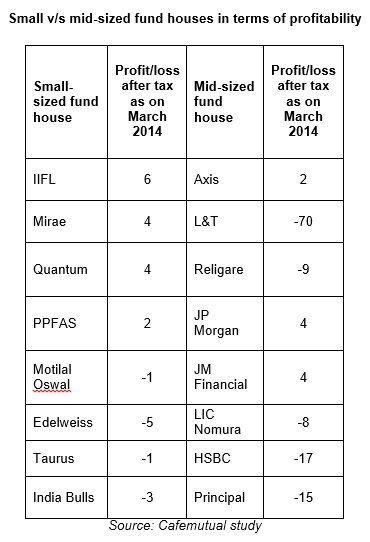

Not only did fund houses like Mirae, Quantum, PPFAS and IIFL turned profitable last fiscal, they have overtaken many of their larger peers in profits.

Size doesn’t matter. It would appear so going by the profit numbers crunched by Cafemutual. Though AMCs like ING, Pinebridge and Morgan Stanley exited mutual fund business in the recent past, many small AMCs have set an example that they can not only survive in the competitive environment but also overtake their bigger counterparts in terms of profitability.

Not only have some fund houses like Mirae, Quantum, IIFL and PPFAS turned profitable last fiscal, these fund houses have overtaken many of their larger peers such as Axis, JP Morgan, Religare, L&T, LIC Nomura, Principal and HSBC in terms of profitability.

Among these fund houses, IIFL has reported a growth of 400% in its PAT in FY13-14 by posting a net profit of Rs. 6 crore as compared to loss of Rs. 2 crore in the previous year. IIFL MF’s AUM grew by 11% from Rs. 210 crore to Rs.234 during the same period.

Interestingly, in just nine months i.e. from April 2013 to December 2013, Mirae Asset MF’s jumped 300%. Its PAT was Rs.4 crore (April 2013- December 2013) as against Rs.1 crore in FY 2012-13.

Meanwhile, Quantum MF which follows July to June accounting year witnessed a growth of 33% in its PAT at Rs.4 crore as against Rs.3 crore during the previous year.

Finally, PPFAS which has not even completed a year of operations has reported a profit of Rs. 2 crore as on March 2014. At a recent Cafemutual Confluence event, Rajeev Thakkar, Chief Investment officer & Equity Fund Manager, PPFAS MF said that his fund house was profitable because their costs were under control. Also, PPFAs had been managing only one fund since it started its mutual fund business, he added.

Nikhil Kothari of Etica Wealth Management points out that small fund houses work with a limited set of advisors which helps them keep their costs low. Also, such AMCs work on specific geographies and focus on developing niche products. Mid-sized AMCs, on the other hand, spend heavily on new funds and marketing as they try to compete with their larger counterparts. These AMCs focus on building a large distribution network. If their funds doesn’t perform well it could be a major dent on their balance sheet, he added.

It remains to be seen whether these small fund houses continue to grow through their innovative offerings in future. However, going by their strategy, it is clear that they want to be different to be successful.

The original article could be seen here.