.png)

We have often heard advisors and experts asking investors to invest in equities with a minimum investment horizon of five years. In his first annual note, Rajeev Thakkar, CIO, PPFAS Mutual Funds, explains the rationale behind the minimum time period of ‘5 years.’

The note says, “In the last 20 financial years (March 31, 1998 to March 31, 2018) the Nifty 50 Index has given a return of 11.65 per cent p.a. on an average.” However, the note cautions investors that it is not wise to expect similar returns over any one year period.

The note also mentions an interesting data point- looking at a data of 20 financial years, only four years have given returns anywhere close to the average returns. The four financial years were 2017-18, 2010-11, 2006-07 and 2004-05. In fact, in seven out of the 20 years, returns have been negative.

| 1 Yr Returns | |

| 2017-18 | 10.25% |

| 2016-17 | 18.55% |

| 2015-16 | -8.86% |

| 2014-15 | 26.65% |

| 2013-14 | 17.98% |

| 2012-13 | 7.31% |

| 2011-12 | -9.23% |

| 2010-11 | 11.14% |

| 2009-10 | 73.76% |

| 2008-09 | -36.19% |

| 2007-08 | 23.89% |

| 2006-07 | 12.31% |

| 2005-06 | 67.15% |

| 2004-05 | 14.89% |

| 2003-04 | 81.14% |

| 2002-03 | -13.40% |

| 2001-02 | -1.62% |

| 2000-01 | -24.88% |

| 1999-2000 | 41.78% |

| 1998-99 | -3.48% |

Thakkar, in his note, further points out that a simple point which gets ignored by equity investors is that to get average returns from equities one has to average the returns over many years. One cannot hope to get the average returns in any one particular year.

Thakkar says, an investment horizon of five years is not a silver bullet or a magic potion curing all ailments, but it reduces the chances of negative returns and even the magnitude of negative returns.

Another interesting data point mentioned in the note - in the case of rolling five year returns over the last 25 financial years— the number of negative periods fall to two out of 20 and even in those two periods, the maximum negative return is 2.62 per cent per annum, compared to negative 36 per cent annual return as seen in the above table.

To conclude, it clearly underlined the fact that equities make sense only when an investor has a long tenure to earn decent double-digit returns.

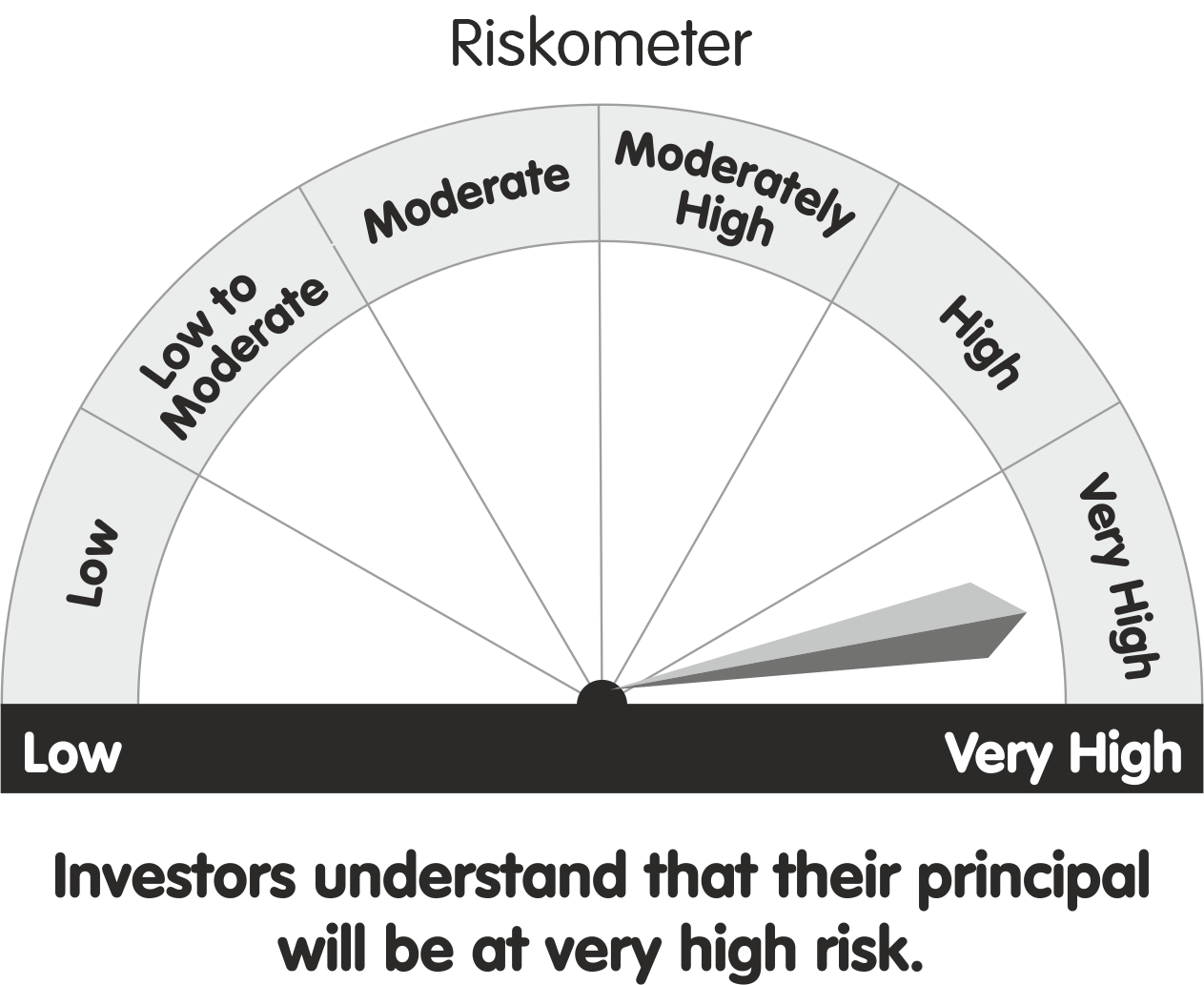

Riskometer This product is suitable for investors who are seeking* This product is suitable for investors who are seeking* The investment objective of the Scheme is to seek to generate long-term capital growth from an actively managed portfolio primarily of Equity and Equity Related Securities. Scheme shall invest in Indian equities, foreign equities and related instruments and debt securities. Investors should consult their financial advisers if in doubt about whether this scheme is suitable for them. Download SID/SAI and KIM here. |

comments powered by Disqus