Moneycontrol News

There is nothing better than watching market soar record highs for a trader. However, for a mutual fund (MF) manager, it poses a separate challenge. The S&P BSE Sensex climbed mount 30K in opening trade on Wednesday to hit a fresh record high of 30,213.72.

The liquidity driven rally has kept investors longing for more so far in the year 2017. The Nifty rose nearly 13 percent and nearly 18 percent from December low of 7,900.

The rally has also pushed valuation of many small and midcap stocks. Most of the stocks in the broader market are trading above their respective historical averages which pose a challenge for fund managers to hunt for value.

"We are in a strong momentum market, especially in the small and mid-cap space and some Indian consumption related themes. Moat, long runway, the size of opportunity etc. are some the terms which are used to justify buying at any price," Rajeev Thakkar, Chief Investment Officer, PPFAS Mutual Fund said in a note.

"There are some investment managers who see the present at a new era for India and that the size of the opportunities justifies any valuation. We are clearly not in that camp," he said.

Thakkar further added that while we recognise the potential, we will continue to be anchored by valuation parameters and will wait for the right opportunity to come by. PPFAS Mutual Fund is sitting on cash, cash equivalents, money market, arbitrage positions which amount to about 16 percent of the portfolio.

"Whenever we have cash, we do not force ourselves to invest if opportunities are not present. The work to identify opportunities continues at all points in time," said Thakkar. Even though valuation of some companies have hit the roof, he continues to remain excited by the bottom-up stock picks that we make or continue to hold.

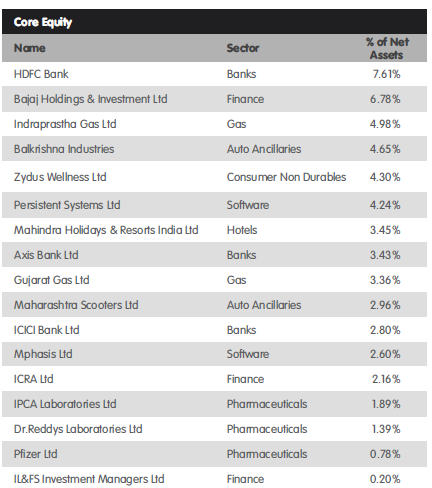

Top heavyweight stocks in PPFAS Mutual Fund, an open ended equity scheme. It seeks to generate long-term capital growth from an actively managed portfolio primarily of equity and equity-related securities.

The core holdings of the portfolio include names like HDFC Bank, Bajaj Holdings, IGL, Zydus Wellness, Persistent Systems, Mahindra Holidays, Axis Bank, Gujarat Gas, Maharashtra Scooters, ICICI Bank, etc. among others.