We have our skin in the game

Parag Parikh Flexi Cap Fund

₹ 408.78 Cr.

Total number of units held in Parag Parikh Flexi Cap Fund - Direct Plan held as per SEBI Master Circular dated May 19, 2023 relating to Alignment of interest of Key Employees ('Designated Employees') of Asset Management Companies ('AMCs') with the unitholders of the Mutual Fund as at

31-03-2024 = 1222421.410 units.

At PPFAS Mutual Fund, we are inspired by The Hammurabi Code.

Around 18th Century BC lived a King named Hammurabi who instituted a social law now known as the Hammurabi's code. It is the one of the first evidence of law ever written down. One of the principle features of the code was about the builder - If a builder built a house for a man & the house collapses to cause the death of the owner, then the builder has to be put to death.

Such a punishment seems incredibly harsh especially when there can be many reasons for the collapse. But with such a heavy downside in place, the builder has absolutely no incentive to cut corners in constructing the house. He has to use the best materials & the best building techniques to build the best possible house which will last for a long time. The builder literally has his own skin in the success & longevity of the building.

This type of a system ensures a very strict moral obligation & not just a professional responsibility. How could this same moral obligation be translated to the fund management business?

Ideally, in the fund management profession, the only way to instill a sense of accountability is to ensure that the Fund Management team is investing their own monies along with those of the clients'. At PPFAS Mutual Fund, this ideal transcends into reality, as the key stakeholders in the Fund have invested a substantial portion of their equity investments in

Parag Parikh Flexi Cap Fund.

Having our own skin in the game demonstrates the willingness to link our financial well-being with yours. This also places an implicit onus on us to make optimum use of our time & abilities in order to enhance the scheme's performance and eschew the reckless behaviour that fund managers are sometimes accused of.

By investing in our scheme and disclosing it every month, we are going beyond the extant Regulations. We believe that this one disclosure will serve to inspire greater confidence among our unitholders, than thousands of times of assurances ever can.

Details of Insider Holdings as at March 31, 2024

| Name |

Designation |

Number of units held |

| Suneel Rasmikant Gautam |

Director |

1,10,17,983 |

| Hitesh Dharmasinh Gajaria |

Director |

23,60,526 |

| Sahil P Parikh |

Director |

11,41,729 |

| PARAG PARIKH FINANCIAL ADVISORY SERVICES LTD |

Sponsor Company |

10,08,790 |

| Neeta Milan Shukla |

Others |

13,597 |

| Rohil A Gandhi |

Others |

8,302 |

| Pritam Mahendra Kijbile |

Others |

1,548 |

Note: These holdings include those of the individual as well as his immediate/dependent family members.

| Name |

Designation |

Number of units held |

| PPFAS ASSET MANAGEMENT PVT LTD |

|

2,37,76,714 |

| Geeta Parag Parikh |

- |

65,58,487 |

| Rajeev Navinkumar Thakkar |

Director and CIO |

49,83,633 |

| Neil Parag Parikh |

Chairman and CEO |

19,88,761 |

| Rajesh Bhojani |

Director |

1,40,044 |

| Subrata Kumar Mitra |

Director |

32,918 |

Note: Holdings of Late Mr.Parag S. parikh are transmitted to Geeta Parag Parikh.

| Name |

Designation |

Number of units held |

| Dhaval Sumantrai Desai |

Director |

4,10,912 |

| Burjor Dorab Nariman |

Director |

41,189 |

| V RAMESH |

Director |

102 |

Note: These holdings include those of the individual as well as his immediate/dependent family members.

| Name |

Designation |

Number of units held |

| Raunak Onkar |

Dedicated Fund Manager for overseas investments |

2,57,095 |

| Jayant R Pai |

Chief Marketing Officer |

1,84,083 |

| Aalok Ramesh Mehta |

Chief Sales Officer - Direct Channel and Head Investor Relations |

1,76,937 |

| Mahesh Vishvanath Sarode |

Head Investor Relations - Distributor Channel |

64,421 |

| Shashi Menghraj Kataria |

COO,CFO and Director |

39,641 |

| Raj Kirit Mehta |

Fund Manager - Debt |

32,687 |

| Raju H Shelat |

Head - Back Office Operations |

30,109 |

| Rukun R Tarachandani |

Fund Manager - Equity |

7,705 |

| Priya Hariani |

Chief Compliance Officer and Company Secretary |

1,962 |

| Ranbir D.Nayal |

Chief Information Security Officer and Head - IT |

1,682 |

| Shubham Gupta |

Chief Risk Officer |

297 |

Note: These holdings include those of the individual as well as his immediate/dependent family members.

| Name |

Number of units held |

| Ashok Pandurang Kerkar |

52,339 |

| Usha Dalsukhbhai Galia |

35,708 |

| Ratnavathi Arun Puthran |

30,707 |

| Saransh Banga |

29,559 |

| Paresh Ashok Kerkar |

28,309 |

| Jignesh C Desai |

23,810 |

| Shailendra Pandey |

23,090 |

| Parminder Singh Surendar Singh Saini |

12,534 |

| Sanjay B Shroff |

11,651 |

| Prithvinath Reddy Gaddam |

8,812 |

| Madhavi D Dey |

7,277 |

| Mansi |

4,705 |

| Priyank Soni |

3,428 |

| Digamber Singh Bisht |

3,127 |

| Janhavi Udyavar |

3,061 |

| Biju Abraham Verghese |

2,972 |

| Mansi Riki Kariya |

2,839 |

| Lunar Chandrakant Sutar |

2,778 |

| Priyanka Mangesh Shetye |

2,499 |

| Akhil Anilkumar |

2,420 |

| Abimanue A |

2,249 |

| D Megalingam |

2,246 |

| Vinay Teli |

2,064 |

| R Karthika |

1,979 |

| Oly Das |

1,608 |

| Nikhila K |

1,605 |

| Sudhakaran Gopalan |

1,588 |

| Vrutti Mehta |

1,279 |

| Priyanka Yadav |

1,229 |

| Kavita Sahadeo Kamble |

1,121 |

| Sneh Bhatia |

1,033 |

| Chandrashekhar Vishram Navrat |

954 |

| Ninad Chandrakant Bhosle |

804 |

| Harikrishna Ramabadraiah Theerupari |

765 |

| Aditi Avinash Pandere |

710 |

| Ankur Pal |

671 |

| Paresh Dilipkumar Shukla |

607 |

| Premprakash Dubey |

580 |

| Manisha Jeetendra Singh |

579 |

| Sonal Vinod Makwana |

557 |

| Akshay Ashok Bhatuse |

529 |

| Prasanna Vilas Patil |

459 |

| Sagarkumar Anilbhai Pandya |

451 |

| Asmit Lodha |

426 |

| R Venkataramana |

400 |

| Arun Yadav |

339 |

| Era Naynish Kadam |

319 |

| Sanket Sahadev Yadav |

315 |

| Makwana Yatin Sureshbhai |

296 |

| NARENDRA KALA |

269 |

| Aarti Santosh Kharade |

149 |

| Valerian Francis Fernandes |

144 |

| Apala Bose |

132 |

| Shrikant P Pancholi |

101 |

| Rahul Rana |

71 |

| Vivek V Patankar |

25 |

| Nisha Pravinbhai Kachhela |

23 |

| Anoka |

19 |

| Abhishek Goenka |

12 |

Note: These holdings include those of the individual as well as his immediate/dependent family members.

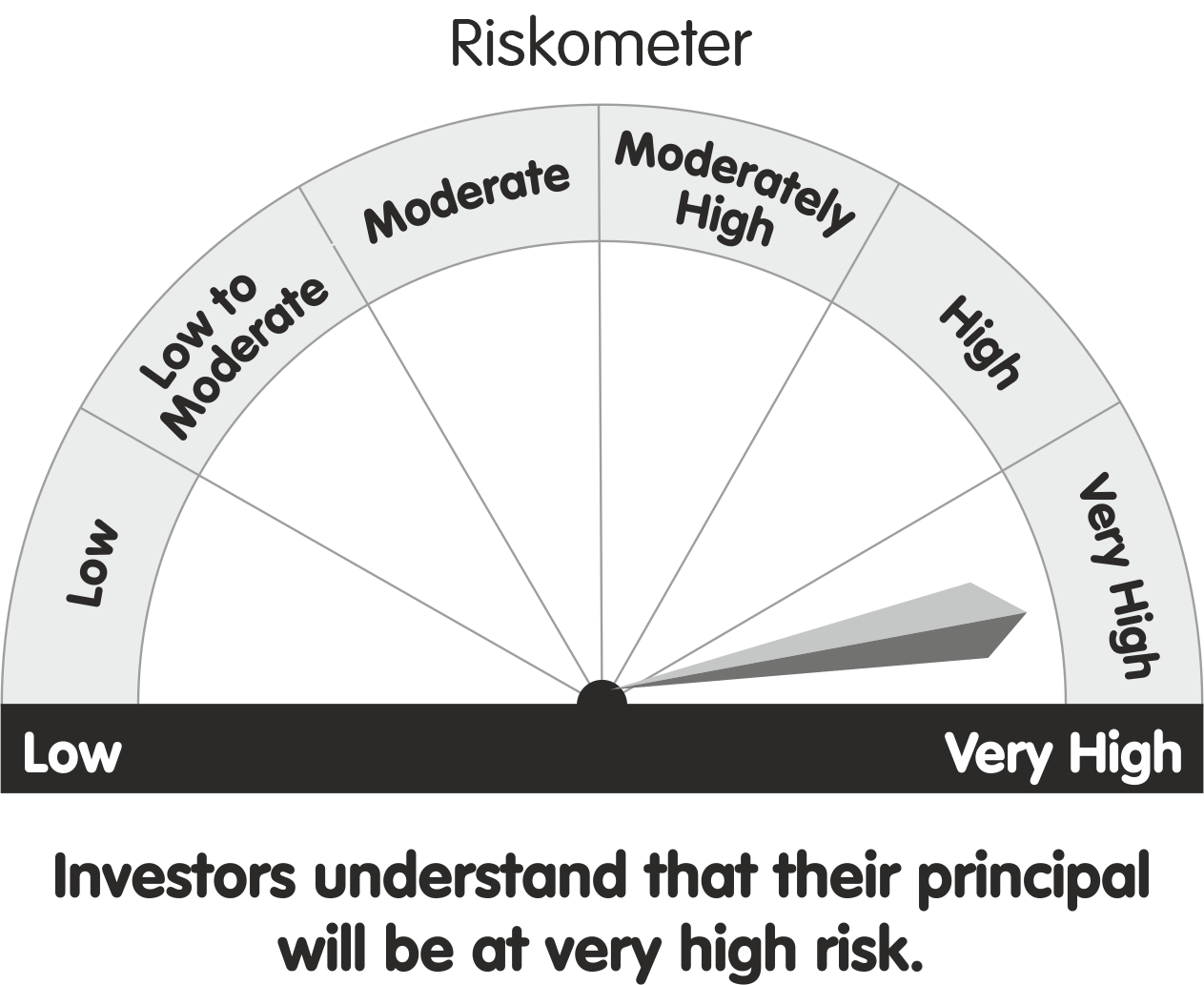

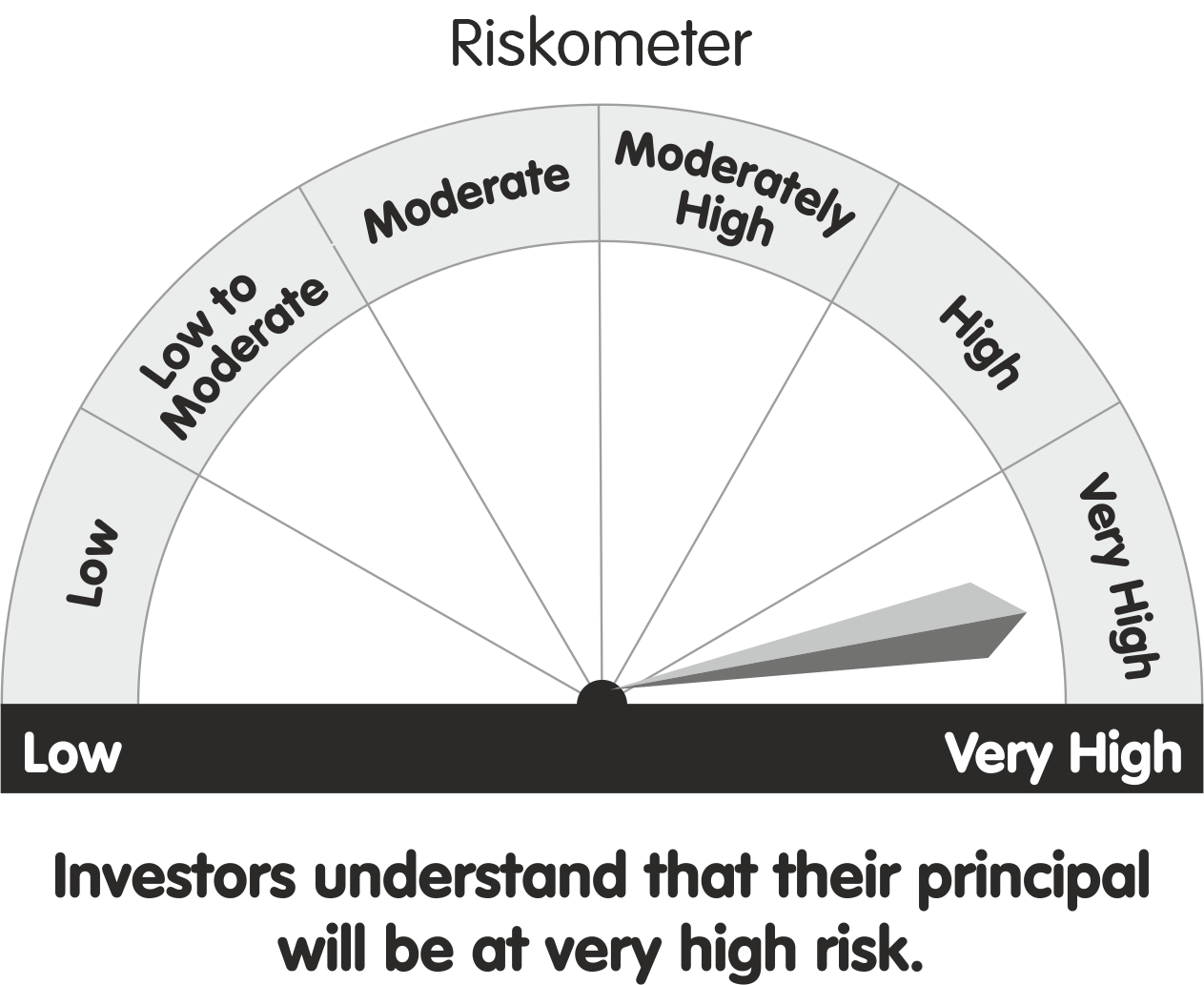

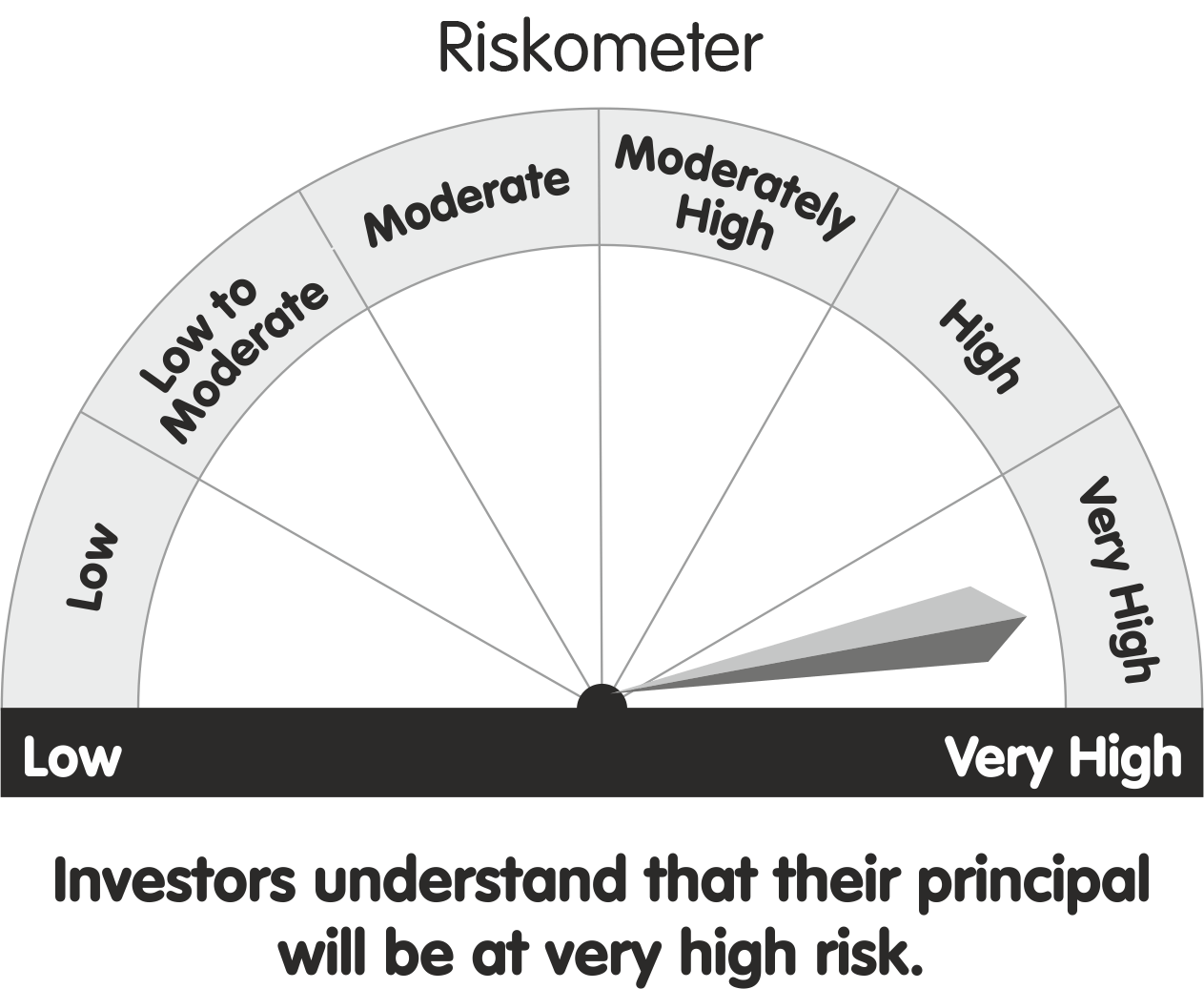

Parag Parikh Flexi Cap Fund

This product is suitable for investors who are seeking* This product is suitable for investors who are seeking*

The investment objective of the Scheme is to seek to generate long-term capital growth from an actively managed portfolio primarily of Equity and Equity Related Securities. Scheme shall invest in Indian equities, foreign equities and related instruments and debt securities.

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

|

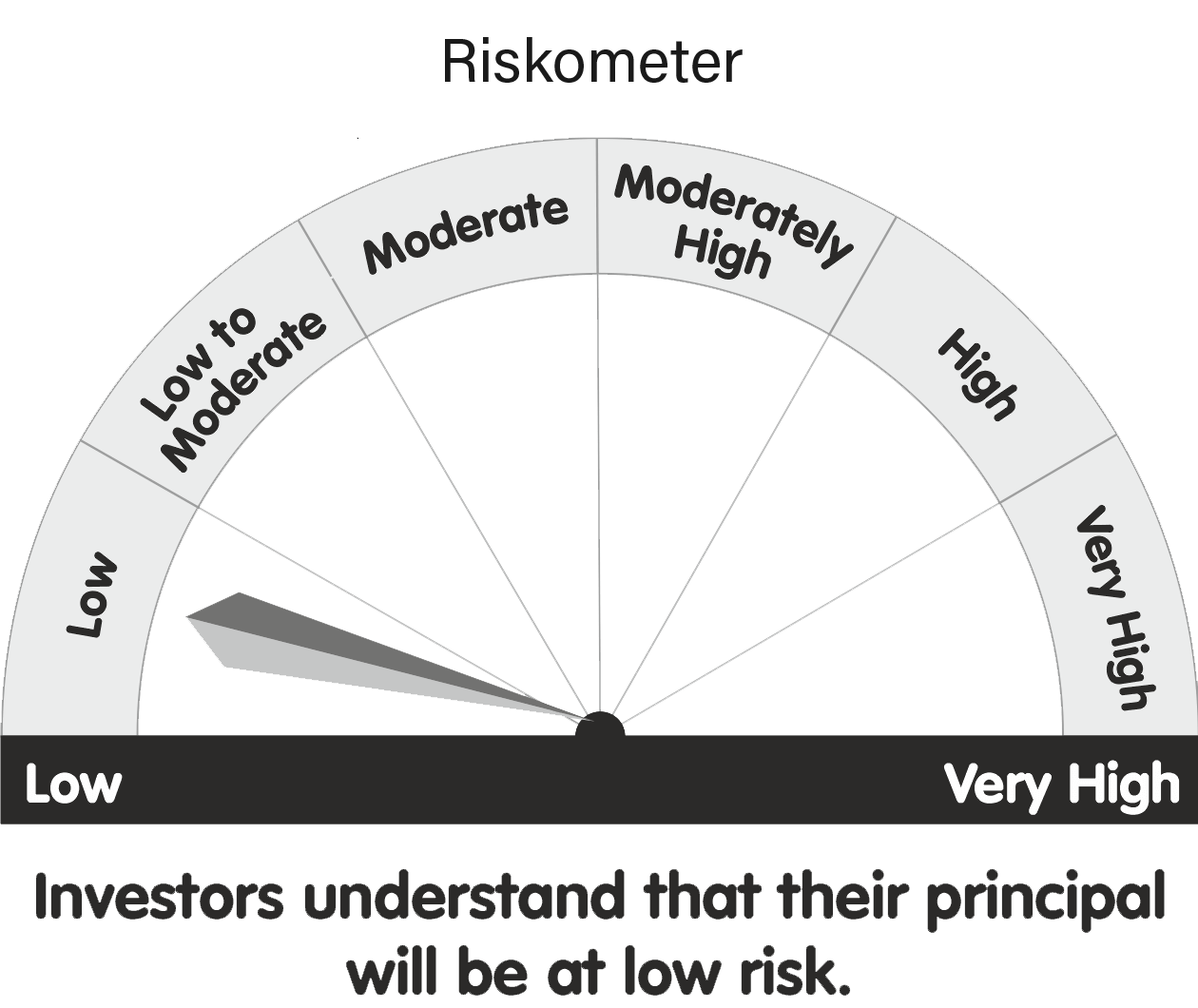

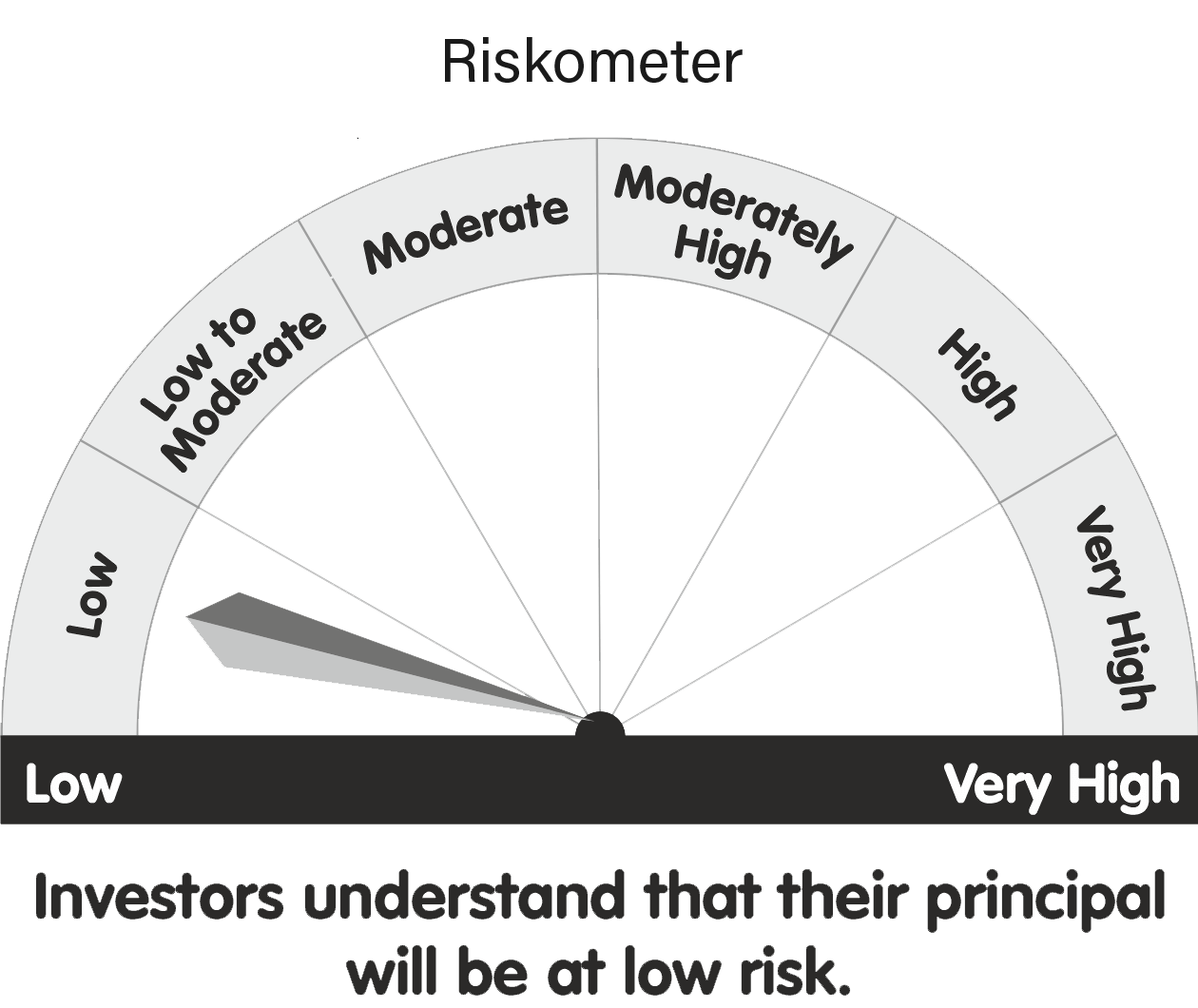

Parag Parikh Liquid Fund

This product is suitable for investors who are seeking*

This product is suitable for investors who are seeking*

- Income over short term

- Investments in Debt/money market instruments

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

|

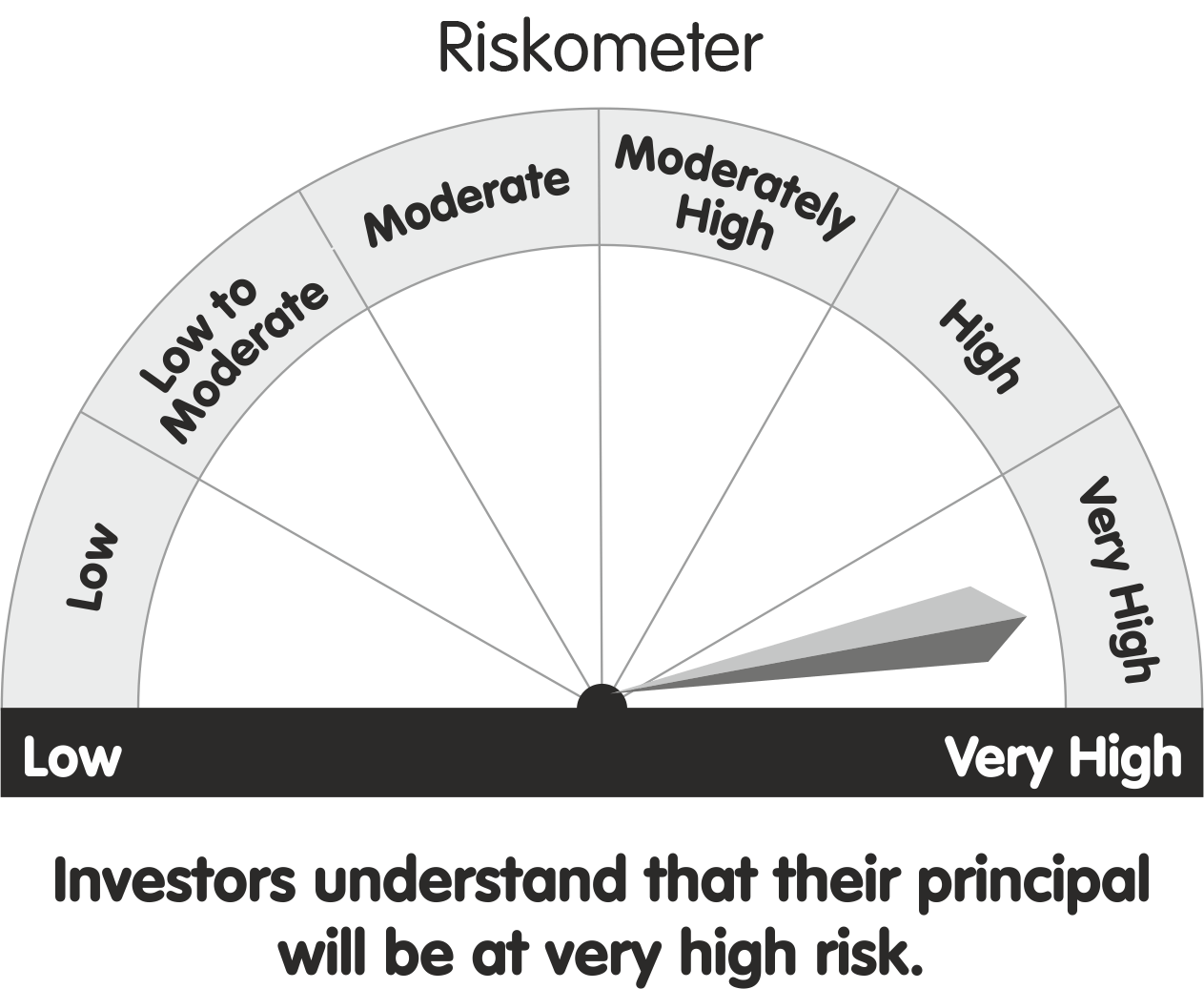

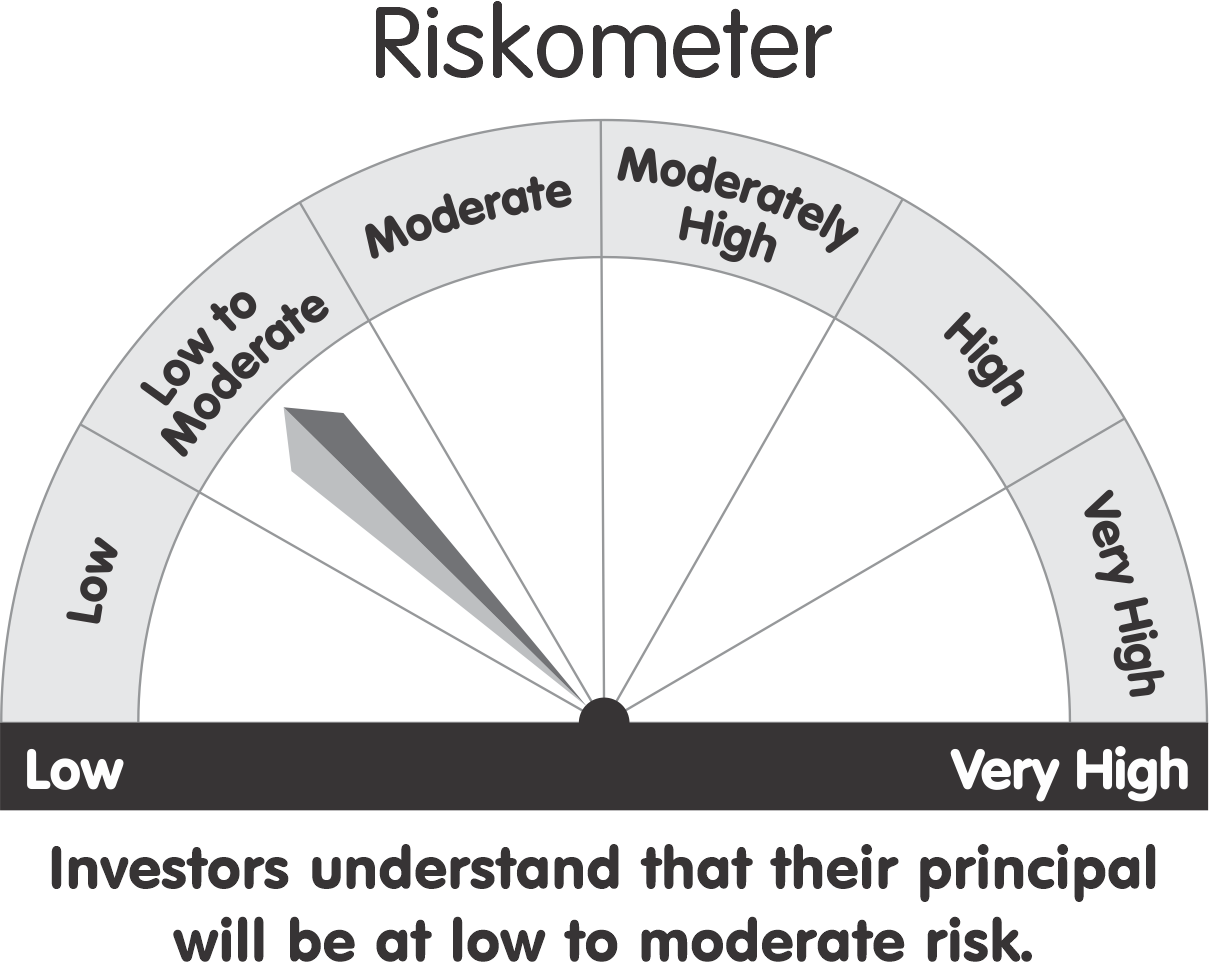

Parag Parikh ELSS Tax Saver Fund

This product is suitable for investors who are seeking* This product is suitable for investors who are seeking*

Long term capital appreciation

Investment predominantly in equity and equity related securities.

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

|

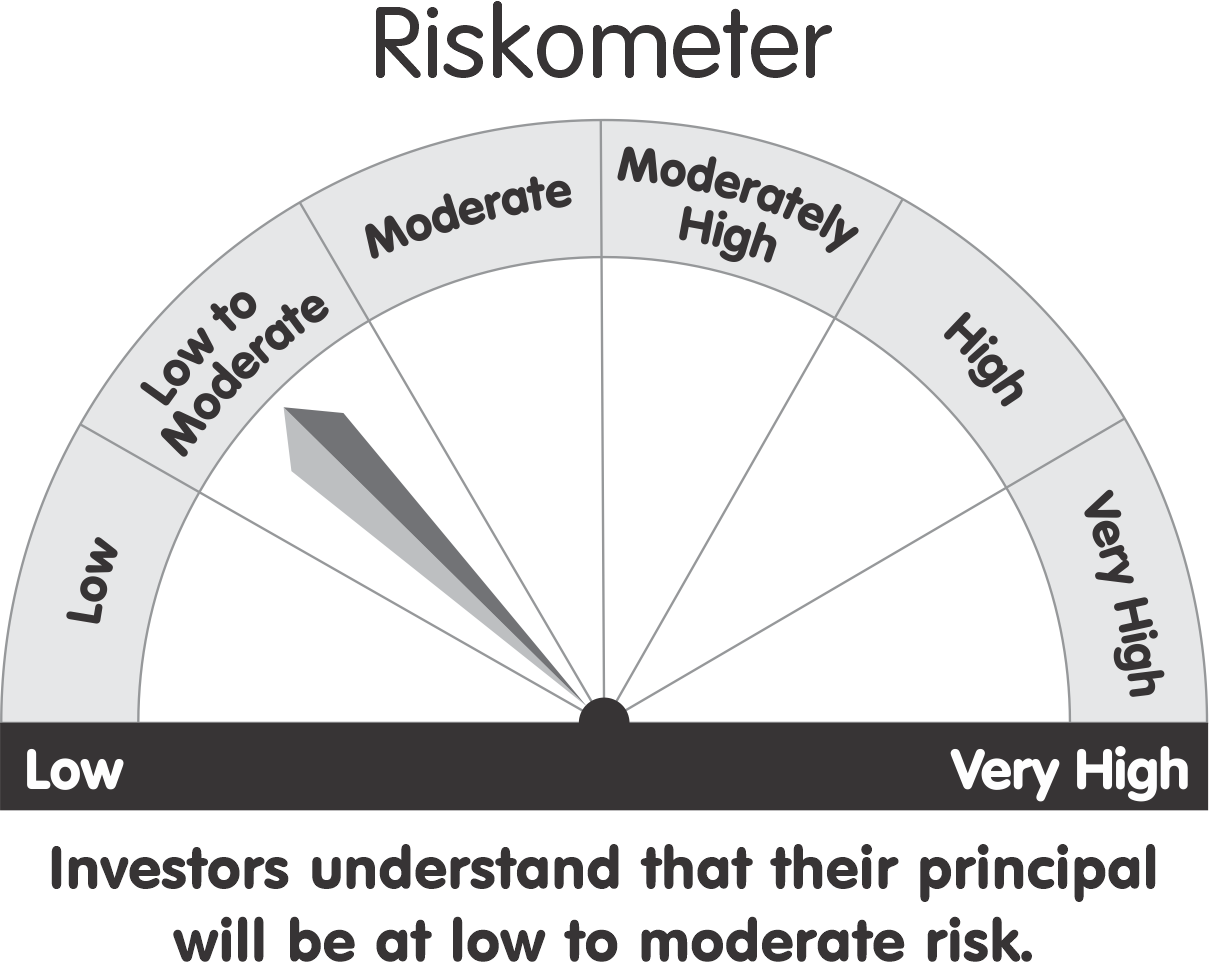

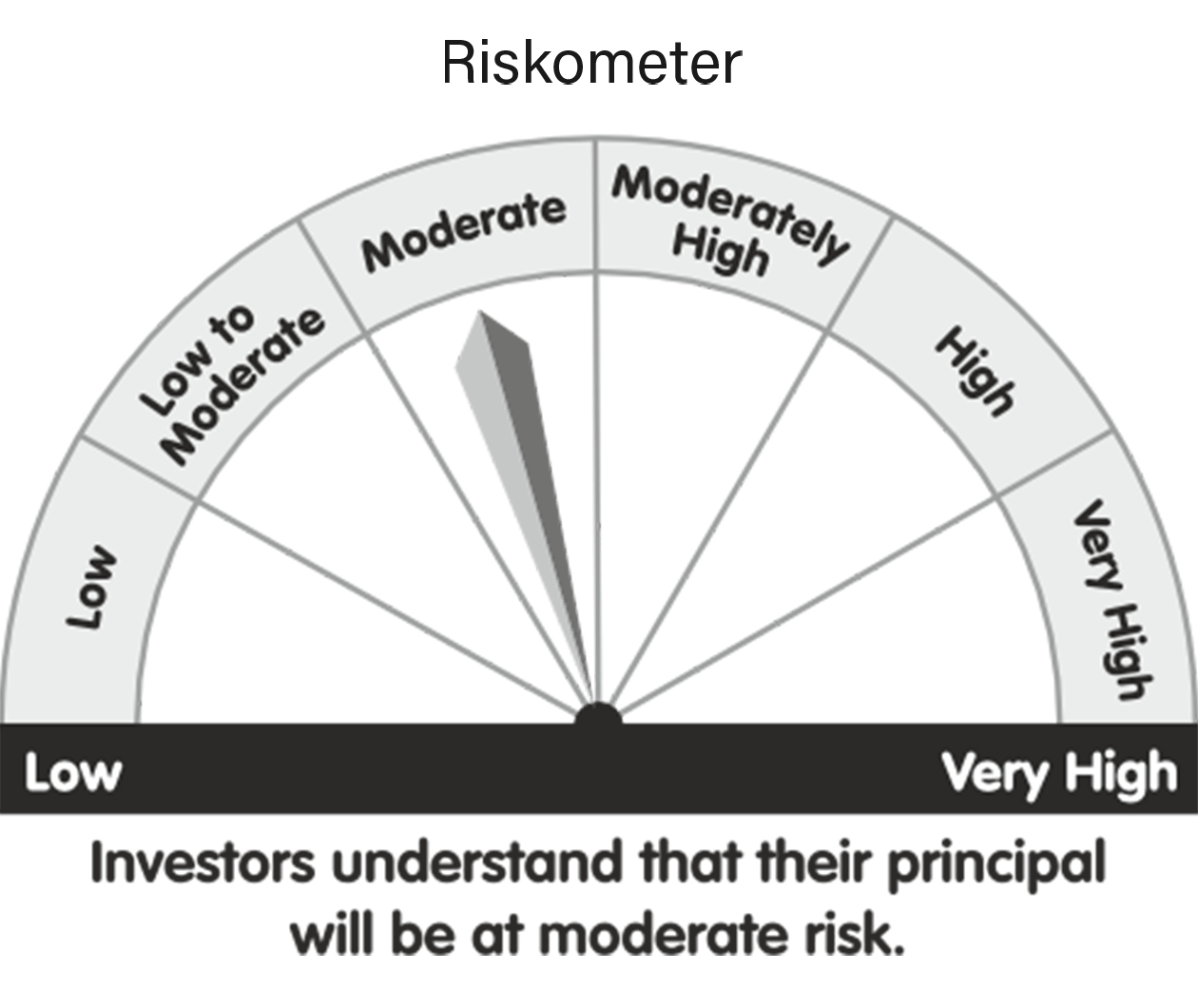

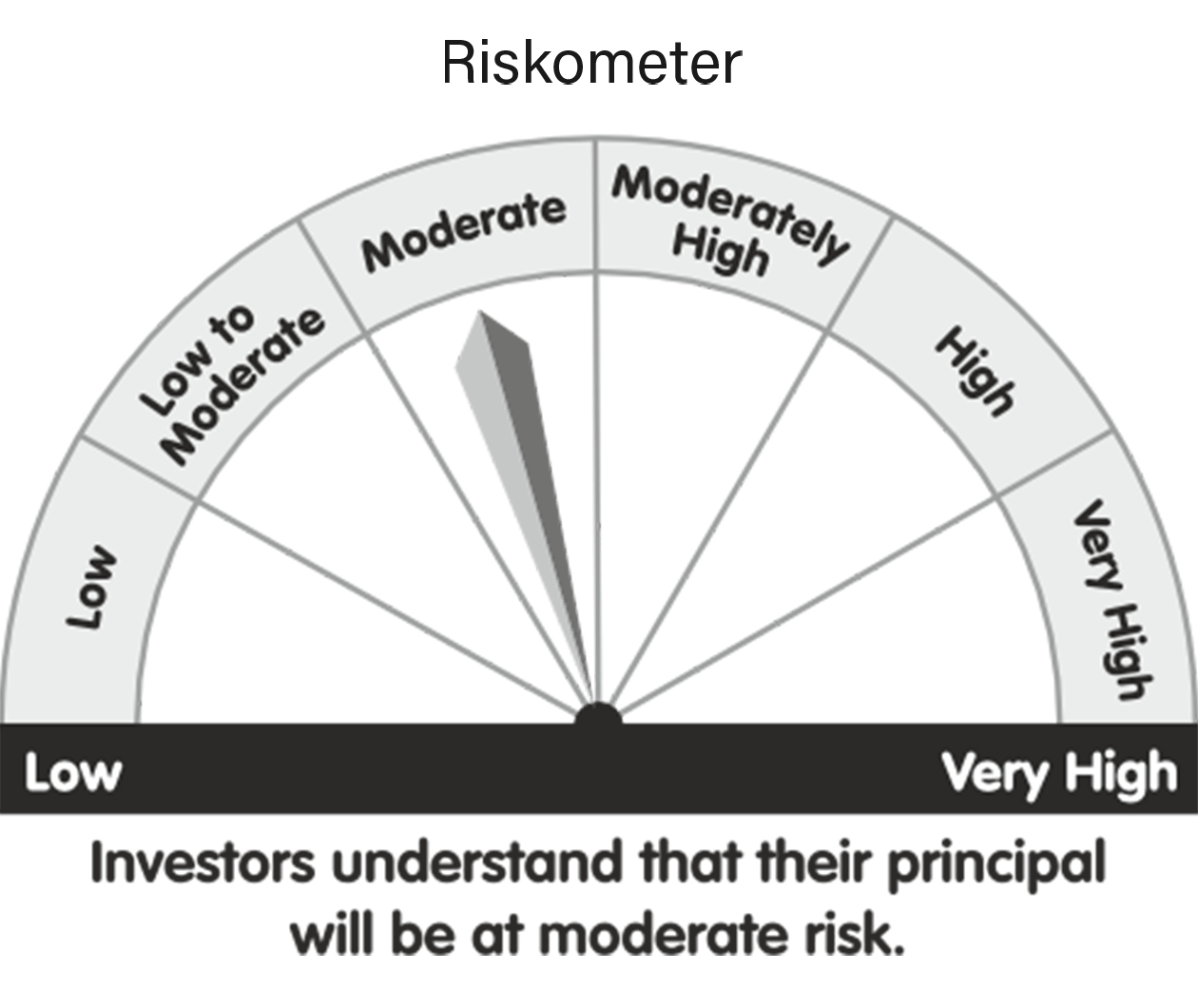

Parag Parikh Conservative Hybrid Fund

This product is suitable for investors who are seeking* This product is suitable for investors who are seeking*

To generate regular income through investments predominantly in debt and money market instruments.

Long term capital appreciation from the portion of equity investments under the scheme.

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

|

Parag Parikh Arbitrage Fund

This product is suitable for investors who are seeking* This product is suitable for investors who are seeking*

To generate income by investing in arbitrage opportunities.

Predominantly investing in arbitrage opportunities in the cash and derivatives segment of the equity market.

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

|

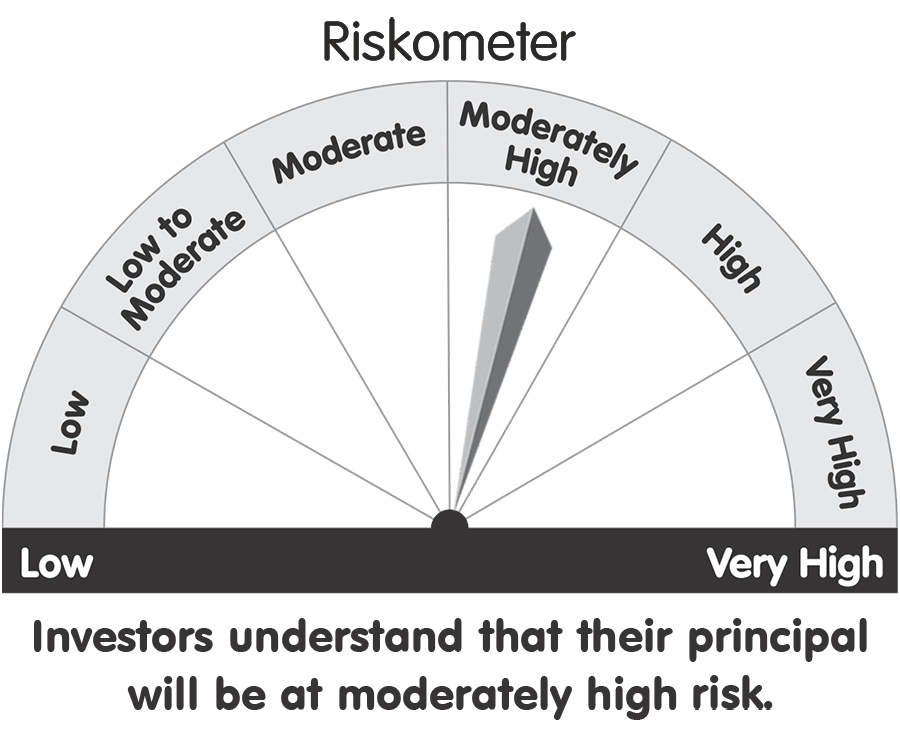

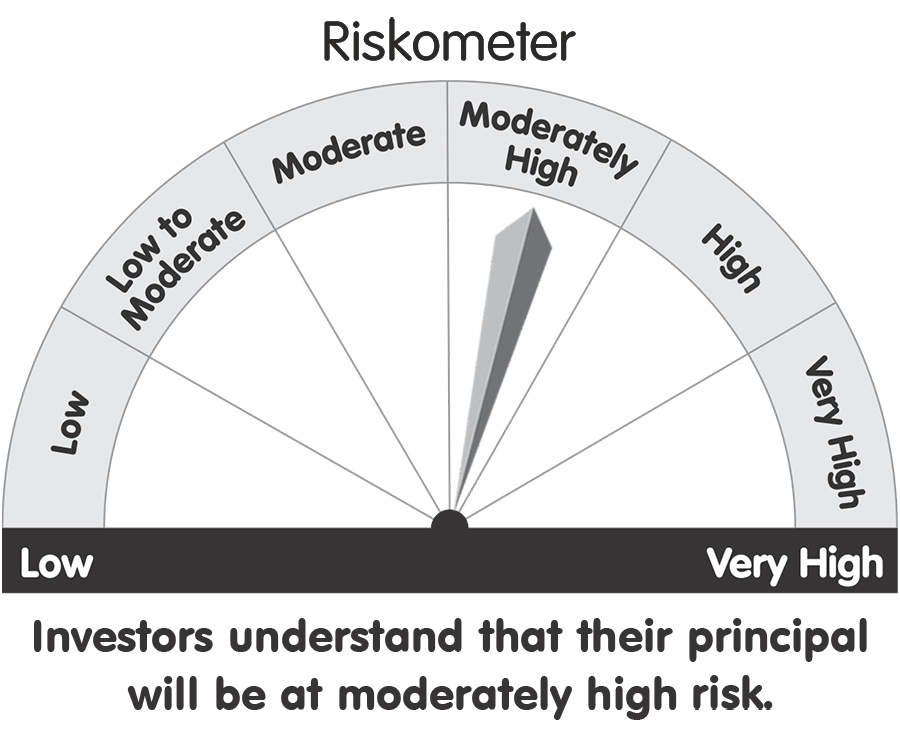

Parag Parikh Dynamic Asset Allocation Fund

This product is suitable for investors who are seeking* This product is suitable for investors who are seeking*

Capital Appreciation & Income generation over medium to long term.

Investment in equity and equity related instruments as well as debt and money market instruments while managing risk through active asset allocation

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

|

Download SID/SAI and KIM here.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

This product is suitable for investors who are seeking*

This product is suitable for investors who are seeking*  This product is suitable for investors who are seeking*

This product is suitable for investors who are seeking*

This product is suitable for investors who are seeking*

This product is suitable for investors who are seeking*

This product is suitable for investors who are seeking*

This product is suitable for investors who are seeking*

This product is suitable for investors who are seeking*

This product is suitable for investors who are seeking*

This product is suitable for investors who are seeking*

This product is suitable for investors who are seeking*