| Around the Blog and Media |

| Articles, blog posts, interviews and Quotes in the media from last month. |

|

.jpg) |

| Finding value in a rising market environment |

| Rajeev Thakkar's quote in Mint, February 1, 2017 |

| Read More → |

|

|

|

| Is Budget fineprint as impressive as the first impression? Read this |

| Neil Parikh's quote in the Economic Times, February 1, 2017 |

| Read More → |

|

|

|

|

|

|

| Budget 2017 boost for infrastructure mutual funds? |

| Rajeev Thakkar's quote in the Economic Times, February 1, 2017 |

| Read More → |

|

|

|

| BUDGET 2017: Fair but not lovely |

| Neil Parikh's quote in Mumbai Mirror, February 2, 2017 |

| Read More → |

|

|

|

|

|

|

| Should you change your mutual fund strategy after Budget 2017? |

| Rajeev Thakkar's quote in the Economic Times, February 3, 2017 |

| Read More → |

|

|

|

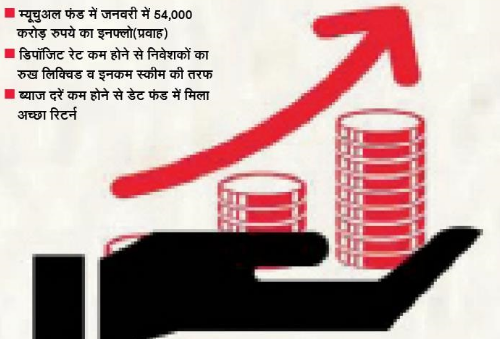

| म्यूचुअल फंड निवेशकों के रुझान में बदलाव ! |

| Rajeev Thakkar's quote in Navbharat Times, February 10, 2017 |

| Read More → |

|

|

|

|

|

|

| Why closed-end mutual fund schemes are a risky investment |

| Jayant Pai's quote in the Economic Times Wealth, February 13, 2017 |

| Read More → |

|

|

|

| Strong domestic, foreign fund inflow into market likely |

| Neil Parikh's interview in Financial Chronicle, February 13, 2017 |

| Read More → |

|

|

|

|

|

|

| Your money: Expense can't be decisive factor |

| Rajeev Thakkar's quote in Business Standard, February 16, 2017 |

| Read More → |

|

|

|

| What should MF investors do in an overvalued market? |

| Rajeev Thakkar's quote in The Economic Times, February 16, 2017 |

| Read More → |

|

|

|

|

|

|

| Expense ratio: will larger MFs too follow Quantum, PPFAS' footsteps? |

| Neil Parikh's quote in Hindu Business Line, February 21, 2017 |

| Read More → |

|

|

|

| Investing in 2017: The return of the large-caps |

| Rajeev Thakkar's quote in Forbes India, February 27, 2017 |

| Read More → |

|

|

|

|

|

|

| MF investors prefer 'direct' approach |

| Jayant Pai's quote in Hindu Business Line, February 27, 2017 |

| Read More → |

|

|

.gif) |

| Risk vs Uncertainty |

| Article by Jayant Pai in Afternoon Dc, February 27, 2017 |

| Read More → |

|

|

|

|

|

|

| Budget Reactions |

| Neil Parikh's quote in Mutual Fund Insight, February 28, 2017 |

| Read More → |

|

|

|

|

|

|