Aadhar-based-KYC

Keen to invest in

Parag Parikh Flexi Cap Fund but unable to do so, as you are not KYC/KRA compliant? Well, here's some good news...

Now you can complete your

Aadhar based eKYC process online and seamlessly proceed to invest in our scheme.

Step by step process:

- Visit our online purchase portal here

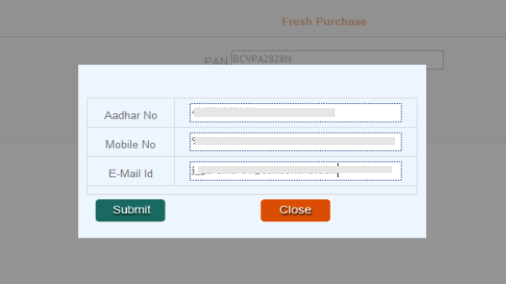

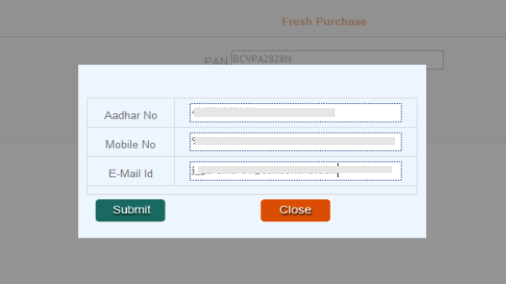

- Fill in your PAN No. to check if you are a KYC/KRA Compliant

- If not, proceed for the eKYC with your Aadhar No., Mobile and Email id

- Follow the necessary steps to complete the process

- Once you are done with the process, you will be redirected to the online application form.

Points to note:

- You will need to upload an image of your signature (.png or .jpg file) in the eKYC portal. Hence, keep it ready before you begin.

- You will receive a One-Time-Password (OTP) at two stages during the eKYC process.

- You can subscribe to our units by paying either through your Net Banking or Debit Card.

- SEBI circular currently permits investment of ₹ 50,000/- per Financial Year per Mutual Fund for Aadhaar based eKYC using OTP verification.

If you like this, you could share it with other like-minded investors.

Invest Now