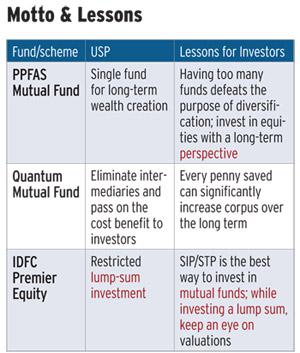

We bring you three funds that follow unique strategies and lessons investors can learn from them.

Picture for representation purpose only. (Source: Reuters)

At a time when almost all fund houses are in the race to take advantage of investors' renewed interest in equities and launch new funds, this fund house holds annual general meetings (AGMs) of investors, where it makes it a point to reiterate that it will have one equity fund.

Another fund house says that at current valuations it will not accept lump-sum investments in one of its flagship schemes. Yet another persists with its long-held direct-to-investor approach despite knowing that distributors can help it collect more funds.

In spite of the fact that inflows into mutual funds had almost dried up for a good part of the past five years, a few fund houses have managed to avoid the temptation of going all out to get more business.

These fund houses have several lessons for retail investors. We talked to CEOs of these fund houses to find out their strategies and what investors can learn from them.

PPFAS MUTUAL FUND: MINIMUM CLUTTER, MAXIMUM TIME

The fund house, which launched its only scheme, Parag Parikh Flexi Cap Fund, in May 2013, believes "too many choices lead to decision paralysis and confuse investors." Hence, it intends to have only one "general value equity scheme."

The fund house, which launched its only scheme, Parag Parikh Flexi Cap Fund, in May 2013, believes "too many choices lead to decision paralysis and confuse investors." Hence, it intends to have only one "general value equity scheme."

"We do not believe in having multiple schemes and will take advantage of investment opportunities available in this scheme itself," says a letter from Parag Parikh, CEO, PPFAS Mutual Fund.

Parikh, says having too many schemes defeats the purpose of investing in equities through mutual funds.

"If the investor had the expertise to choose from hundreds of differently structured schemes, he/she would also probably have the expertise for direct equity investment. Also, when one is promoting sector funds or funds based on themes or market capitalisation, one is taking away the benefits of having a diversified equity portfolio," says Parikh.

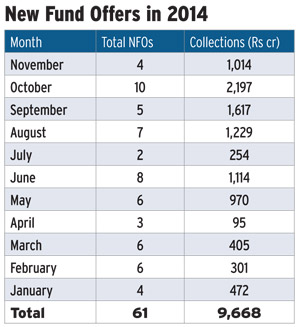

Parikh is perhaps not off the mark when he says that too many new fund offers, or NFOs, are being launched. Since January 2014, mutual funds have launched 61 (41 of which are close-ended) equity funds, which have collected Rs 10,000 crore.

At the end of November, there were 362 open-ended equity funds (including tax saving and exchange-traded funds) with over Rs 3 lakh crore assets under management, or AUM, and 61 close-ended funds with AUM of Rs 15,000 crore.

At the end of November, there were 362 open-ended equity funds (including tax saving and exchange-traded funds) with over Rs 3 lakh crore assets under management, or AUM, and 61 close-ended funds with AUM of Rs 15,000 crore.

Parag Parikh Flexi Cap Fund invests at least 65% money in domestic equities and the rest in bonds, money market securities and foreign equity markets. At the end of November, it had invested 67% funds in domestic shares, 27% in foreign ones and held the rest in deposits and cash.

"Our belief is that in today's globalised world the country of listing does not matter much. Some of the best-known Indian groups have huge global operations. Many companies listed overseas also earn a lot of revenue in India and other emerging markets. Our research team is structured on sector lines and analysts look at companies in their sectors across geographies," says Parikh.

The emphasis is on investing for the long term so much so that the Scheme Information Document (SID) says the fund is not suitable for those with an investment horizon of less than five years.

"Our investment philosophy is adhering to the time-tested principle of long-term investing. Our communications are clear that only investors with a long time horizon should invest. We give no illusions that we are good at making a fast buck. This has helped us attract serious long-term investors," says Parikh.

In an effort to communicate directly with investors, the fund house held AGMs of unit holders in Chennai, Bengaluru and Mumbai in November.

Parikh says they are trustees of the funds and offer themselves to investor scrutiny through AGMs. The AGMs discussed the fund house's plans, ability to meet the high net worth criterion set by the Securities and Exchange Board of India (Sebi), investment strategies and other operational issues. Sebi has increased the minimum net worth requirement for mutual funds from Rs 10 crore to Rs 50 crore.

Srikanth Meenakshi, founder and chief operating officer, fundsindia.com, says directly interacting with investors, especially when the scheme has not done as well as others in the category, is a bold move. He further says that unlike shareholder AGMs, which are held at one place once a year, the fund has held three AGMs in separate places.

However, Meenakshi, whose fundsindia.com is an online distributor of financial products, says he is ambivalent about the single fund strategy.

"I believe there should be different strokes for different folks. There are investors who want to invest in pure mid-cap or pure large-cap funds. There could be investors who do not want to invest 40% funds in foreign stock markets. Investors should have all options," he says.

Read more here.