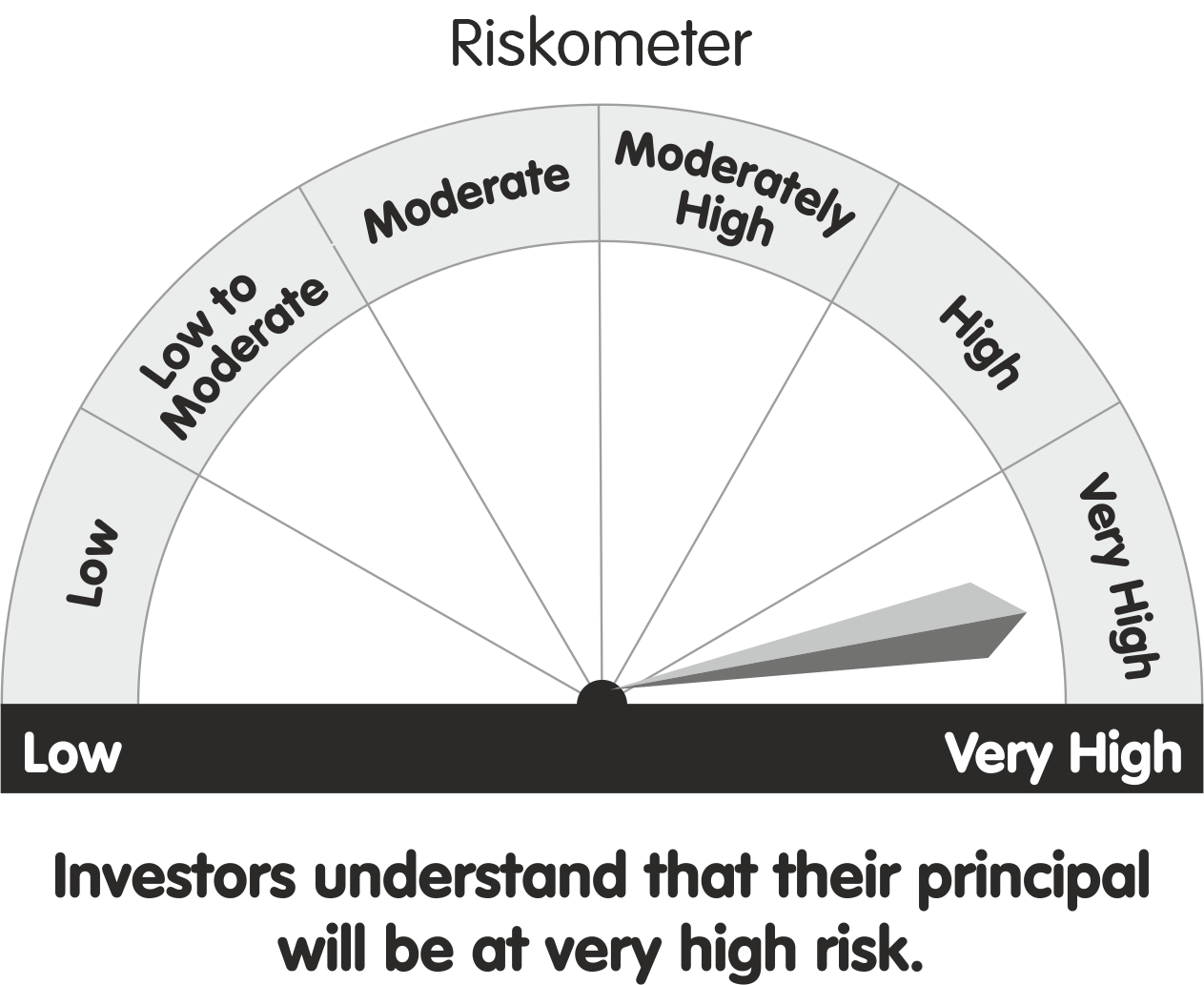

Riskometer This product is suitable for investors who are seeking* This product is suitable for investors who are seeking* The investment objective of the Scheme is to seek to generate long-term capital growth from an actively managed portfolio primarily of Equity and Equity Related Securities. Scheme shall invest in Indian equities, foreign equities and related instruments and debt securities. Investors should consult their financial advisers if in doubt about whether this scheme is suitable for them. Download SID/SAI and KIM here. |