To generate regular income through investments predominantly in debt and money market instruments. The Scheme also seeks to generate long term capital appreciation from the portion of equity investments under the scheme.

However, there is no assurance or guarantee that the investment objective of the Scheme will be realized.

It is a credible and tax-efficient alternative to certain fixed income instruments (like bank fixed deposits), offering the scope to earn income along with the prospect of growth in Net Asset Value (NAV) when held for a reasonably long period.

| Type of Instruments | Normal Allocation (% of Net Assets) |

Risk Profile |

|---|---|---|

| Debt securities (including securitized, debt) & Money Market instruments |

75-90 | Low to Medium |

| Equities & Equity related instruments | 10-25 | Medium to High |

| Units issued by REITs and InviTs | 0-10 | Medium to High |

An open-ended hybrid scheme investing predominantly in debt instruments.

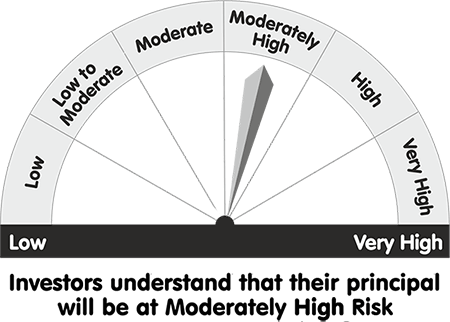

This product is suitable for investors who are seeking*

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

©

PPFAS Asset Management Private Limited. All rights reserved.

Sponsor: Parag Parikh Financial Advisory Services Limited. [CIN: U67190MH1992PLC068970], Trustee: PPFAS Trustee Company Private Limited. [CIN: U65100MH2011PTC221203], Investment Manager (AMC): PPFAS Asset Management Private Limited. [CIN: U65100MH2011PTC220623]