|

Download factsheet for December 2023 | Media Coverage

Articles, blog posts and interviews in the media from last month.Volatile Bazaar में

निवेश को लेकर Retail Investors में कितनी घबराहट ?

|

|

|

|

|

NEWSLETTER

FEBRUARY 2024

|

|

Add your Brand

|

Get your logo printed on Scheme Flyers instantly.

Try it Now

|

|

|

|

|

|

- The Web App. for Distributors - The Web App. for Distributors

A few key features:

- Create folios for your investors

- Submit additional purchase requests

- Register eMandates (OTMs)

- Set up SIPs and STPs

- Pause and cancel SIPs and STPS

- Initiate switches within the schemes

- Request a redemption

- View AUM summary, investment type-wise AUM, gross sales and commissions etc.

You may discover that it is a more convenient way to transact, compared to the paper-based option.

Register

Now

You may share your feedback on [email protected]

|

|

Media Coverage |

|

Articles, blog posts and interviews in the media from last month. |

|

|

| |

Note:

1. Views expressed are personal.

2. Viewers/readers should note that the objective of these articles/interviews is to

communicate with our unit-holders and share with them our thought process. It should

be noted that views expressed here are based on information available in the public

domain at this moment. Views expressed here can change depending on change in

circumstances. Nothing discussed here constitutes a buy/ sell/ hold recommendation.

|

|

|

|

|

Please

help us improve our newsletter by your feedback

|

|

|

|

|

|

|

| |

|

|

|

|

|

Please help us improve your experience with PPFAS Mutual Fund |

We thank you for supporting us by recommending our Schemes to your clients.

Since inception, we have always strived to maintain high standards on all fronts.

However, there are times when we have fallen short - especially when compared with

other Mutual Funds.

As we approach our tenth anniversary, we are keen to learn from past shortcomings,

and remedy it, either through internal deliberations (with our Compliance Team,

App. Team, etc.) or in collaboration with our Registrar, CAMS.

We therefore request you to devote a few minutes to spell out the pain-points /

hurdles encountered by you while dealing with us.

While we cannot guarantee that a solution will be found for every issue... we

promise you that we will try our best.

|

|

|

|

|

|

Parag Parikh Flexi Cap Fund

An open ended dynamic equity scheme investing across large cap,

mid cap,

small cap stocks.

|

|

|

This product is suitable for investors who are seeking*

The investment objective of the

Scheme is to seek to generate long-term capital growth

from an

actively

managed portfolio primarily of

Equity and Equity Related

Securities. Scheme shall invest in

Indian equities, foreign equities and

related instruments and debt

securities.

|

|

|

|

|

|

|

|

|

Parag Parikh ELSS Tax Saver Fund

An open-ended Equity linked savings scheme with a statutory lock in of 3

years and tax benefit

|

|

|

This product is suitable for investors who are seeking*

- Long Term Capital Appreciation.

- Investment predominantly in equity and equity related

securities.

|

|

|

|

|

|

|

|

|

Parag Parikh Conservative Hybrid Fund

An open-ended hybrid scheme investing predominantly in debt

instruments

|

|

|

This product is suitable for investors who are seeking*

- To generate regular income through investments predominantly

in debt and money market instruments.

- Long term capital appreciation from the portion of equity

investments under the scheme.

|

|

|

*Investors should consult their financial advisers if in doubt about whether the product is suitable for

them.

|

|

|

|

|

|

Parag Parikh Arbitrage Fund

An open ended scheme investing in arbitrage opportunities.

|

|

|

This product is suitable for investors who are seeking*

- To generate income by investing in arbitrage opportunities.

- Predominantly investing in arbitrage opportunities in the cash and derivatives segment of the equity market.

|

|

|

|

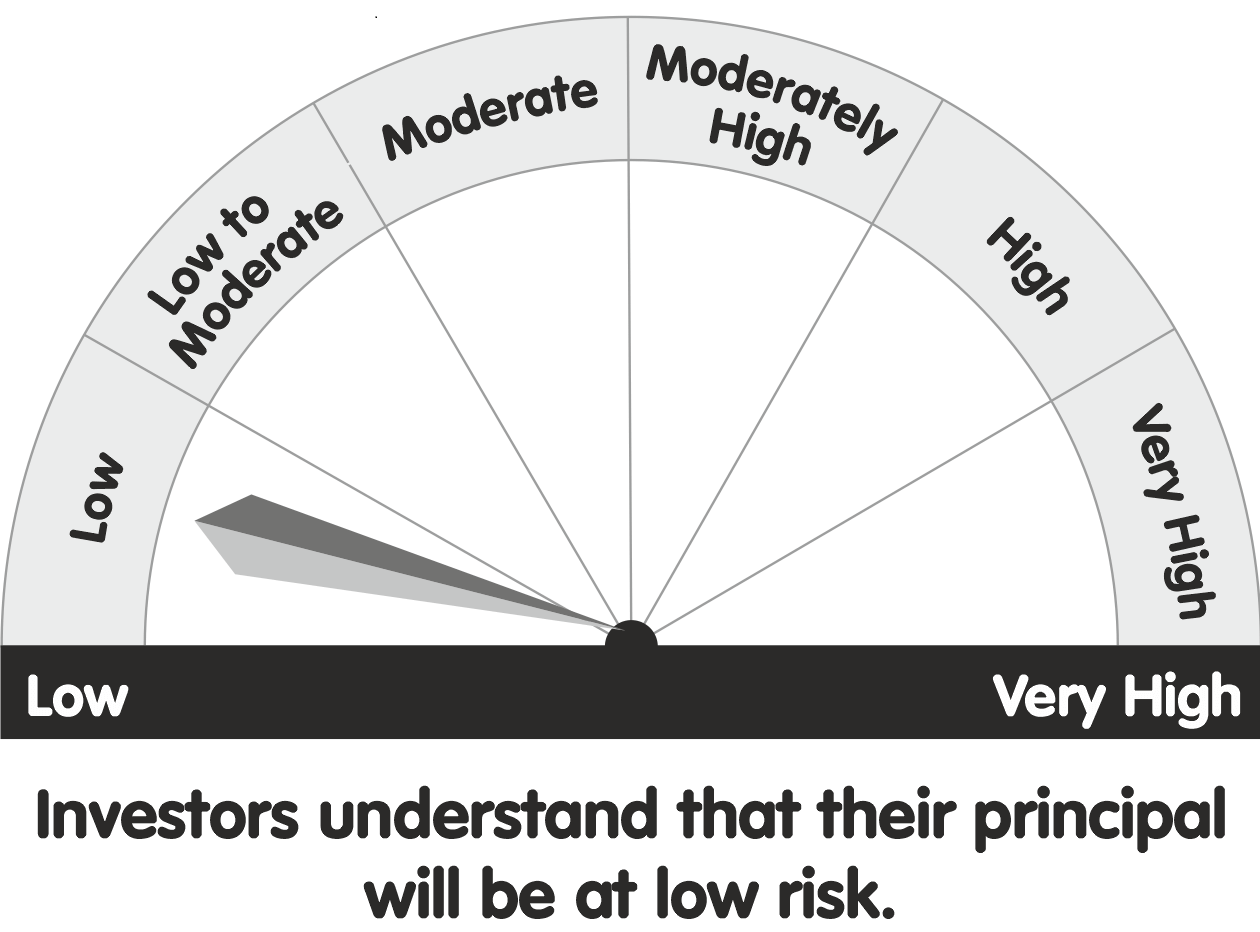

Riskometer

|

|

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

|

|

|

|

|

|

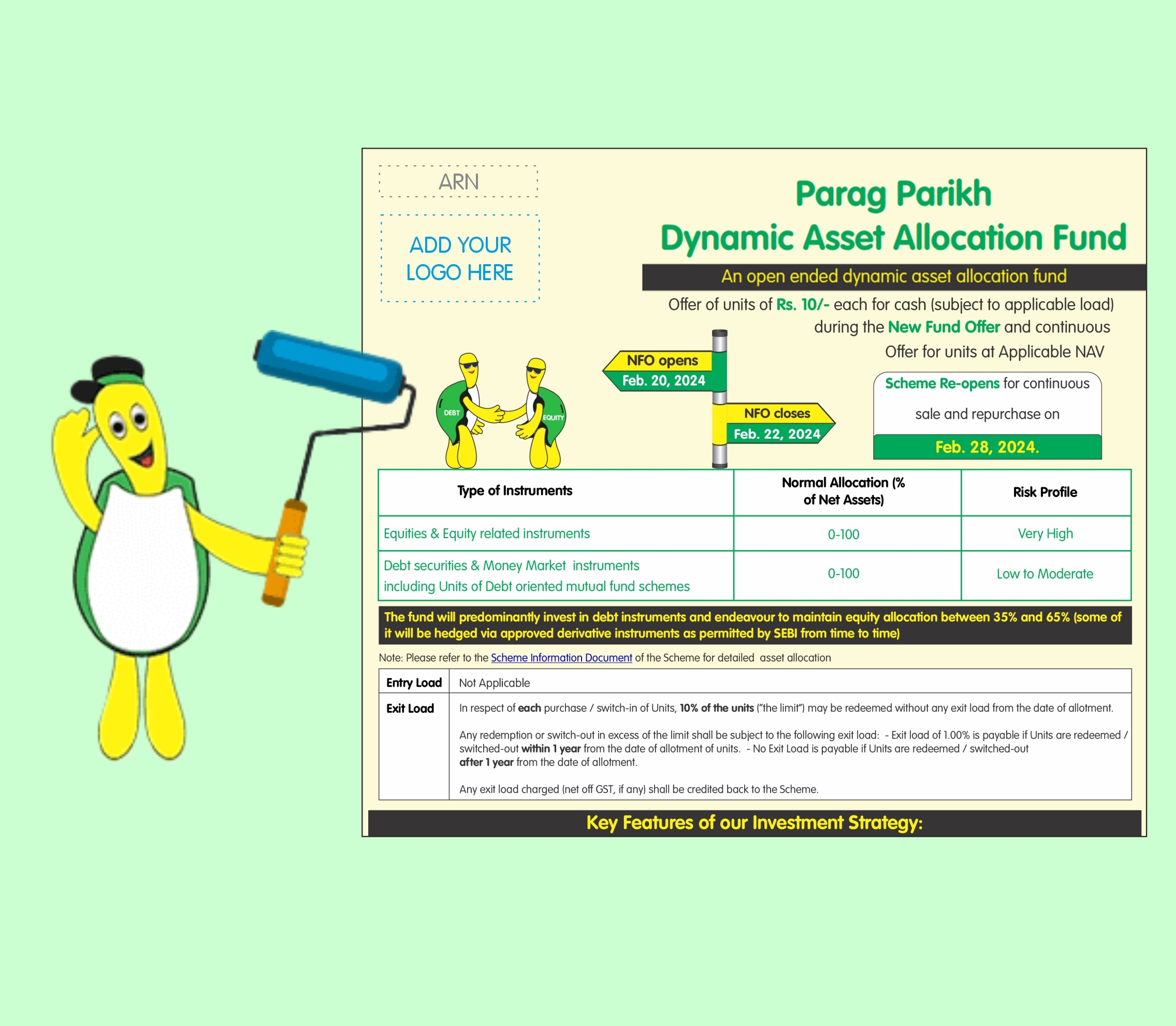

Parag Parikh Dynamic Asset Allocation Fund

An open ended dynamic asset allocation fund.

|

|

|

This product is suitable for investors who are seeking*

- Capital Appreciation & Income generation over medium to long term.

- Investment in equity and equity related instruments as well as debt and money market instruments while managing risk through active asset allocation.

|

|

|

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Note: The product labelling assigned during the NFO is based on internal assessment of the scheme characteristics or model portfolio and the same may vary post NFO when the actual investments are made.

|

|

|

|

|

|

Parag Parikh Liquid Fund

An Open Ended Liquid Scheme.A Relatively Low Interest Rate Risk and

Relatively low Credit Risk

|

|

|

This product is suitable for investors who are seeking*

- Income over the short term.

- Investments in debt / money market instruments.

|

|

|

|

|

|

|

|

|

Potential Risk Class (PRC) of the debt scheme of PPFAS Mutual Fund :

|

|

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

|

|

|

|

|

|