Parag Parikh Flexi Cap Fund

An open-ended dynamic Equity scheme investing across large cap, mid cap, small cap stocks

An open-ended dynamic Equity scheme investing across large cap, mid cap, small cap stocks

Buying securities at a discount to intrinsic value will help to create value for investors. Our investment philosophy is to invest in such value stocks. Long Term refers to an investment horizon of 5 years and more. You are requested to read Scheme Information Document (SID) to know more about investment process followed.

We only include companies with low debt, high cash flows, investor-friendly managements, etc. Most important, these must be quoting at a discount to their intrinsic value at the time of purchase. Join us if you too would like to own such companies in your portfolio.

Take the case of a Swiss army knife. It is a multi-functional gadget having various tools. Similarly, Parag Parikh Flexi Cap Fund has the flexibility to invest in Indian and foreign companies irrespective of market capitalisation and sectors.

65% of corpus invested in Indian equities. Hence it enjoys the same tax benefits as any other Indian equity mutual fund scheme, despite it having the freedom to invest in foreign stocks.

The investment objective of the Scheme is to seek to generate long-term capital growth from an actively managed portfolio primarily of equity and Equity Related Securities. The Scheme shall be investing in Indian equities, foreign equities and related instruments and debt securities.

Lumpsum

New Purchase:

₹ 1,000 and in multiple of ₹ 1 thereafter.

Additional Purchase:

₹ 1,000 and in multiple of ₹ 1 thereafter.

Systematic Investment Plans

Monthly SIP:

₹ 1,000 and in multiple of ₹ 1 thereafter.

Quarterly SIP:

₹ 3,000 and in multiple of ₹ 1 thereafter.

Direct Plan: Do-It-Yourself and benefit from a lower 'Expense Ratio'.

Regular Plan: Choose this option if you would like one of our Distribution Partners to help you out.

For both the above plans the Scheme offers only "Growth Option" and no "Dividend option".

Entry Load: Not Applicable

Exit Load:

In respect of each purchase / switch-in of Units, 10% of the units (“the limit”) may be redeemed without any exit load from the date of allotment.

Any redemption or switch-out in excess of the limit shall be subject to the following exit load:

2.00 % if the investment is redeemed on or before 365 days from the date of allotment of units.

1.00 % if the investment is redeemed after 365 days but on or before 730 days from the date of allotment of units.

No Exit Load will be charged if investment is redeemed after 730 days from the date of allotment of units.

No exit load will be charged, in case of switch transactions between Regular Plan and Direct Plan of the Scheme for existing as well as prospective investors.

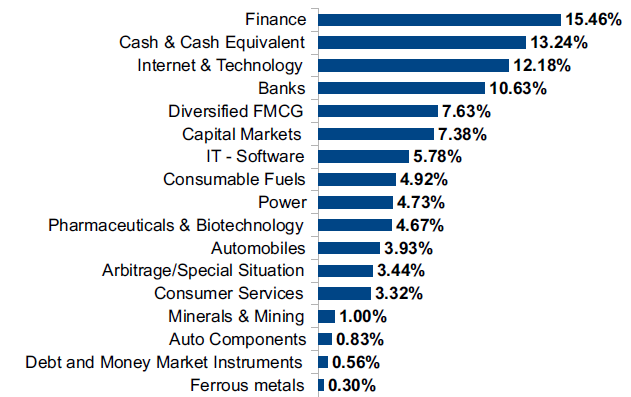

Its investment universe is not restricted by any self-imposed limitations in terms of sector, market capitalisation, geography, etc. However, an average of 65% of its corpus will be invested in listed Indian equities, in order to benefit from the favourable Capital Gains tax treatment accorded to such schemes.

| Name | Sector | % of Assets |

|---|---|---|

| Housing Development Finance Corporation Ltd. | Finance | 7.81% |

| ITC Ltd. | Diversified FMCG | 7.63% |

| Bajaj Holdings & Investment Ltd. | Finance | 7.53% |

| ICICI Bank Ltd. | Banks | 5.57% |

| HCL Technologies Ltd. | Power | 5.34% |

| Axis Bank Ltd. | Banks | 5.06% |

| Name | Sector | % of Assets |

|---|---|---|

| #Microsoft Corporation | Internet & Technology | 4.94% |

| #Alphabet Inc (Google Class A) | Internet & Technology | 4.47% |

| #Amazon.Com Inc | Consumer Services | 3.32% |

| #Meta Platforms Inc (Formerly Facebook Inc) | Internet & Technology | 2.77% |

| #Suzuki Motor Corp (ADR)^ | Automobiles | 0.55% |

As at February 28, 2023, 70.15% is invested in Indian equities and 16.05% is invested in foreign equities. The residual 12.41% is parked in TREPS etc. & Fixed Deposit Receipts (FDR). Scheme Factsheet here.

The domestic portion of the scheme is managed by Mr. Rajeev Thakkar, while Raunak Onkar manages the foreign investment component. Raj Mehta is responsible for the 'fixed income' investment component.

CIO and Fund Manager - Equity

Dedicated Fund manager- Overseas Investments

Fund Manager - Debt