|

Factsheet for February 2021 is out now. Download it here...

|

|

|

|

NEWSLETTER - MAY 2021 |

|

Presenting... Parag Parikh Conservative Hybrid Fund |

NFO closes on 21 May, 2021 (Today)

Know more →

|

|

Media Coverage |

|

Articles, blog posts and interviews in the media from last month. |

|

|

| |

Note: Viewers/readers should note that objective of these articles/interviews is to communicate with our unit-holders and share with them our thought process. It should be noted that views expressed here are based on information available in public domain at this moment. Views expressed here can change depending on change in circumstances. Nothing discussed here, constitute a buy/ sell/ hold recommendation.

|

|

|

|

Financial Opportunities Forum

Raj Mehta discusses the drivers for growth in the industry along with the key players, sub-segments, variables and regulations to keep a track of. Even though some companies are discussed, it is not a recommendation to Buy or Sell.

|

|

|

|

|

|

|

|

Know more about the Financial Opportunities Forum

|

|

|

The two tweets our 31,800+ Followers engaged with most, last month.

@ppfas @ppfas

|

|

|

|

|

|

|

|

|

|

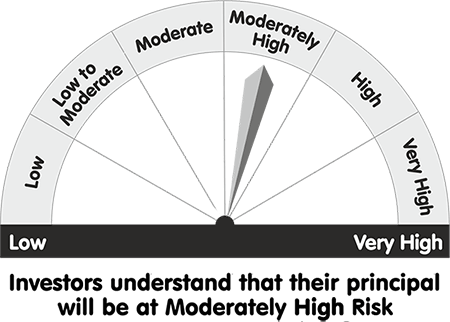

This product is suitable for investors who are seeking*

- To generate regular income through investments predominantly in debt and money market instruments.

- Long term capital appreciation from the portion of equity investments under the scheme.

|

|

|

|

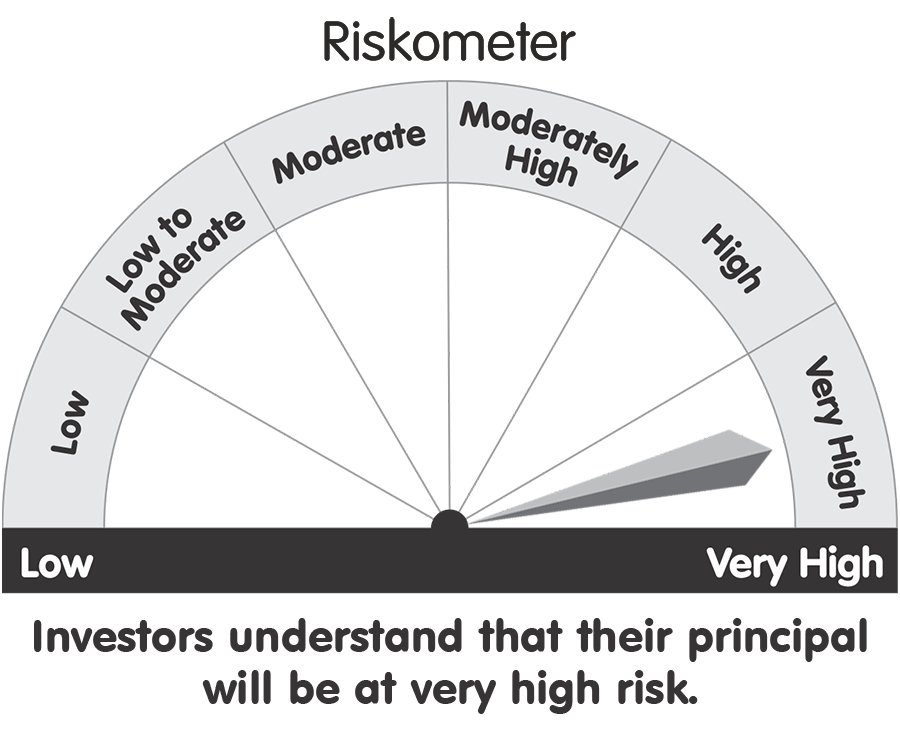

Riskometer

|

|

|

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

For more information, please visit amc.ppfas.com/ppchf

Note: The product labelling assigned during the NFO is based on internal assessment of the scheme characteristics or model portfolio and the same may vary post NFO when the actual investments are made.

|

|

|

|

|

|

|

|

|

|

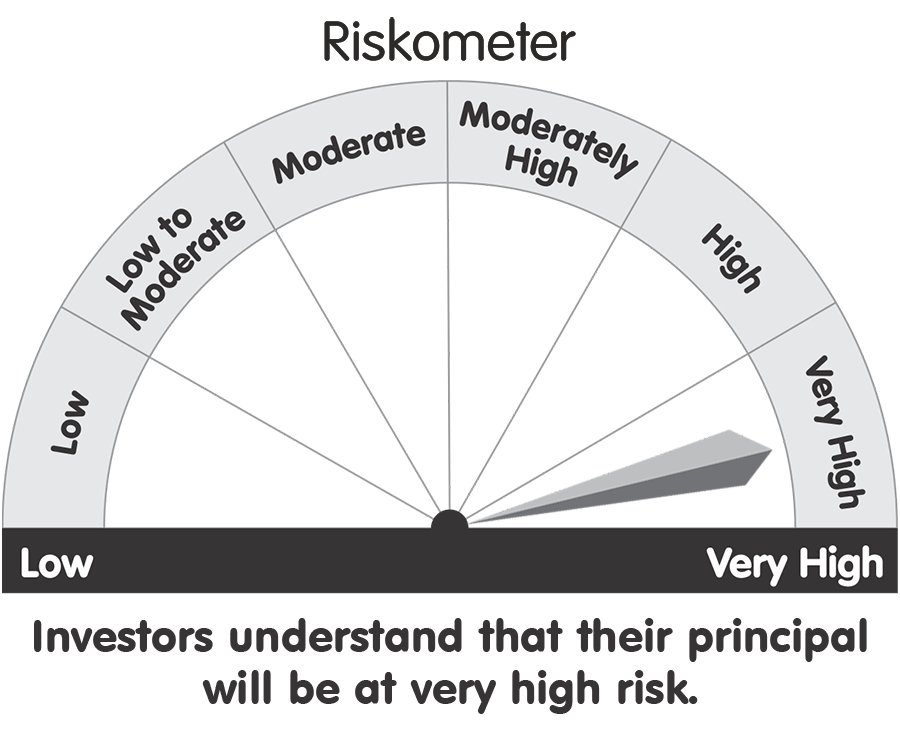

This product is suitable for investors who are seeking*

The investment objective of the Scheme is to seek to generate long-term capital growth from an actively managed portfolio primarily of Equity and Equity Related Securities. Scheme shall invest in Indian equities, foreign equities and related instruments and debt securities.

|

*Investors should consult their financial advisors if in doubt about whether this scheme is suitable for them.

Download SID/SAI and KIM here.

|

|

|

|

Riskometer

|

|

|

|

|

|

|

|

| |

|

|

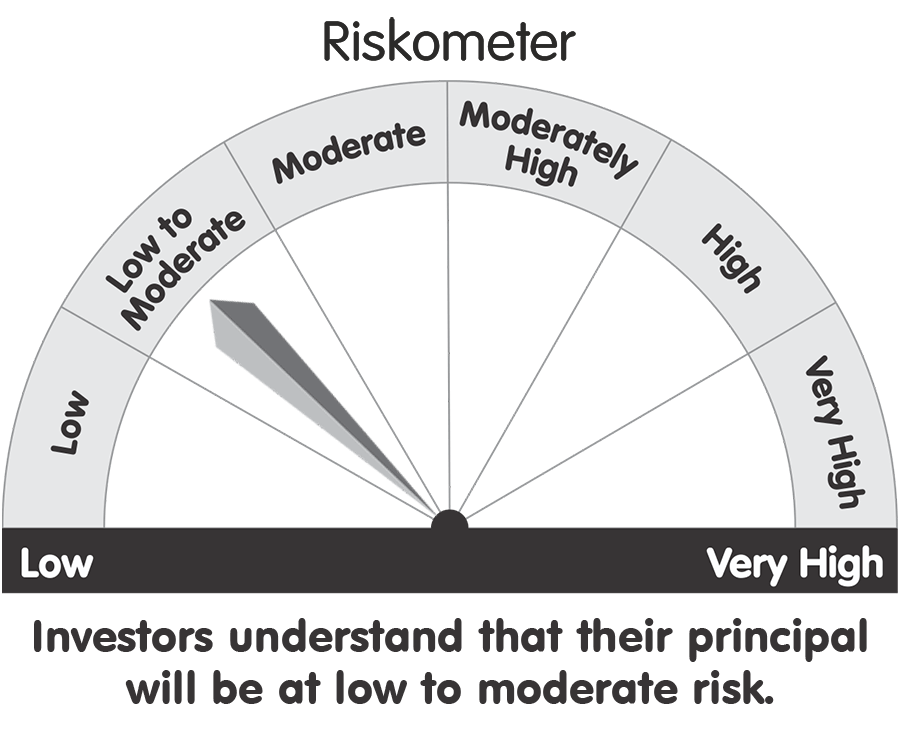

This product is suitable for investors who are seeking

- Income over short term

- Investments in Debt / money market instruments

*Investors should consult their financial advisors if in doubt about whether this scheme is suitable for them.

Download SID/SAI and KIM here.

|

|

|

|

Riskometer

|

|

|

|

|

|

|

| |

|

|

This product is suitable for investors who are seeking

- Long term capital appreciation

- Investment predominantly in equity and equity related securities.

*Investors should consult their financial advisors if in doubt about whether this scheme is suitable for them.

Download SID/SAI and KIM here.

|

|

|

|

Riskometer

|

|

|

|

|

|

|

| |

|

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

|

|

|

| Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

|

|

|

|