Money Today brings you investing lessons from the world's greatest value investors and 10 stocks that meet their stringent criteria.

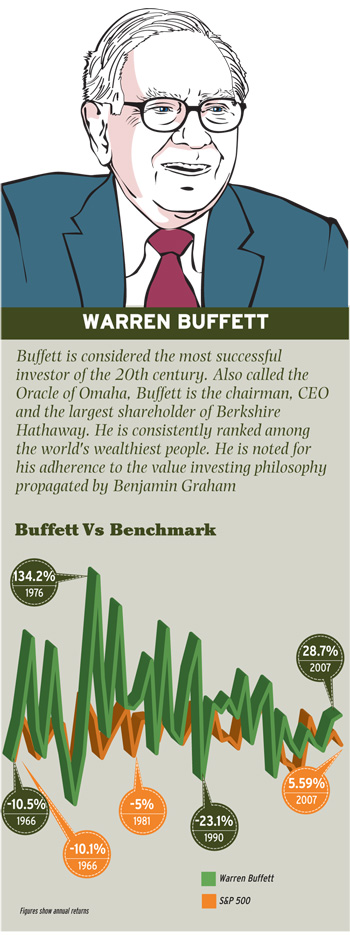

Value investing must be the most talked about investment philosophy on the planet. One reason for this is that it can deliver good returns in all types of market situations. So, when stock markets are down in the dumps, value investors such as Warren Buffett tell investors to not let go of the opportunity to buy good stocks at low prices.

But what if markets are rising, in fact have already risen quite a bit, and suddenly there is a dearth of stocks quoting for less than their fair value, increasing the risk for investors? The answer, interestingly, can be found from the same set of investors. For instance, Buffett's advice to investors at this stage is to keep an unwavering focus on earnings so that they don't end up overpaying for a stock.

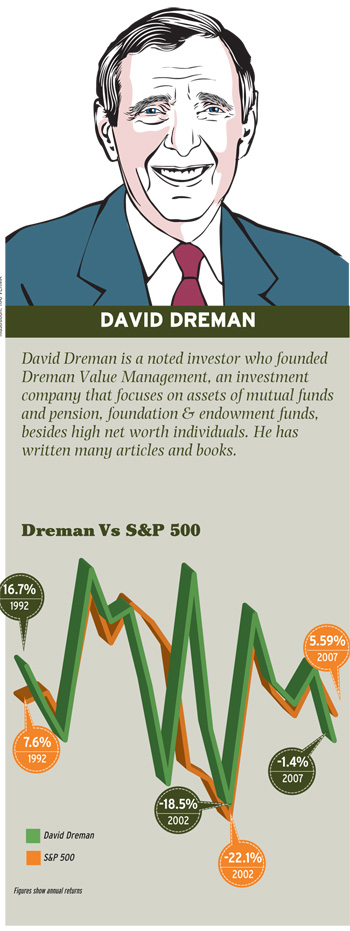

Indian investors, on account of the sharp and sudden rise in stock markets since the start of the year, are in precisely such a situation. So, for help, we decided to delve into the minds of the world's most well-known value investors such as Buffett, Benjamin Graham and David Dreman.

The aim was to find out how they would have proceeded in the current market and found stocks that can give good returns in the times to come. We also bring you, for good measure, ten stocks that pass the tough quality tests prescribed by another value investing legend, John Neff.

Defining Value Investing

Value investors buy shares of companies they believe the market is undervaluing.

"All investing is value investing. What is investing if not an attempt to buy something for less than its worth?" says Sanjay Bakshi, adjunct professor at Management Development Institute (MDI), Gurgaon.

Pricing is the key. "Overpaying for an asset can make you money if you can find a greater fool to buy it from you at an even higher price. This works for a while but it cannot work indefinitely as the supply of greater fools is not infinite," he says.

"The culture of value buying is already there in India, with consumers rushing to buy various products in attractive discount offers; value investing can also be understood as a style of investing in equities when they are cheap and holding them till they become reasonably valued," says Sankaran Naren, CIO, ICICI Prudential AMC, one of India's largest fund houses.

In an article, "The Superinvestors of Grahamand-Doddsville," published in the 1984 issue of Hermes, Columbia Business School magazine, Warren Buffett had written, "The common intellectual theme of investors from Graham-and-Doddsville is this: they search for discrepancies between the value of a business and the price of small pieces of that business in the market."

But there are some who feel that the value investing discipline has evolved over the years. "Value investing as per Graham's definition involved buying a stock for an amount just equivalent to the company's net working capital. Today you do not have such opportunities because with time investors are becoming more savvy and sophisticated," says Atul Kumar, head, equity funds, Quantum Mutual Fund. Does this mean that value investing is dead? No. It has just evolved. Here's how.

Value Vs Growth

A lot of investors differentiate between growth and value investing. The former focuses on companies that will grow faster than the average. In such a case, investors are willing to pay a high price for faster future growth. Value investing, on the other hand, involves finding companies whose stock prices understate their true worth. The price is the key here.

Bakshi of MDI says, "Warren Buffett demolished the distinction between growth and value long ago when he said growth was just a component of value, sometimes negative and sometimes positive. Averaged out, growth in the airline industry has hurt investors while growth in the chocolate business has made investors rich."

Raamdeo Agrawal, joint managing director, Motilal Oswal, says value investing is what every investor practices. This is because the aim of investing is making money and to do that one has to buy at a price less than what it is expected to be. "Investing is broadly classified as value and growth but I don't believe they are separate. No one will buy a business if it is not growing," he says.

The key difference, say experts, is that growth investing puts a lot of emphasis on future growth. Value investing, on its part, goes more with past facts and the company's present position.

Shades of Value Investing

In India, different value investors have different philosophies. "I am a moat investor," says Bakshi of MDI. 'Moat' is a term Buffett uses to illustrate a competitive advantage which is sustainable because of high entry barriers in the area in which the company operates.

"Profitable and scalable businesses with moats which are run by honest and competent managers can compound capital at high rates for a long time. This combination of longevity and compound interest are the key ingredients of successful value investing I know about," writes Buffett.

"Profitable and scalable businesses with moats which are run by honest and competent managers can compound capital at high rates for a long time. This combination of longevity and compound interest are the key ingredients of successful value investing I know about," writes Buffett.

"My approach is to pay less than fair value for the business to have a higher margin of safety. This ensures that I get growth as an additional bonus," says Agarwal of Motilal Oswal.

Parag Parikh, director, Parag Parikh Financial Advisory Services (PPFAS), says, "We prefer to own businesses that keep doing well over a long period. We buy them when we notice that the market is not fully appreciating the opportunity/capability. If the business keeps doing well and delivers as per our expectations and the opportunity to continue the momentum exists, there is no reason to sell out." Adding a note of caution, he adds, "Occasionally the market does give too much importance to prospects of an industry and ends up overvaluing it. That may be the time to sell."

Some take a multi-level approach. "At Quantum, we look at companies trading at low valuations in terms of price-to-earnings ratio, price-to-book value and other such metrics. One important thing we look at is events which will help in value unlocking. Only when there are earnings or valuation triggers will the value be unlocked," says Atul Kumar, head of equities, Quantum AMC.

Vinay Khattar, research head, Edelweiss, says, "We focus on stocks that are out of favour with the market or are valued below their intrinsic worth as earnings growth expectations are muted. In this context, even a small change in earnings growth expectations can give fairly good returns, even as the downside is protected."

"We also believe that a margin of safety exists in stocks trading at fair value but where the visibility of future earnings is high given the huge opportunity size in the business," he says. One can also create own rules. "I look at assets generating acceptable returns. Acceptable economic growth rate is the opportunity cost to the shareholder for investing in the equity of that company," says Phani Sekhar, fund manager, portfolio management service, Angel Broking.

Margin of Safety

Graham, the father of value investing, wrote in The Intelligent Investor that if he were to explain sound investing in three words, then all he would say is 'margin of safety.' This naturally leads to the question, what is 'margin of safety'?

Graham, the father of value investing, wrote in The Intelligent Investor that if he were to explain sound investing in three words, then all he would say is 'margin of safety.' This naturally leads to the question, what is 'margin of safety'?

'Margin of safety' is the difference between the expected value of the asset and the price at which it is bought. For example if you think that the value of a stock is Rs 100 and you buy it for Rs 60, your margin of safety is Rs 40.

"We believe this is the most important concept in value investing. It is paying less than fair value for an asset, which protects the capital even if something goes wrong," says Khattar of Edelweiss.

"Margin of safety protects us from errors in judgement," says Parikh of PPFAS.

However, adding a word of caution, he says, "It is very difficult to calculate when we are dealing with long holding periods because the business can evolve in ways we may not have expected. It must be coupled with awareness about the developments in the industry."

What will Work for Indians?

"A long-only, reasonably diversified portfolio across India and developed market equities with primary exposure to ultra-large caps and some to mid- and small-caps. One must focus on quality stocks at low valuations," says Vikas Gupta, executive vice president, Arthveda Fund Management.

ICICI Prudential's Naren says despite the perception that India is a growth market, value investing has a good chance of working here. "Our experience with value investing over the last decade has been good. We believe that value investing requires an investment horizon of three-five years to bear fruit," he says.

But Parag Parikh of PPFAS says not all forms of value investing will work in India. "In India we do not have corporate raiders and hostile takeovers. Further, in Indian companies, usually the promoter family controls a large part of equity, and so it is difficult to impose change or protect minority shareholders." That's why Parikh says that one must be on guard against value traps.

Value traps are companies whose stock is statistically cheap but rather than the stock price rising to the intrinsic value, the intrinsic value falls to the stock price. This can happen due to poor capital allocation, misappropriation of funds, and so on.

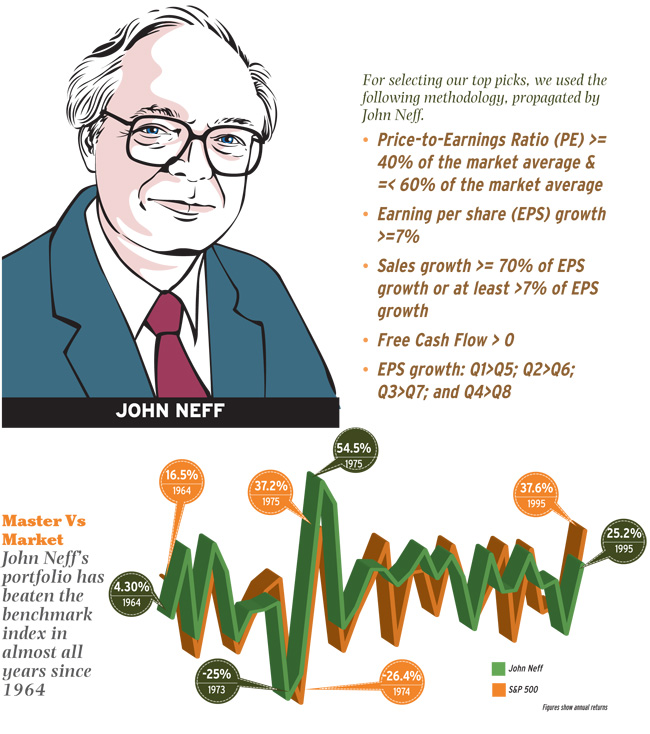

John Neff is not a name people recognise as easily as Berkshire Hathway's Warren Buffett. Yet, within the global investing community, he is a star in his own right.

Neff steered Vanguard Windsor Fund from 1964 to 1995. In these 31 years, the fund grew at 13.7% a year against 10.6% rise in the S&P 500.

Sankaran Naren, CIO and ICICI Prudential AMC, says: "John Neff's investing style is contrarian." But the rush of liquidity across the world has made it difficult for investors to use this style in the near term, he says. "However, a year back, the investing styles recommended by David Dreman and John Neff enabled us to consider launching a series of close-ended value funds," says Naren.

The original article could be seen here.