Evaluate performance consistency and returns under different market conditions

After PPFAS Mutual Fund reduced the expense ratio on its sole scheme - Parag Parikh Long Term Value Fund - by 20 basis points, Quantum Asset Management came up with a road map to gradually reduce the expense ratios across its funds as assets under management (AUM) increase.

While expense ratio is not the key criteria in selecting a mutual fund scheme, any reduction is beneficial to investors who plan to stay with the fund for a long tenure. Say, you have invested ₹ 10 lakh in an equity scheme. The fund charges an expense ratio of 1.5 per cent, which it then reduces by 20 basis points to 1.30 per cent. The fund earns 14 per cent gross compounded annual return over the next 10 years. Net of expense ratio, its earning would have been 12.5 per cent earlier but becomes 12.7 per cent now. With the earlier expense ratio, you would have made ₹ 32.47 lakh while with the latter you earn ₹ 33.05 lakh at the end of this period, a gain of ₹ 58,194.

Rajeev Thakkar, chief investment officer and associate director at PPFAS Mutul Fund, explains: "When markets are rising, investor pay little heed to expense ratio as returns generated are high. But in today's scenario, where markets are volatile, corporate earnings growth is low, and return expectations are average (10-15 per cent a year), lower expense can contribute to returns."

Financial advisors suggest that investors should look at various parameters, and not just expense ratio when choosing a fund.

A retail investor, who has limited resources for doing research, should look at returns over different periods, third-party star ratings, and also look at whether the same fund manager who earned those returns is still at the helm. "One should check rolling returns that show performance over different periods, rather than just point-to-point returns," says Tarun Birani, founder and chief executive officer, TBNG Capital Advisors. The simplest way of doing this is by looking at one-year returns every month — from February 2016 to February 2017, January 2016 to January 2017, and so on, for at least 36 such periods. Then calculate the average for those periods and see how it fares against other funds.

According to financial planners, a fund that maintains a TER on the lower side shows the efforts of the management to keep expenses in check.

According to financial planners, a fund that maintains a TER on the lower side shows the efforts of the management to keep expenses in check.

Explains Jimmy Patel, CEO, Quantum Mutual fund: TER is the cost of running and managing a mutual fund which is charged to the investor. It includes fund management fees, marketing or selling expenses, transaction costs, investor communication costs, custodian fees, and registrar fees. The expense ratio is calculated as a percentage of the fund's average net asset value (NAV).

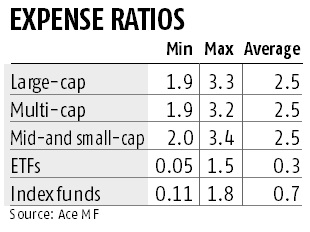

The Securities and Exchange Board of India has restrictions on the expenses mutual funds can charge investors. For actively managed equity funds, Sebi allows an expense ratio of maximum 2.5 per cent for the first ₹ 100 crore (average weekly net assets), 2.25 per cent for next ₹ 300 crore, 2 per cent for the subsequent ₹ 300 crore and 1.75 per cent for the balance corpus. For debt funds, the expense ratio allowed is 0.25 percentage points lower than equity funds.

At all costs, investors should avoid being in a fund that gives you poor returns while charging above-average expense ratio.

The original article could be seen here.