The go-anywhere, do-anything approach of the fund has worked quite well

It invests across market caps within India, picks marquee names abroad, and holds cash, debt and arbitrage positions while waiting for the right opportunity — when quality stocks are available at reasonable or attractive prices.

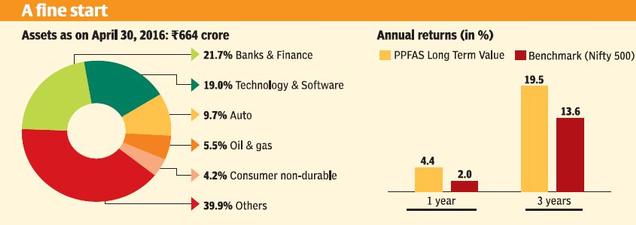

This go-anywhere, do-anything approach within its value investing mandate has worked quite well for . The fund, that recently turned three, has beaten its benchmark — Nifty 500 — by a neat 6 percentage points annualised since its inception, and by about 3 percentage points over the past year. With an almost 20 per cent annualised return since inception, Parag Parikh Long Term Value Fund is also among the best performers in the multi-cap funds category. It is a good choice for those willing to bet on a young fund that is showing much promise. However, investors need to have some stomach for risk. The fund has a high exposure to smaller stocks (about 40 per cent of the portfolio), foreign stocks (about a quarter of the portfolio) and limited track record (it is yet to go through a full-blown bear market).

Standing out

Three features make Parag Parikh Long Term Value Fund stand out. One, its significant exposure to foreign stocks acts as a risk diversifier. The fund takes exposure to businesses abroad which may not have similar peers in India — for instance, the stock of Alphabet (earlier Google), or to stocks which trade cheaper compared to their Indian counterparts (for instance, Nestle and 3M). The fund hedges most of its foreign exchange risk arising from foreign stocks. Despite the foreign holdings in its portfolio, Parag Parikh Long Term Value Fund fits the criterion of an equity fund, since at least 65 per cent of its corpus is in Indian stocks. So, fundholders don’t have to pay tax on gains from sale of units held for more than a year.

Next, the promoter group, along with management and employees, holds close to 13 per cent in the fund — this considerable ‘skin in the game’ adds to investor comfort level. Finally, Parag Parikh Long Term Value Fund is the only fund launched so far from the fund house, unlike the plethora of similar funds launched by many peers. The flipside, though, of a single, still-relatively small fund, (corpus of about ₹664 crore), is a higher expense ratio compared with the category average. This is mitigated by a buy-and-hold strategy in a compact portfolio of about 30 stocks.

Also, the rise in the fund’s corpus should moderate the expense ratio. The fund size has grown despite the change at the top last year due to the demise of the fund’s founder and noted value investor Parag Parikh.

Winning big

Many of the fund’s stock picks have paid off quite well. The Google stock, for instance, has gained close to 70 per cent over the past three years, while Maharashtra Scooters and ICRA have gained three to four times in this period. Private sector banks, auto and software are the fund’s largest holdings currently. This suggests that it is sector-agnostic in its search for value picks.

The original article could be seen here.