Even as mutual fund investors wrestle with the idea of venturing into the deep sea with direct plans, they have to grapple with another critical element of building a strong portfolio—fund selection. Apart from the problem of plenty facing those picking funds on their own, another headache is the confounding nomenclature that prevents investors from actually identifying a suitable fund.

All in the name

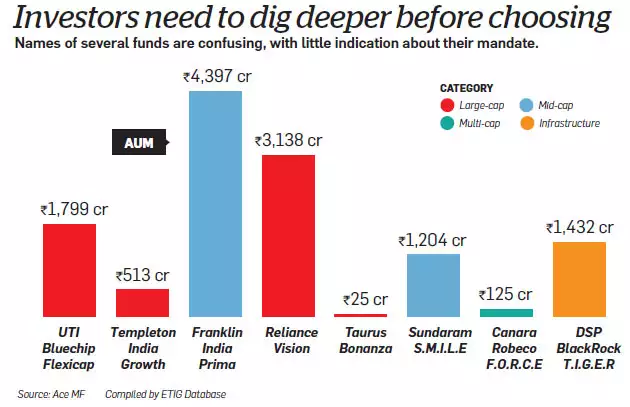

Names of several schemes are either confusing, vague or give no clear indication of where they seek to invest. Investors simply cannot gauge what the investment focus will be. A reference to blue-chip, mid-cap, top 200, emerging businesses, dynamic or value in the scheme name instantly tells you about the fund's mandate. But some schemes simply do not afford you that luxury. As Roopali Prabhu, Head of Investment Products, Sanctum Wealth Management, says, " .

Sample a few: UTI Bluechip Flexicap Fund. The name makes no sense—is it a large-cap biased fund with added freedom to roam into other segments? A look at its investment objective reveals that it aims to achieve long-term capital appreciation and/or dividend distribution by investing in stocks that are "leaders" in respective industries, sectors or sub-sectors. Wouldn't 'Industry Leader's Fund' been a better fit then?

Some names are downright misleading, albeit unintentionally. For instance, the two-decade old scheme Templeton India Growth Fund. Unlike what the name suggests, this fund is actually known to ply a value investing strategy. The 'growth' and 'value' styles of investing are as different as chalk and cheese, with the latter being a path far less travelled. ICICI Prudential Value Discovery and PPFAS Long Term Value are other prominent offerings in this space that spell out their distinct approach.

Some funds have over the years changed their mandate but kept the original name intact, leading to a gap in what the name suggests and what it does. Manoj Nagpal, CEO, Outlook Asia Capital, points out, "These funds have changed character and investors have been informed, but the name has not been aligned accordingly." Franklin India Prima is a case in point. It was named owing to its initial objective of participating purely in primary market offers, but it later changed focus to investing in high growth small and mid-cap companies.

Some names are so vague that they do not reveal a specific agenda. Take for instance the numerous funds seeking to make good of some 'opportunities'—UTI Opportunities, Birla Sun Life India Opportunities, Kotak Opportunities and Mirae Asset India Opportunities, among others. A closer look suggests these schemes have varying mandates—while one focuses purely on riding export-oriented businesses, others aim to capitalise on opportunities resulting from ongoing reforms and structural shifts in the economy, and so on.

There are some like Taurus Bonanza and Reliance Vision which give no clear indication of where they put investors' money. Other fancy names like Sundaram S.M.I.L.E, DSP BlackRock T.I.G.E.R and Canara Robeco F.O.R.C.E are likely to leave investors scratching their heads. "More exotic the name, more confusing it is for the investor," says Amol Joshi, Founder, PlanRupee Investment Services.

There are instances of schemes of the same fund house that seem to overlap each other's mandate. ICICI Prudential AMC offers two schemes, ICICI Pru Select Large Cap and ICICI Pru Focused Bluechip. Both seem to refer to the same thing, yet differ slightly from one another. Both are true-to-label large-cap funds, but while the former runs a focused portfolio of 14 frontline stocks, the latter now runs a diversified portfolio of more than 45 stocks owing to its much larger corpus, contrary to suggestions of a focused approach.

Similarly, SBI Emerging Businesses and SBI Magnum Midcap do not have any distinguishing element in the name even though these run different templates. Same goes for schemes like Birla Sun Life Frontline Equity and Birla Sun Life Top 100.

What you should do

If you go purely with the scheme name to decide which one fits your needs, you would be none the wiser. Investors need to dig deeper to figure out what these products actually offer and whether they are suitable for them. A closer look at the fund objective in the fact sheet or scheme information document should help clear things to an extent. Prabhu says investors should look at broader parameters other than name and point to point performance while selecting funds.

"To understand the underlying risk it is important investors understand the positioning of the fund and not just the current portfolio," she says. In equity funds, for instance, it is important to understand whether the fund will run a concentrated or diversified portfolio or if the fund will move down the market cap curve, and so on. In case of bond funds, investors should know whether the fund manager will invest in long-term g-secs or buy aggressive credits.

The original article could be seen here.