|

Factsheet for June 2020 is out now. Download it here...

Media Coverage

Articles, blog posts and interviews in the media from last month.

- Mr. Neil Parikh Parikh's interview in Mutual Fund Insight

- How to calculate advance tax? | The Money Show

|

|

|

|

NEWSLETTER - JULY 2020 |

|

Media Coverage |

|

Articles, blog posts and interviews in the media from last month. |

|

|

| |

Note: Viewers/readers should note that objective of these articles/interviews is to communicate with our unit-holders and share with them our thought process. It should be noted that views expressed here are based on information available in public domain at this moment. Views expressed here can change depending on change in circumstances. Nothing discussed here, constitute a buy/ sell/ hold recommendation.

|

|

|

|

The two tweets our 22600 Followers engaged with most, last month.

@ppfas @ppfas

|

|

|

|

|

|

|

|

|

|

|

The investment objective of the Scheme The investment objective of the Scheme is to seek to generate long-term capital growth from an actively managed portfolio primarily of Equity and Equity Related Securities. Scheme shall invest in Indian equities, foreign equities and related instruments and debt securities.

|

Investors should consult their financial advisors if in doubt about whether this scheme is suitable for them.

Download SID/SAI and KIM here.

|

|

|

|

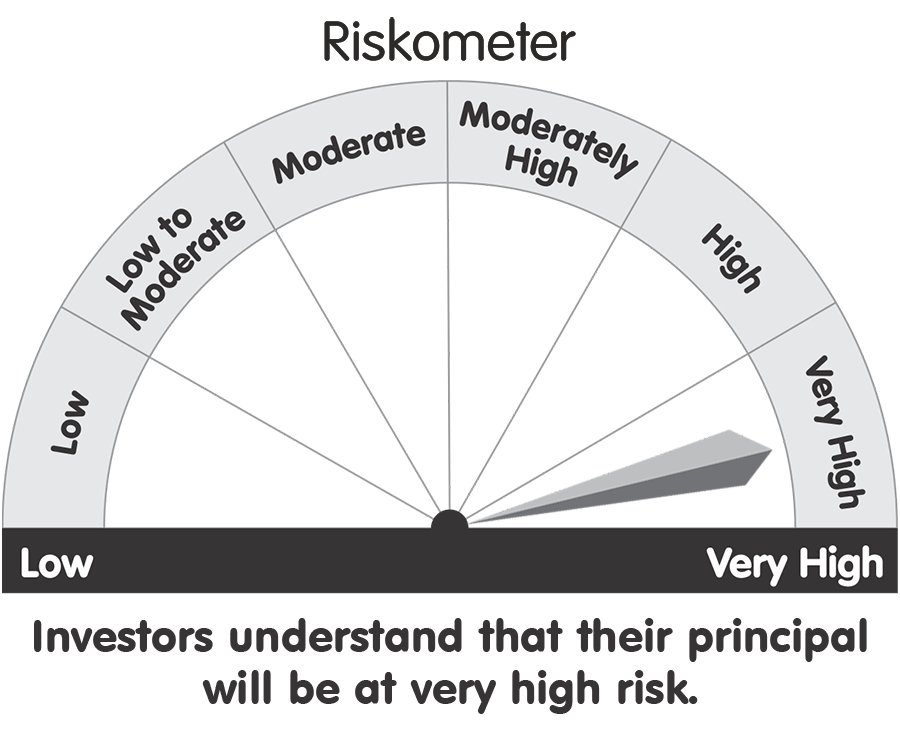

Investors understand that their principal will be at Moderately High risk.

|

|

|

|

|

|

|

|

|

|

| This product is suitable for investors who are seeking |

|

(I) Income over the short term

(II) Investment in debt / money market instruments.

Investors should consult their financial advisors if in doubt about whether this scheme is suitable for them.

Download SID/SAI and KIM here.

|

Investors understand that their principal will be at Low risk. |

|

|

|

|

|

|

| |

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

|

|

|

| |

|

|

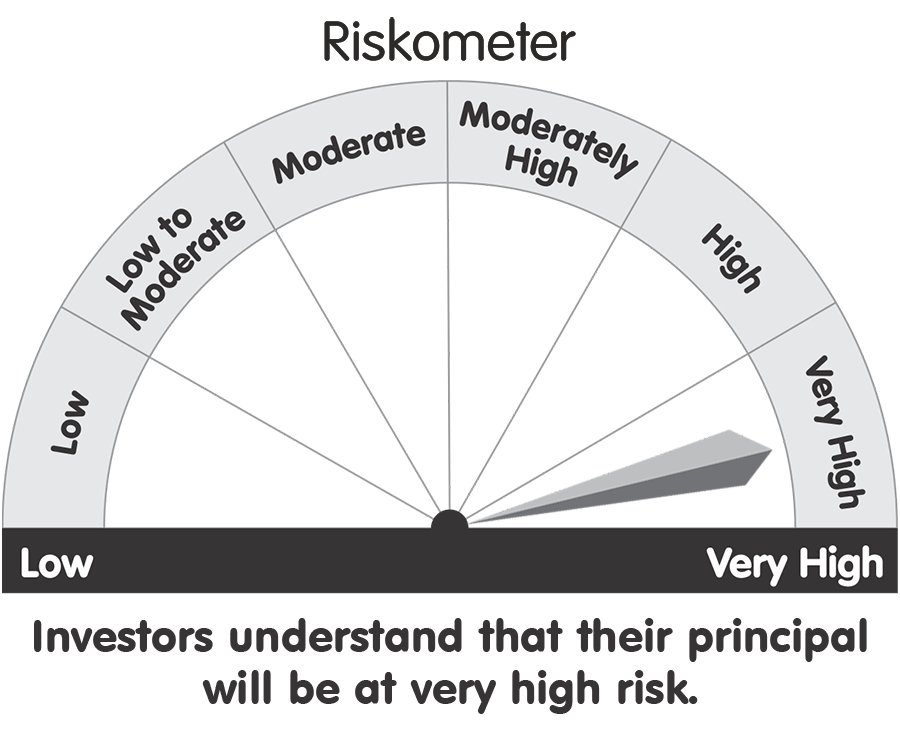

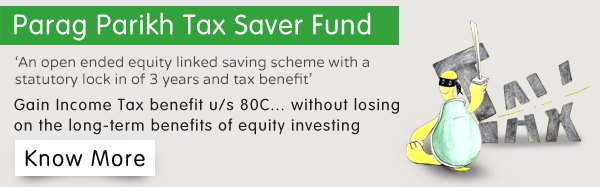

This product is suitable for investors who are seeking

- Long term capital appreciation

- Investment predominantly in equity and equity related securities.

Investors should consult their financial advisors if in doubt about whether this scheme is suitable for them.

Download SID/SAI and KIM here.

|

|

|

|

Investors understand that their principal will be at Moderately High risk.

|

|

|

|

|

|

|

| |

|

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

|

|

|

| |

'PPFAS Selfinvest' |

|

|

|

|

Consistent with our preference for 'digital over terrestrial', we have launched our Mobile and Web Apps. titled 'PPFAS SelfInvest'.

|

|

Through this you can currently:

|

- Create a new Folio

- Make additional purchases, redeem and switch.

- Undertake SIP, STP and SWP transactions

- View your investments

- Fetch your Account Statement

More features will be added soon...

|

|

|

Improvements undertaken in the latest version

(Version Nos. 3.9.40 for iOS and Android) |

- Stay home and get your eKYC done - a new investor can now initiate the eKYC process from the mobile app.

- Redemption and SWP are blocked for folios which have their eKYC request status as 'Under Process'. The status needs to be “Registered” to allow those actions.

|

|

|

Please help us improve your online experience... |

Have you ever tried out / invested via PPFAS SelfInvest.

Over the past year, we have been receiving several suggestions on how we could improve your online experience. While we have been able to implement some of these quickly, we are continuously working on those which are more long-drawn. Unfortunately, feedback received at irregular intervals can be difficult to collate and review. Hence we thought of developing a central repository for App. related suggestions. Besides enlightening us, it will also help us decide the order of priority with respect to new feature additions / improvements in User Interface (UI).

If yes, we thank you for doing so. We request you to please provide your suggestions, below.

|

|

|

|

|

|

|

|

|

| Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

|

|

| Download PPFAS SelfInvest |

|

|

|

|

|

|