Three years ago, the markets were in a comatose state, with the Sensex struggling below 20,000 and the Nifty at 5,800 levels.

The mood changed after Narendra Modi was named the prime ministerial candidate by the BJP on September 13, 2013.

In the following weeks, markets moved decisively upwards. In three years, the Sensex has gained over 9,000 points, rising at a compounded growth rate of over 14%. This might not appear too spectacular, but was just the good news that investors were waiting for. In the past three years, investors have poured money into stocks and mutual funds, while FIIs have renewed their commitment.

The asset under management (AUM) of mutual funds touched an all-time high of ₹ 14,39,661 crore in June this year, up 45% since September 2013. FIIs have made net equity purchases of ₹ 2,03,333 crore in the past three years.

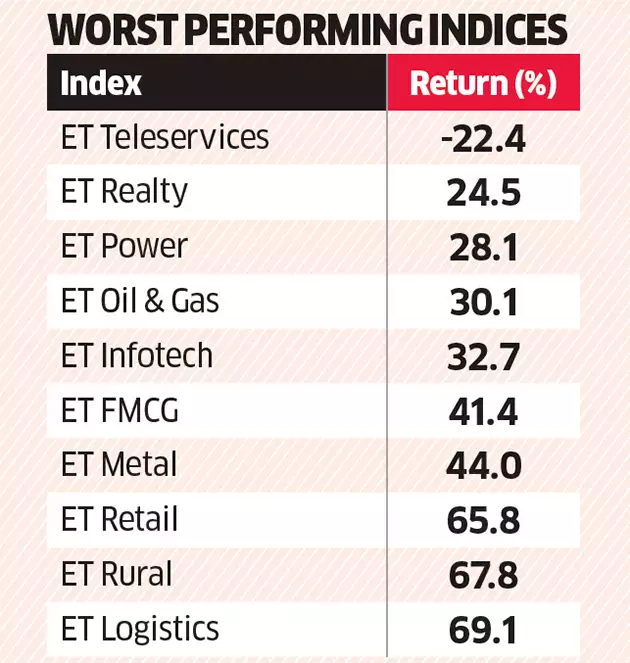

The rising tide has lifted all boats, including the chronically ill sectors such as infrastructure and realty. The ET Realty index has risen 24% in the past three years and the infrastructure funds category has delivered 27% compounded returns since September 2013. The telecom sector is the only bad apple here. The ET Teleservices index has fallen 22% in the past three years.

To be fair, Modi alone has not energised the markets. The then newly-appointed RBI governor Raghuram Rajan had already taken a series of measures in 2013 to stem the sharp decline in the rupee. Curbs on gold imports bolstered the rupee while the regular increase in petrol and diesel prices reduced the fiscal deficit. Rajan also tamed inflation by hiking benchmark rates.

By the time Modi came to power in May 2014, stock markets were already on a roll. The thumping majority for the BJP in the general elections further fuelled the rally.

But there were a few blips in this bull run. Growth in corporate earnings was sluggish and the absence of big-ticket reforms caused markets to slip in 2015. After hitting an all-time high in January 2015, the Sensex had slipped 22% over the next 12 months.

However, it resumed its upward trajectory this year owing to the prospects of improvement in corporate earnings, onset of a healthy monsoon as well as the passage of some key reforms, such as the Goods & Services Tax, Real Estate Regulatory Bill and more.

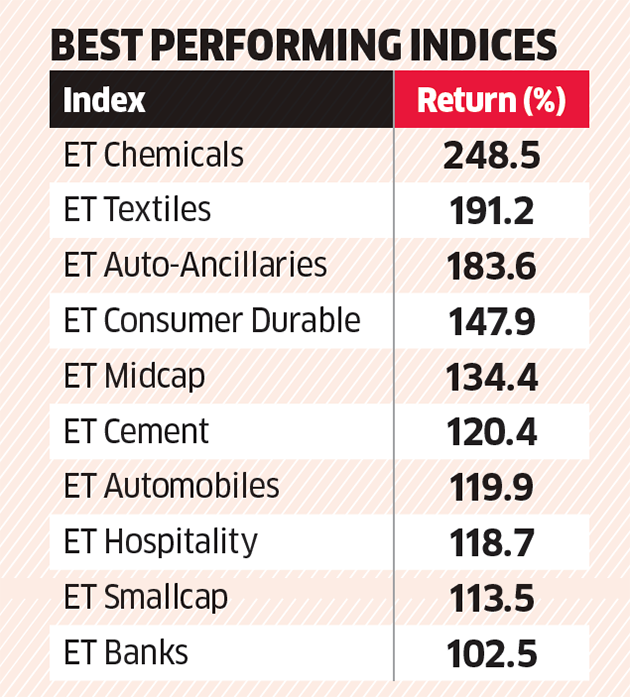

Small and midcaps ruled the charts Small-cap and mid-cap stocks (and the mutual funds that invest in them) have been the stars of the Modi rally.

The S&P BSE Midcap and BSE SmallCap indices have jumped 139% and 132%, respectively, compared to a modest 47% gain for the frontline S&P BSE Sensex.

Apart from the higher growth rate in smaller companies, what attracted investors' attention was these companies' focus on the domestic market. The recovery in the Indian economy helped these companies even as larger companies with international exposure suffered due to a global slowdown.

The biggest winners in the midcap basket (SRF, TVS Motor and Bajaj Finance) have grown at a staggering CAGR of more than 100% in the past three years. For the same reasons, the best performing equity funds are from the mid- and small-cap categories and large-cap funds are among the laggards.

The consumption theme has emerged strong in the past three years. Specialty chemicals stocks have been at the forefront of the rally during this period. The market for this business is growing at a rapid pace and Indian companies are expected to be beneficiaries of a potential decline in this business in China.

While analysts expect niche players in chemicals to continue doing well, most are sceptical of sustainability of the rally in textile stocks given the stiff competition from other low-cost manufacturing nations.

Other prominent sectors that have emerged biggest winners are those which offer a play on the domestic consumption story and pickup in construction activity. With consumer discretionary spend on the uptick, stocks belonging to consumer durables, automobile and allied sectors have fared particularly well. With disposable incomes set to rise owing to the abundant monsoon and Seventh Pay Commission payouts, analysts expect the trend to continue.

"The consumption theme will remain strong over the next few years, particularly in the rural segment led by revival in monsoon and benefits under NREGA," says Vikas Gupta, CIO, Arthveda Capital.

HIGH CAPEX AND DEBT PUNISHED

The telecom sector was the biggest loser, with leading companies like Reliance Communications, Idea Cellular and Bharti Airtel witnessing a decline in share prices. "Rising spectrum costs, heightened competition and debt overhang have soured investor sentiment in this sector," says Rajeev Thakkar, CIO, PPFAS Mutual Fund.

Going forward, Reliance Jio's disruptive entry into the already hyper-competitive environment will continue to weigh on these stocks, argue analysts. Meanwhile, analysts remain optimistic on infrastructure stocks.

While the initial uptick in this basket during the Modi euphoria has since moderated, these are likely to come back stronger as new projects start coming on board.

Arthveda Capital's Gupta says, "Some of the traditional players got stuck in unviable projects and are unlikely to benefit from the infrastructure push by the government, having already overspent. But the newer players are better positioned to benefit from the spending."

GOLD, FIXED INCOME AND REALTY

Though gold prices have bounced back in recent months, the metal has generated only 2% CAGR during the last three years. Recent measures to wean investors away from gold (such as the sovereign gold bonds that give 2.75% more than gold) will further reduce its demand.

Experts say investors should continue to hold just 5-10% of the portfolio in gold. Bond prices have witnessed a huge rally in the past three years, though most of the gains have come in the past 6-8 months.

The yield on 10-year government papers has come down significantly during this time. With inflation under control, RBI may cut rates further to revive growth. This means that deposit rates will go down further, though debt funds will generate good returns.

It seems NDA regimes are not very good for real estate investors. They try to increase supply by speeding up realty projects. Just like in the 1999-2004 period, realty is under pressure.

A correction is underway and prices have remained stagnant in most cities in the past three years. With black money getting squeezed further, experts feel that realty will be under pressure.

The original article could be seen here.