|

Factsheet for March 2020 is out now. Download it here... Note on COVID-19 & current market view

by Mr. Rajeev Thakkar

|

|

|

|

NEWSLETTER - APRIL 2020 |

We held an hour-long #TwitterChat with our Fund Management Team last Month, While it focused primarily on our stance pursuant to the #COVID2019 pandemic, other aspects were also discussed.

Read the transcript here

|

|

|

|

|

|

|

'Investor Education' initiative |

Our latest Investor Education Initiative dwells on two topics which, though unrelated, are perturbing investors in equal measure:

|

|

|

|

|

|

|

Media Coverage |

|

Articles, blog posts and interviews in the media from last month. |

|

|

Behavioral Finance |

Every month we will include a few relevant articles in association with  India India

|

|

|

| |

Note: Viewers/readers should note that objective of these articles/interviews is to communicate with our unit-holders and share with them our thought process. It should be noted that views expressed here are based on information available in public domain at this moment. Views expressed here can change depending on change in circumstances. Nothing discussed here, constitute a buy/ sell/ hold recommendation.

|

|

|

|

|

|

|

|

|

The investment objective of the Scheme The investment objective of the Scheme is to seek to generate long-term capital growth from an actively managed portfolio primarily of Equity and Equity Related Securities. Scheme shall invest in Indian equities, foreign equities and related instruments and debt securities.

|

Investors should consult their financial advisors if in doubt about whether this scheme is suitable for them.

Download SID/SAI and KIM here.

|

|

|

|

Investors understand that their principal will be at Moderately High risk.

|

|

|

|

|

|

|

|

|

|

| This product is suitable for investors who are seeking |

|

(I) Income over the short term

(II) Investment in debt / money market instruments.

Investors should consult their financial advisors if in doubt about whether this scheme is suitable for them.

Download SID/SAI and KIM here.

|

Investors understand that their principal will be at Low risk. |

|

|

|

|

|

|

| |

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

|

|

|

| |

|

|

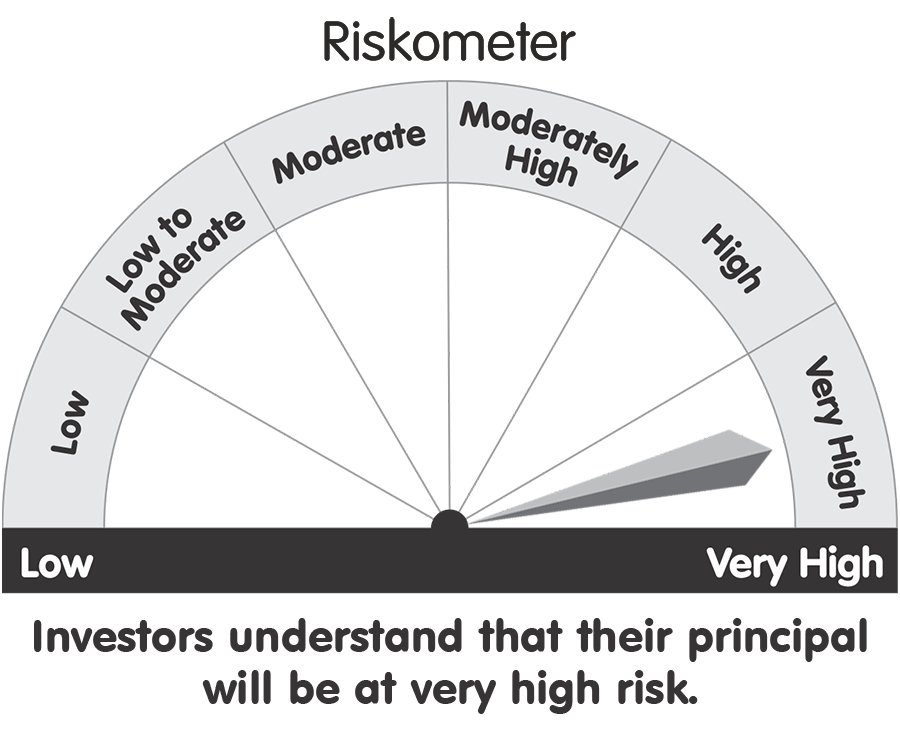

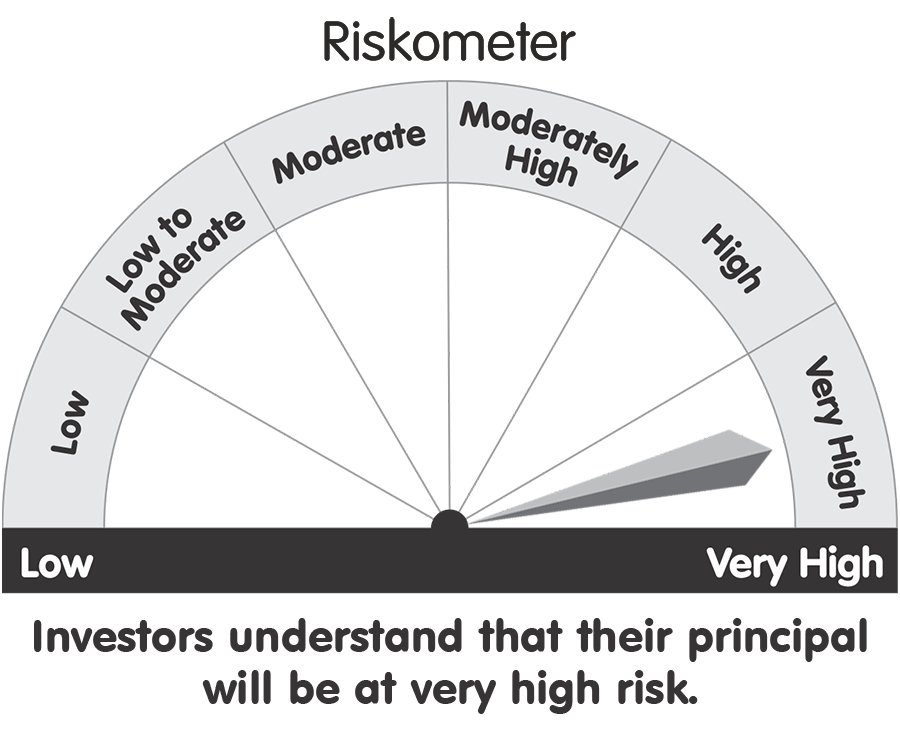

This product is suitable for investors who are seeking

- Long term capital appreciation

- Investment predominantly in equity and equity related securities.

Investors should consult their financial advisors if in doubt about whether this scheme is suitable for them.

Download SID/SAI and KIM here.

|

|

|

|

Investors understand that their principal will be at Moderately High risk.

|

|

|

|

|

|

|

| |

|

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

|

|

|

| |

'PPFAS Selfinvest' |

|

|

|

|

Consistent with our preference for 'digital over terrestrial', we have launched our Mobile and Web Apps. titled 'PPFAS SelfInvest'.

|

|

Through this you can currently:

|

- Create a new Folio

- Make additional purchases, redeem and switch.

- Undertake SIP, STP and SWP transactions

- View your investments

- Fetch your Account Statement

More features will be added soon...

|

|

|

Improvements undertaken in the latest version

(Version Nos. 3.9.20 for iOS and Android) |

- Added information in the additional purchase, register SIP pages (for minor folios) as per SEBI guidelines.

- Bug fixes and improvements.

|

|

|

Please help us improve your online experience... |

Have you ever tried out / invested via PPFAS SelfInvest.

Over the past year, we have been receiving several suggestions on how we could improve your online experience. While we have been able to implement some of these quickly, we are continuously working on those which are more long-drawn. Unfortunately, feedback received at irregular intervals can be difficult to collate and review. Hence we thought of developing a central repository for App. related suggestions. Besides enlightening us, it will also help us decide the order of priority with respect to new feature additions / improvements in User Interface (UI).

If yes, we thank you for doing so. We request you to please provide your suggestions, below.

|

|

|

|

|

|

|

|

|

| Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

|

|

| Download PPFAS SelfInvest |

|

|

|

|

|

|