Parag Parikh Conservative Hybrid Fund is an open-ended hybrid scheme investing predominantly in debt instruments.

To generate regular income through investments predominantly in debt and money market instruments. The Scheme also seeks to generate long term capital appreciation from the portion of equity investments under the scheme.

However, there is no assurance or guarantee that the investment objective of the Scheme will be realized.

It is a credible and tax-efficient alternative to certain fixed income instruments (like bank fixed deposits), offering the scope to earn income along with the prospect of growth in Net Asset Value (NAV) when held for a reasonably long period.

Fixed Income Investments:

A relatively wide mandate permits us to include both, ‘accrual’ and ‘duration’ related instruments in our portfolio. These include Sovereign, State Government, PSU and corporate securities across all maturities.

Note : Please refer to the Scheme Information Document (SID) for more details on Asset Allocation of Scheme.

|

|

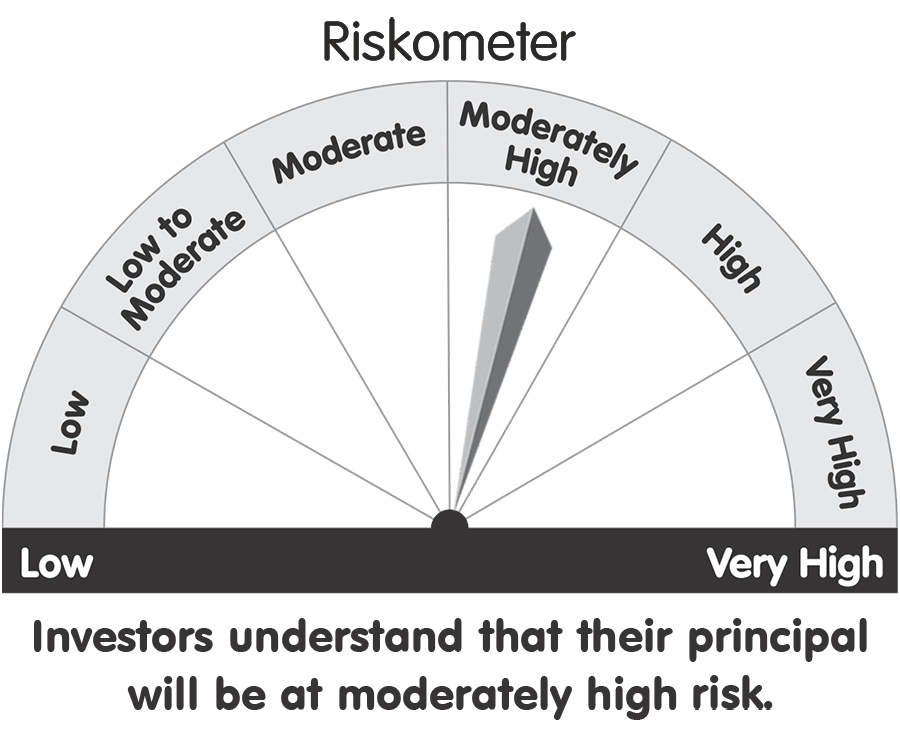

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.