We always have this curiosity regarding where the top management of a fund puts its own money for investment. With PPFAS you needn't worry about all this...

Parag Parikh Financial Advisory Services' (PPFAS) Long Term Value Fund is walking the talk of putting personal investments of its directors and key employees into the fund and making it public.

Having debuted last month, Parag Parikh Flexi Cap Fund is being promoted as one meant only for long-term investors.

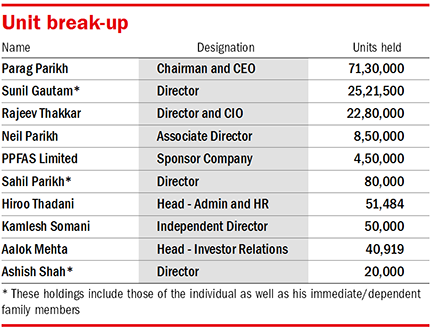

The AMC has now released a list which has details of top management putting its own money as investment in the fund. Leading from the front, chairman and CEO Parag Parikh has more than 50 per cent of the total units held by those associated with the fund.

"When we ask you to invest we do the same and thus have our interests aligned. It is our commitment to follow best practices," Parikh says.

The original article could be seen here.