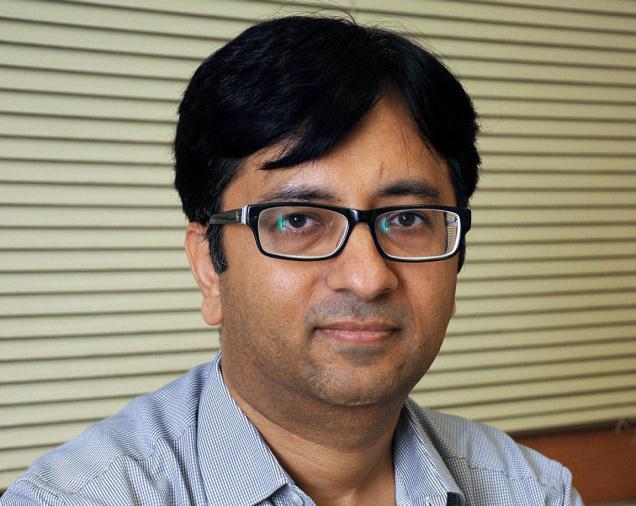

Except for sentiment, there’s no likely impact on market, says Rajeev Thakkar of PPFAS AMC

Bloomberg TV India's Abha Bakaya and Priyank Lakhia caught up with Rajeev Thakkar, CIO and Director, PPFAS Asset

Management, to talk markets and commodities.

What is your take on the Fed hike? Are you definitely expecting a hike or is it more a question of quantum and what is the likely impact that you are expecting?

Firstly, the importance for us is not as big as it is made out in the market. A 25 bps increase does not change the world. So from zero if you move to 25 bps and your ECB rates are effectively (-)30 bps, essentially we are in a world of free money. It is not that money has suddenly become expensive. The Fed's increases will be gradual and if, over a two-three year period, rates move to 2 per cent, it is still very low-cost money.

So I do not see a great impact on markets, except for sentiment. I don’t think anyone is expecting over 25 bps.

So you don’t see that ‘risk-averse’ scenario setting in which we did see when people were still anticipating the hike?

There are some things happening where the proximate cause it stated as the Fed fund increase. But there are some underlying factors other than the Fed rate increase. For example, the freeze up of the credit funds, high yield bond funds have their roots in the inability of the companies to pay — particularly energy, mining and metals companies. That has nothing to do with a 25 bps Fed increase.

We have seen the market correct at 17-18 per cent. Is this still a good opportunity to go ahead and buy?

As far as valuations go, things clearly had run up ahead of themselves and a lot of those excesses are being corrected. The question being — after the 17-18 per cent fall that you mentioned, is it a great time to go out and buy? My answer is: not indiscriminately. One has to be careful about what one buys. The consensus out there is that the consumption story is great for India going forward. To an extent I think a lot of that theme is in the price. Despite the fall, prices in consumption stocks are still not at great levels to enter. Over the next one year we may see more pain in cyclicals.

But the value is slowly starting to emerge in cyclicals and manufacturing rather than the core consumption theme, which has been a great performer in the past. FMCG, pharma are still not looking that attractive despite the fall.

The market had put a lot of hope in the reform agenda and GST. How do you see that as it stands?

Practically speaking, April 1, 2016 should be ruled out for GST. Parliament has to pass the Bill, then States have to come on board, after which the administrative machinery has to be set in place.

A lot of things need to be done. It’s not that you switch on a button and GST starts. The preparation may take a year. One should realistically hope for April 1, 2017. But the delay is not much of a deal breaker for the markets. What people mainly will look at is demand and how robust the consumption space pans out rather than passage and non-passage of GST.

In the run-up to the Fed’s move we have already started seeing pressure building up on the currency. How do you see that impact select pockets of the market’s earnings?

I am not so worried on the dollar-rupee front. Unlike some of the commodity dependent currencies like that of Russia and Brazil, we in fact benefit when energy prices are low. So crude is one of the biggest components of our imports, gold again, when prices are down. We are seeing a good amount of growth, relative to what is happening in the world. Capital will still come in, but some exporters could face some headwinds on account of slow demand. But I don’t see currency being such a worry that we will go into a freefall kind of scenario. I think most macros are favourable to India rather than adverse.

One central theme for 2015 has been a risk-off on emerging markets (EMs). Will domestic institutional investors and other local money still keep at it in 2016?

This is a rather surprising trend that we are seeing. I am surprised that foreign funds are not buying and are redeeming. Sixty per cent of Europe’s bonds are giving a negative yield. The US too will be closer to zero rates.

At such a time, India is growing at 5-7 per cent; earnings are coming in a well governed market where macros are improving. So while I don’t have a crystal ball, I’d expect money to flow in rather than go out. One can’t paint all EMs with the same brush.

Some distinction will be made.

The original article could be seen here.