Value of top five US infotech giants thrice that of blue-chip companies in Nifty 50 index

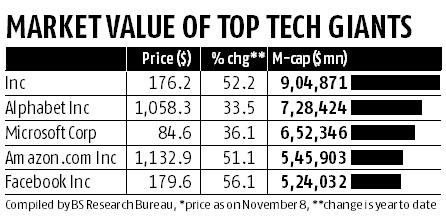

The gravity-defying act of US technology giants continues. Apple Inc, chief showstopper, crossed $900 billion in market capitalisation for the first time on Wednesday, cementing its position as the world's largest listed company.

The iPhone maker's shares closed at $176.24, buoyed by robust earnings growth and the chatter surrounding its iPhone X launch.

The top five tech companies - Apple, Alphabet, Microsoft, Amazon and Facebook - now have a total market capitalisation of $3.36 trillion, nearly thrice that of India's Nifty 50 companies. What's more, their combined m-cap is larger than the 2016 gross domestic product value of all countries barring America, China, Japan and Germany, show World Bank data.

The share prices of Facebook, Apple and Amazon have run up by more than 50 per cent this year, beating 40 stocks from the Nifty 50 pack and 38 stocks from the Nifty Next 50 index. In effect, they have given better returns than 78 per cent of India's top 100 companies, although Indian equities have gained 25 per cent this year.

Domestic investors can take exposure to US stocks through US feeder funds such as Reliance US Equity Opportunities Fund, Motilal Oswal Most Shares Nasdaq 100, Kotak US Equity, ICICI Prudential US Bluechip Equity and Franklin US Opportunities Fund, among others.

"Most of these (IT majors) companies have consistently surpassed revenue growth and profit expectations for several quarters. And, while these are fundamentally tech firms, most are consumer-oriented. The positive outlook on the US economy also augurs well for these companies," said the global head of a large fund house.

Apple, for instance, posted revenues of $52.6 billion for the quarter ended September, a rise of 12 per cent from the year-ago period. International sales accounted for 62 per cent.

Apple has been growing on account of robust device sales, said experts. As these zoom, its service offerings through app downloads and media consumption has also seen a surge. On the flip side, its newer offerings such as Apple Watch and audio players have seen limited traction.

"Apart from the premium and super-premium segments, the company is now targeting the lower end as well, foraying into newer geographies," said Rajeev Thakkar, director, PPFAS, which has invested Rs 144 crores in Alphabet, Facebook and Apple.

Facebook and Alphabet have benefited from a big shift in media consumption. Consumption of news and video content, for instance, has shifted to mobile devices and the internet, from the traditional mediums of television or the newspaper. So, advertisers have moved their spending to these new media.

Amazon has benefited from its lead in cloud computing and e-commerce.

"Unlike the earlier dotcom cycle, growth in the share prices of these tech firms has been accompanied by a rise in revenues and earnings growth," observed Thakkar.

The original article could be seen here.