|

|

| Change in Scheme Name |

Our scheme's name has changed from PPFAS Long Term Value Fund to 'Parag Parikh Long Term Value Fund' w.e.f. 16th September 2016.

Please click here to read the relevant Addendum.

Our Chairman and CEO, Mr. Neil Parag Parikh explains the reasons behind this move :

- To pay homage to our Founder, "Mr. Parag Parikh" whose vision and actions have been instrumental in where we stand today.

- Given Mr. Parag Parikh's standing and image in the industry, we believe it has the potential to ensure better connect and recall among investors and distributors as compared to a bland acronym.

There is no other change in any of the Scheme's attributes. |

|

|

|

|

| Factsheet » August 2016 |

| No new names entered into or old names exited from the portfolio.Our top three holdings are... Alphabet (11.31%), Maharashtra Scooters (8.76%) and HDFC Bank (6.93%). |

|

|

|

|

|

| A discussion about Business Failures |

| Presentation by Raunak Onkar at the Financial Opportunities Forum held on August 31, 2016 |

|

|

| We normally study why & how businesses are built & scaled which seems like a positive bias for looking at reality.With this discussion, let's take a look at how & why businesses fail with some examples from the recent past. |

|

|

|

|

|

|

| Around the Blog and Media |

| Articles, blog posts, interviews in the media from last month. |

|

.gif) |

| Primary markets are not always a golden goose |

| Article by Jayant Pai in Afternoon DC, August 01, 2016. |

| Read More → |

|

|

|

| Living in a world of negative interest rates |

| Article by Rajeev Thakkar in Livemint, August 10, 2016 |

| Read More → |

|

|

|

|

|

|

| Time to look away from traditional energy companies: Rajeev Thakkar |

| Rajeev Thakkar's interview by The Economic Times - August 19, 2016 |

| Read More → |

|

|

.gif) |

| The devil resides in the details... |

| Article by Jayant Pai in Afternoon DC, August 22, 2016 |

| Read More → |

|

|

|

|

|

|

|

|

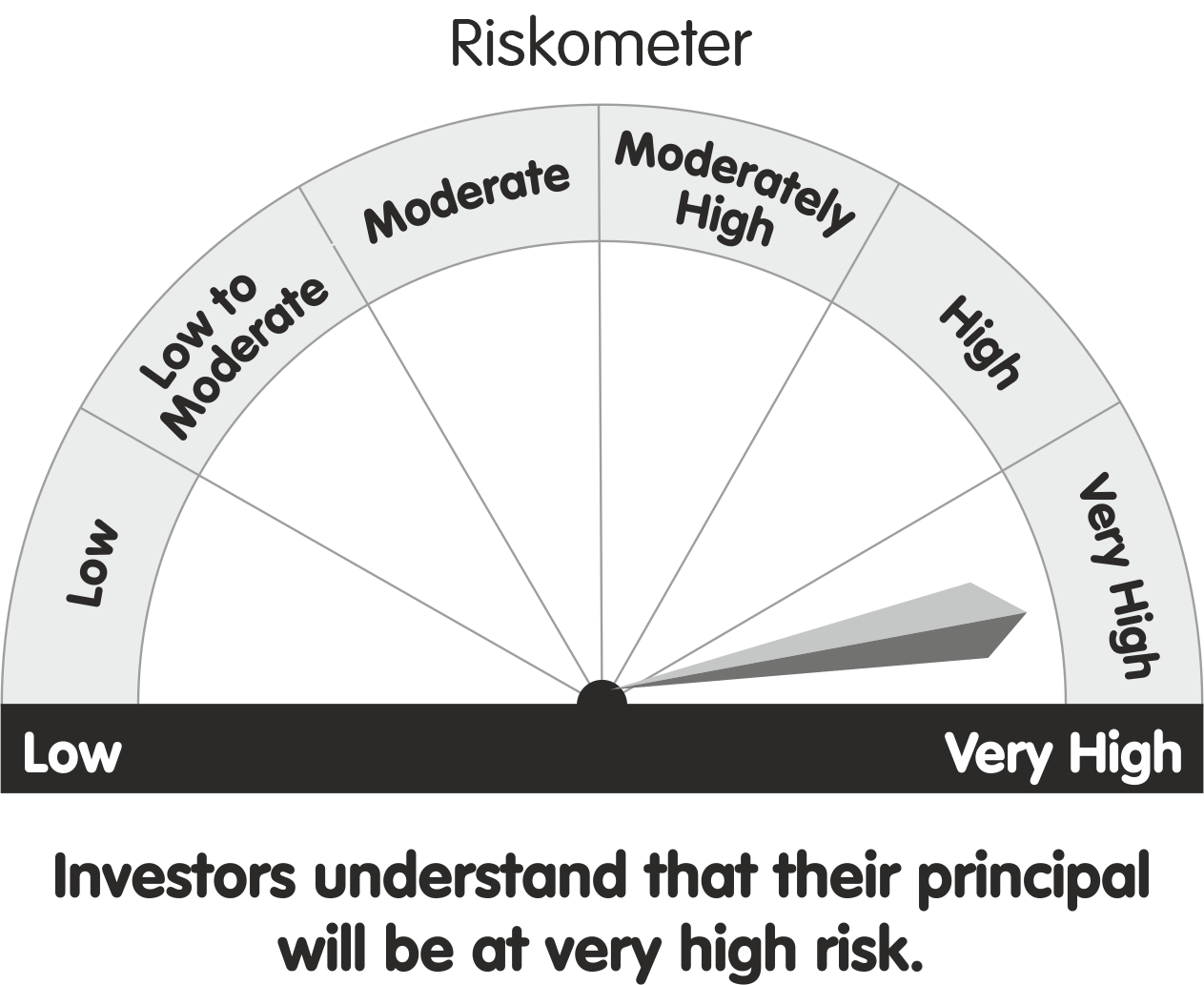

| Riskometer |

This product is suitable for investors who are seeking* This product is suitable for investors who are seeking*

The investment objective of the Scheme is to seek to generate long-term capital growth from an actively managed portfolio primarily of Equity and Equity Related Securities. Scheme shall invest in Indian equities, foreign equities and related instruments and debt securities.

Investors should consult their financial advisers if in doubt about whether this scheme is suitable for them.

Download SID/SAI and KIM here.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

|

|

|

|

|

PPFAS Asset Management Private Limited

Great Western Building, 1st Floor, 130/132, Shahid Bhagat Singh Marg, Near Lion Gate, Fort,

Mumbai - 400 001. INDIA. Tel: 91 22 6140 6555, Fax: 91 22 6140 6590

Investor Helpline:

91 22 61406538

Email: [email protected] Website: www.amc.ppfas.com.

Sponsor: Parag Parikh Financial Advisory Services Limited. CIN: U67190MH1992PLC068970,

Trustee: PPFAS Trustee Company Private Limited. CIN: U65100MH2011PTC221203,

Investment Manager (AMC): PPFAS Asset Management Private Limited. CIN: U65100MH2011PTC220623

|

|